7131 Fallen Oak Trace Unit 840 Dayton, OH 45459

Estimated Value: $250,000 - $261,049

3

Beds

2

Baths

1,654

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 7131 Fallen Oak Trace Unit 840, Dayton, OH 45459 and is currently estimated at $256,012, approximately $154 per square foot. 7131 Fallen Oak Trace Unit 840 is a home located in Montgomery County with nearby schools including Primary Village North, Stingley Elementary School, and Tower Heights Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2021

Sold by

Moberg Denice J

Bought by

Moberg Denice J and Denice Moberg Trust

Current Estimated Value

Purchase Details

Closed on

Apr 28, 2020

Sold by

Super Trifecta Llc

Bought by

Moberg Denice J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Outstanding Balance

$95,129

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$160,883

Purchase Details

Closed on

Jan 13, 2020

Sold by

Langer Rebecca J and Langer Philip E

Bought by

Super Trifecta Llc

Purchase Details

Closed on

Dec 10, 2019

Sold by

Langer Philip E and Langer Rebecca J

Bought by

Super Trifecta Llc

Purchase Details

Closed on

Mar 20, 1998

Sold by

Martinovich Donald M and Martinovich Charlene

Bought by

Langer Philip E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

6.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Moberg Denice J | -- | None Available | |

| Moberg Denice J | $170,000 | Chicago Title Company Llc | |

| Super Trifecta Llc | -- | Landmark Ttl Agcy South Inc | |

| Super Trifecta Llc | $139,000 | Landmark Ttl Agcy South Inc | |

| Langer Philip E | $137,500 | -- | |

| Langer Philip E | $137,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Moberg Denice J | $136,000 | |

| Previous Owner | Langer Philip E | $110,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,917 | $67,350 | $13,830 | $53,520 |

| 2023 | $3,917 | $67,350 | $13,830 | $53,520 |

| 2022 | $3,799 | $51,810 | $10,640 | $41,170 |

| 2021 | $3,810 | $51,810 | $10,640 | $41,170 |

| 2020 | $3,804 | $51,810 | $10,640 | $41,170 |

| 2019 | $3,626 | $44,060 | $10,640 | $33,420 |

| 2018 | $3,214 | $44,060 | $10,640 | $33,420 |

| 2017 | $3,177 | $44,060 | $10,640 | $33,420 |

| 2016 | $3,222 | $42,170 | $10,640 | $31,530 |

| 2015 | $3,189 | $42,170 | $10,640 | $31,530 |

| 2014 | $3,189 | $42,170 | $10,640 | $31,530 |

| 2012 | -- | $55,070 | $10,640 | $44,430 |

Source: Public Records

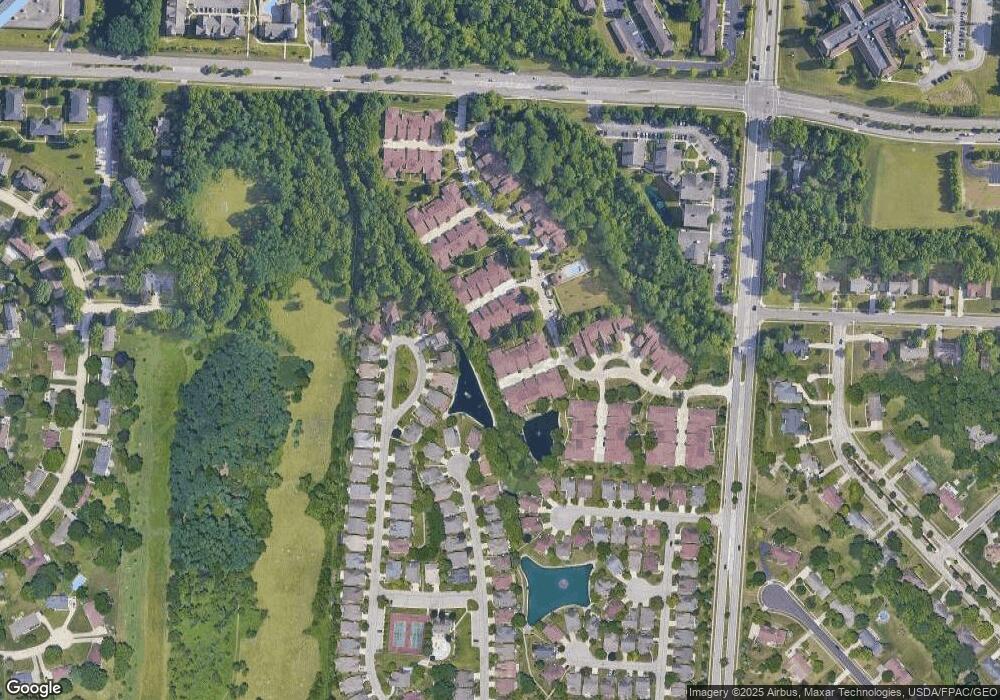

Map

Nearby Homes

- 7129 Fallen Oak Trace Unit 839

- 7128 Hartcrest Ln Unit 130

- 7128 Hartcrest Ln Unit 130130

- 7215 Whitetail Trail Unit 108108

- 686 Doe Crossing Unit 7575

- 6839 Cedar Cove Dr Unit 3993

- 6839 Cedar Cove Dr Unit 93

- 6892 Tifton Green Trail Unit 74

- 1237 Chevington Ct Unit 1515

- 1400 Lake Pointe Way Unit 4

- 119 Blackstone Dr

- 116 E Elmwood Dr

- 6521 Shadow Wynd Cir

- 129 Bradstreet Rd

- 85 Poinciana Dr

- 1511 Lake Pointe Way Unit 6

- 6610 Green Branch Dr

- 6620 Green Branch Dr Unit 8

- 1594 Mapleton Dr

- 204 Linden Dr

- 7127 Fallen Oak Trace Unit 838

- 7121 Fallen Oak Trace Unit 941

- 7125 Fallen Oak Trace Unit 837

- 7139 Fallen Oak Trace Unit 732

- 7119 Fallen Oak Trace Unit 942

- 7141 Fallen Oak Trace Unit 731

- 7137 Fallen Oak Trace Unit 733

- 7123 Fallen Oak Trace Unit 836

- 7135 Fallen Oak Trace Unit 734

- 7116 Hartcrest Ln Unit 131131

- 7117 Fallen Oak Trace Unit 943

- 7140 Hartcrest Ln Unit 129129

- 7115 Fallen Oak Trace Unit 944

- 7133 Fallen Oak Trace Unit 735

- 7113 Fallen Oak Trace Unit 945

- 7170 Whitetail Trail Unit 102102

- 7152 Hartcrest Ln Unit 128128

- 7165 Whitetail Trail Unit 103103

- 7104 Hartcrest Ln Unit 132132

- 7107 Fallen Oak Trace Unit 1048