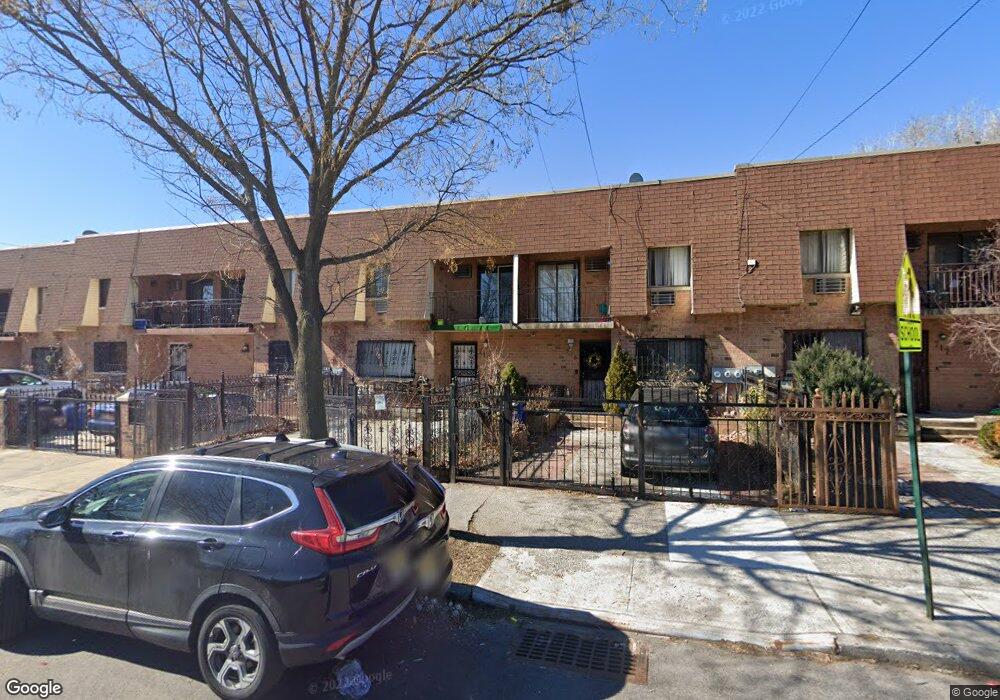

715 Thieriot Ave Unit Gr.Level Bronx, NY 10473

Clason Point NeighborhoodEstimated Value: $803,000 - $932,000

1

Bed

1

Bath

625

Sq Ft

$1,386/Sq Ft

Est. Value

About This Home

This home is located at 715 Thieriot Ave Unit Gr.Level, Bronx, NY 10473 and is currently estimated at $866,333, approximately $1,386 per square foot. 715 Thieriot Ave Unit Gr.Level is a home located in Bronx County with nearby schools including P.S. 100 Isaac Clason, Jhs 131 Albert Einstein, and Holy Cross Elementary School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,863 | $35,078 | $6,489 | $28,589 |

| 2024 | $6,863 | $34,170 | $7,526 | $26,644 |

| 2023 | $6,547 | $32,237 | $6,109 | $26,128 |

| 2022 | $6,071 | $39,360 | $8,880 | $30,480 |

| 2021 | $6,237 | $41,100 | $8,880 | $32,220 |

| 2020 | $6,188 | $39,060 | $8,880 | $30,180 |

| 2019 | $5,957 | $35,160 | $8,880 | $26,280 |

| 2018 | $5,476 | $26,864 | $8,514 | $18,350 |

| 2017 | $5,166 | $25,344 | $6,972 | $18,372 |

| 2016 | $4,937 | $24,696 | $8,213 | $16,483 |

| 2015 | $2,664 | $24,360 | $9,840 | $14,520 |

| 2014 | $2,664 | $23,730 | $9,562 | $14,168 |

Source: Public Records

Map

Nearby Homes

- 721 Thieriot Ave

- 1822 Seward Ave

- 643 Thieriot Ave

- 1787 Randall Ave

- 718 Rosedale Ave

- 715 Rosedale Ave

- 533 Underhill Ave

- 517 Underhill Ave

- 1805 Lacombe Ave

- 511 Bolton Ave

- 508 Bolton Ave

- 1903 Lacombe Ave

- 500 Bolton Ave

- 1739 Lacombe Ave Unit 1B

- 444 Underhill Ave

- 1731 Lacombe Ave Unit 1B

- 1731 Lacombe Ave Unit 4B

- 1731 Lacombe Ave Unit 4A

- 1731 Lacombe Ave Unit 3A

- 1727 Lacombe Ave Unit 3B

- 715 Thieriot Ave

- 715 Thieriot Ave Unit 2

- 713 Thieriot Ave

- 717 Thieriot Ave

- 711 Thieriot Ave

- 719 Thieriot Ave

- 709 Thieriot Ave

- 721 Thieriot Ave Unit 2

- 721 Thieriot Ave Unit 2 Floor

- 723 Thieriot Ave

- 707 Thieriot Ave

- 714 Taylor Ave

- 716 Taylor Ave

- 725 Thieriot Ave

- 705 Thieriot Ave

- 712 Taylor Ave

- 718 Taylor Ave

- 710 Taylor Ave

- 720 Taylor Ave

- 727 Thieriot Ave