715 Olde Clubs Dr Alpharetta, GA 30022

Rivermont NeighborhoodEstimated Value: $637,196 - $767,000

4

Beds

4

Baths

3,095

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 715 Olde Clubs Dr, Alpharetta, GA 30022 and is currently estimated at $707,799, approximately $228 per square foot. 715 Olde Clubs Dr is a home located in Fulton County with nearby schools including Barnwell Elementary School, Haynes Bridge Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2019

Sold by

Brannon Marleen S

Bought by

Hollowell Mary Helen

Current Estimated Value

Purchase Details

Closed on

Jun 7, 2010

Sold by

Shack Myrna Trust

Bought by

Brannon Marleen S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,000

Interest Rate

4.83%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 7, 2005

Sold by

Schack Myrna

Bought by

Schack Myrna Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Interest Rate

6.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 27, 1993

Sold by

Triple Creek Corp

Bought by

Downs Jerry Felicia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,150

Interest Rate

7.19%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hollowell Mary Helen | $453,200 | -- | |

| Brannon Marleen S | $355,000 | -- | |

| Schack Myrna Trust | -- | -- | |

| Schack Myrna | $399,900 | -- | |

| Downs Felicia | -- | -- | |

| Downs Jerry Felicia | $336,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brannon Marleen S | $248,000 | |

| Previous Owner | Downs Felicia | $204,000 | |

| Previous Owner | Downs Jerry Felicia | $203,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,126 | $183,280 | $36,640 | $146,640 |

| 2023 | $5,173 | $183,280 | $36,640 | $146,640 |

| 2022 | $4,928 | $183,280 | $36,640 | $146,640 |

| 2021 | $4,896 | $177,960 | $35,600 | $142,360 |

| 2020 | $4,933 | $175,840 | $35,160 | $140,680 |

| 2019 | $455 | $165,120 | $37,280 | $127,840 |

| 2018 | $4,347 | $161,240 | $36,400 | $124,840 |

| 2017 | $4,136 | $143,760 | $36,360 | $107,400 |

| 2016 | $4,063 | $143,760 | $36,360 | $107,400 |

| 2015 | $4,454 | $143,760 | $36,360 | $107,400 |

| 2014 | $4,610 | $143,760 | $36,360 | $107,400 |

Source: Public Records

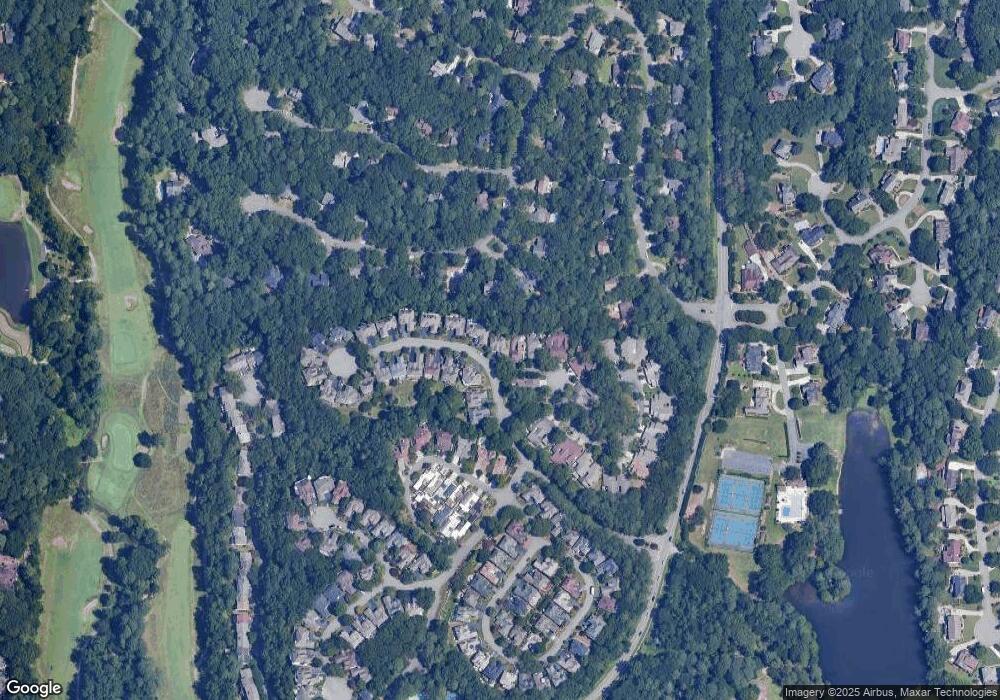

Map

Nearby Homes

- 420 Sandwedge Ln

- 765 Olde Clubs Dr

- 0 Spyglass Bluff Unit 7666454

- 0 Spyglass Bluff Unit 10628282

- 9025 Niblic Dr

- 240 Fairway Ridge Dr

- 225 Brassy Ct

- 530 Matterhorn Way

- 0 Niblick Dr Unit 7655286

- 98 Holly Isles-Harvel Pond Rd

- 8800 Glen Ferry Dr

- 180 Colony Ridge Dr

- 8870 Glen Ferry Dr Unit 1

- 712 Cypress Pointe St

- 703 Cypress Pointe St Unit 123

- 102 Hawkstone Way

- 606 Cypress Pointe St

- 1106 Sandy Lane Dr Unit 206

- 510 Putters Ct

- 725 Olde Clubs Dr

- 520 Putters Ct

- 720 Olde Clubs Dr

- 500 Putters Ct

- 530 Putters Ct

- 530 Putters Ct Unit 530

- 170 Fairway Ridge Dr Unit 170

- 170 Fairway Ridge Dr

- 735 Olde Clubs Dr

- 730 Olde Clubs Dr

- 160 Fairway Ridge Dr

- 710 Olde Clubs Dr

- 540 Putters Ct

- 740 Olde Clubs Dr

- 745 Olde Clubs Dr

- 700 Olde Clubs Dr

- 180 Fairway Ridge Dr

- 535 Putters Ct

- 750 Olde Clubs Dr