7104 Concord Cir Unit 152 Fox Lake, IL 60020

Northeast Fox Lake NeighborhoodEstimated Value: $180,000 - $219,000

2

Beds

2

Baths

1,066

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 7104 Concord Cir Unit 152, Fox Lake, IL 60020 and is currently estimated at $203,448, approximately $190 per square foot. 7104 Concord Cir Unit 152 is a home located in Lake County with nearby schools including Lotus Elementary School, Stanton Middle School, and Grant Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 4, 2016

Sold by

Nitz Mary M

Bought by

Miller John P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,600

Outstanding Balance

$56,451

Interest Rate

3.75%

Mortgage Type

New Conventional

Estimated Equity

$146,997

Purchase Details

Closed on

Apr 19, 2000

Sold by

Wilkinson Larry D and Wilkinson Darlene A

Bought by

The Nitz Family Trust

Purchase Details

Closed on

Sep 21, 1999

Sold by

Wibright Marie L and Wibright Bruce M

Bought by

Wilkinson Larry D and Wilkinson Darlene A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,600

Interest Rate

8.21%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller John P | $87,000 | Chicago Title Insurance Co | |

| The Nitz Family Trust | $90,000 | -- | |

| Wilkinson Larry D | $77,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miller John P | $69,600 | |

| Previous Owner | Wilkinson Larry D | $61,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,638 | $55,835 | $3,803 | $52,032 |

| 2023 | $2,148 | $49,995 | $3,405 | $46,590 |

| 2022 | $2,148 | $39,639 | $3,974 | $35,665 |

| 2021 | $2,212 | $36,987 | $3,708 | $33,279 |

| 2020 | $2,248 | $35,966 | $3,606 | $32,360 |

| 2019 | $2,671 | $34,394 | $3,448 | $30,946 |

| 2018 | $1,431 | $21,035 | $3,723 | $17,312 |

| 2017 | $1,404 | $20,022 | $3,544 | $16,478 |

| 2016 | $979 | $19,322 | $3,420 | $15,902 |

| 2015 | $998 | $18,831 | $3,333 | $15,498 |

| 2014 | $1,936 | $29,549 | $3,654 | $25,895 |

| 2012 | $1,718 | $30,912 | $3,654 | $27,258 |

Source: Public Records

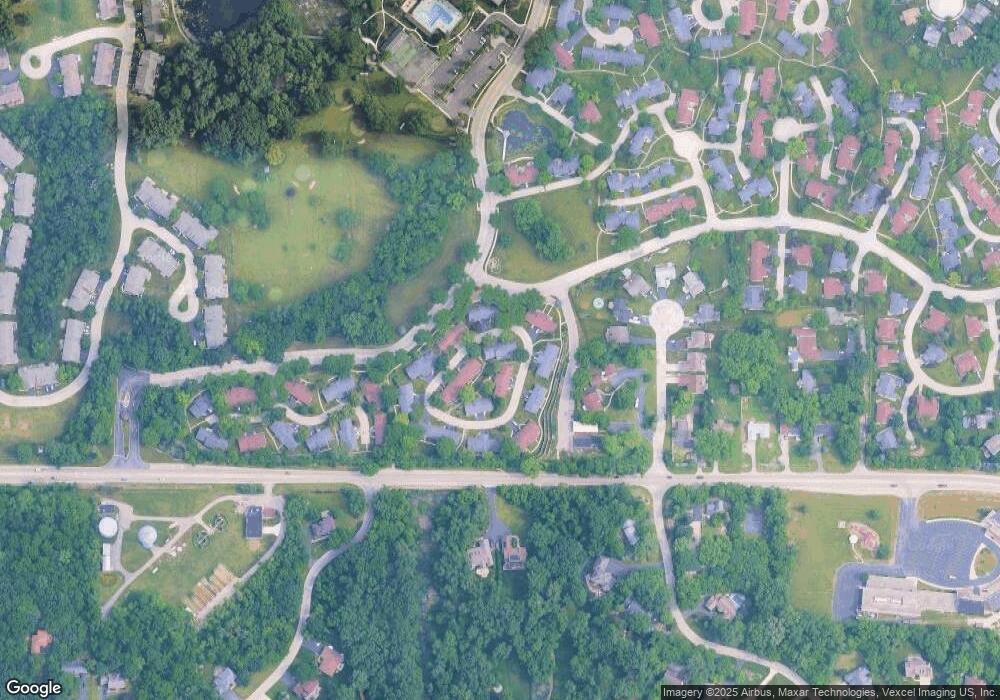

Map

Nearby Homes

- 7216 Oxford Cir Unit 230

- 7108 Granada Ln Unit 280

- 7302 Dunwood Ct Unit 115

- 1045 Fairway Dr Unit 72

- 1047 Fairway Dr Unit 71

- 7314 Chevy Chase Ct Unit 55

- 8215 Balsam Ct

- 13 Saint Thomas Colony Unit 7

- 56 Vail Colony Unit 5

- 52 Oak Hill Colony Unit 4

- 40 Bermuda Colony Unit 7

- 58 Vail Colony Unit 11

- 16 Saint Thomas Colony Unit 6

- 59 Vail Colony Unit 3

- 8300 Reva Bay Ln Unit SLIP4

- 8300 Reva Bay Ln Unit SLIP5

- 36 Bermuda Colony Unit 6

- 45 Nassau Colony Unit 4

- 8217 Primrose Ln Unit 8217

- 8566 Cedar St

- 7102 Concord Cir Unit 151

- 7108 Concord Cir Unit 153

- 7134 Concord Cir Unit 160

- 7101 Concord Cir Unit 129

- 7110 Concord Cir Unit 154

- 7105 Concord Cir Unit 131

- 7132 Concord Cir Unit 159

- 7103 Concord Cir Unit 130

- 7107 Concord Cir Unit 132

- 7112 Concord Cir Unit 155

- 7143 Concord Cir Unit 150

- 7137 Concord Cir Unit 147

- 7128 Concord Cir Unit 158

- 7139 Concord Cir Unit 148

- 7141 Concord Cir Unit 149

- 7126 Concord Cir Unit 157

- 7109 Concord Cir Unit 133

- 7135 Concord Cir Unit 146

- 7114 Concord Cir Unit 156

- 7133 Concord Cir Unit 145