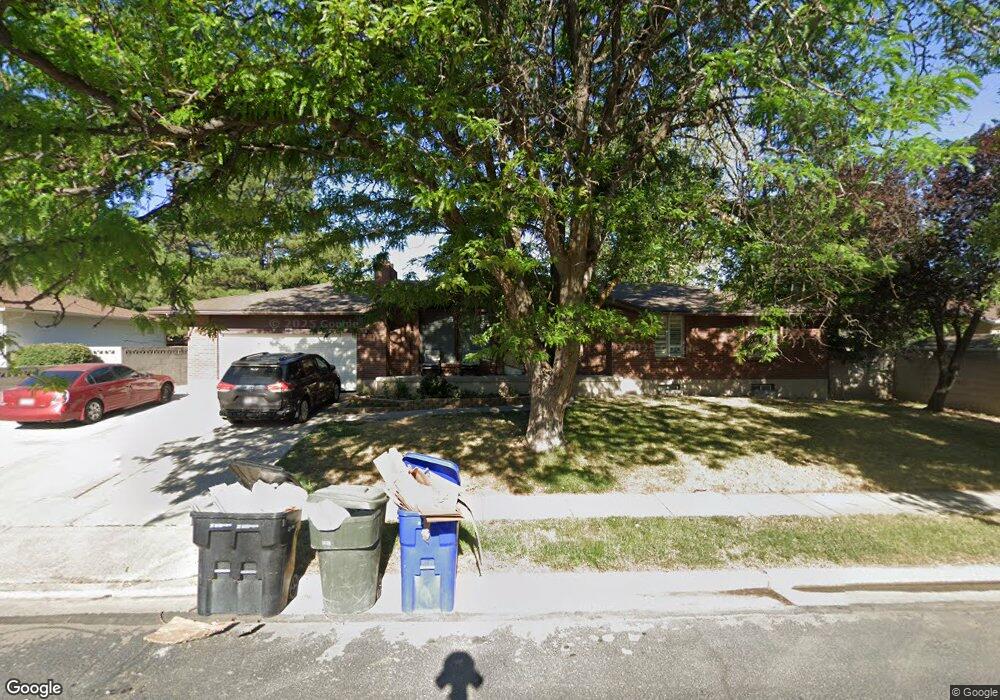

7122 S 2370 W West Jordan, UT 84084

Estimated Value: $567,000 - $642,000

5

Beds

3

Baths

2,925

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 7122 S 2370 W, West Jordan, UT 84084 and is currently estimated at $596,701, approximately $204 per square foot. 7122 S 2370 W is a home located in Salt Lake County with nearby schools including West Jordan School, Westland Elementary School, and West Jordan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2020

Sold by

Crowther Brandon and Crowther Christy

Bought by

Harrison David Andrew and Hull Michelle

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$329,500

Outstanding Balance

$293,208

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$303,493

Purchase Details

Closed on

Apr 4, 2013

Sold by

Thomas Darrel

Bought by

Crowther Brandon and Crowther Christy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,550

Interest Rate

3.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 12, 2012

Sold by

Godoy Luis A and Godoy Heather M

Bought by

Thomas Darrel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Interest Rate

3.34%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 26, 2005

Sold by

Taylor John G and Taylor Dianne S

Bought by

Godoy Luis A and Godoy Heather M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,920

Interest Rate

5.92%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harrison David Andrew | -- | Investors Title Ins Agcy | |

| Crowther Brandon | -- | Mt Olympus Title | |

| Thomas Darrel | -- | United Title Service | |

| Godoy Luis A | -- | Merrill Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harrison David Andrew | $329,500 | |

| Previous Owner | Crowther Brandon | $236,550 | |

| Previous Owner | Thomas Darrel | $220,000 | |

| Previous Owner | Godoy Luis A | $159,920 | |

| Closed | Godoy Luis A | $29,985 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,050 | $607,400 | $138,800 | $468,600 |

| 2024 | $3,050 | $586,900 | $133,900 | $453,000 |

| 2023 | $3,023 | $548,200 | $127,500 | $420,700 |

| 2022 | $3,130 | $558,300 | $125,000 | $433,300 |

| 2021 | $2,650 | $430,400 | $102,000 | $328,400 |

| 2020 | $2,084 | $317,600 | $102,000 | $215,600 |

| 2019 | $2,099 | $313,700 | $102,000 | $211,700 |

| 2018 | $1,907 | $282,600 | $77,000 | $205,600 |

| 2017 | $1,780 | $262,700 | $77,000 | $185,700 |

| 2016 | $1,754 | $243,200 | $77,000 | $166,200 |

| 2015 | $1,716 | $232,000 | $88,000 | $144,000 |

| 2014 | $1,640 | $218,300 | $83,800 | $134,500 |

Source: Public Records

Map

Nearby Homes

- 2312 W Hidden Bend Cove Unit 107

- 2421 W 6900 S

- 6918 S Harvest Cir

- 6924 S 2160 W

- 7361 S 2700 W

- 2510 W Jordan Meadows Ln

- 2573 Jordan Meadows Ln

- 1951 W 7125 S

- 7150 Camelot Way

- 6925 S Lexington Dr

- 7149 S Camelot Way

- 2683 W Carson Ln

- 8524 S Michele River Ave W Unit 109

- 7279 S Kenadi Ct

- 2169 W 7600 S

- 7647 S 2500 W

- 2386 W 7680 S

- 1718 W Trey Way Unit 2

- 6683 Alice Susanna Ln

- 2062 W 7705 S