715 Wheeler Peak Way Unit II Alpharetta, GA 30022

Estimated Value: $557,000 - $710,666

4

Beds

3

Baths

2,696

Sq Ft

$239/Sq Ft

Est. Value

About This Home

This home is located at 715 Wheeler Peak Way Unit II, Alpharetta, GA 30022 and is currently estimated at $643,667, approximately $238 per square foot. 715 Wheeler Peak Way Unit II is a home located in Fulton County with nearby schools including Barnwell Elementary School, Haynes Bridge Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 20, 2002

Sold by

Option One Mtg Loan Tr 2000

Bought by

Elfimov Vladimir

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,600

Outstanding Balance

$71,369

Interest Rate

6.18%

Mortgage Type

New Conventional

Estimated Equity

$572,298

Purchase Details

Closed on

May 7, 2002

Sold by

Logan Terri L and Logan Isaac

Bought by

Wells Fargo Bk/Mn Na

Purchase Details

Closed on

Mar 18, 1997

Sold by

Foley Wm L

Bought by

Stine Sandra L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,675

Interest Rate

7.58%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Elfimov Vladimir | $214,500 | -- | |

| Wells Fargo Bk/Mn Na | -- | -- | |

| Stine Sandra L | $91,500 | -- | |

| Stine Sandra L | $91,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Elfimov Vladimir | $171,600 | |

| Previous Owner | Stine Sandra L | $138,675 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,127 | $189,560 | $53,760 | $135,800 |

| 2023 | $4,127 | $211,440 | $39,920 | $171,520 |

| 2022 | $3,974 | $211,440 | $39,920 | $171,520 |

| 2021 | $3,920 | $168,480 | $29,720 | $138,760 |

| 2020 | $3,945 | $166,440 | $29,360 | $137,080 |

| 2019 | $485 | $148,400 | $31,480 | $116,920 |

| 2018 | $4,076 | $144,880 | $30,720 | $114,160 |

| 2017 | $3,883 | $129,600 | $27,560 | $102,040 |

| 2016 | $3,800 | $129,600 | $27,560 | $102,040 |

| 2015 | $3,841 | $129,600 | $27,560 | $102,040 |

| 2014 | $2,821 | $93,040 | $16,400 | $76,640 |

Source: Public Records

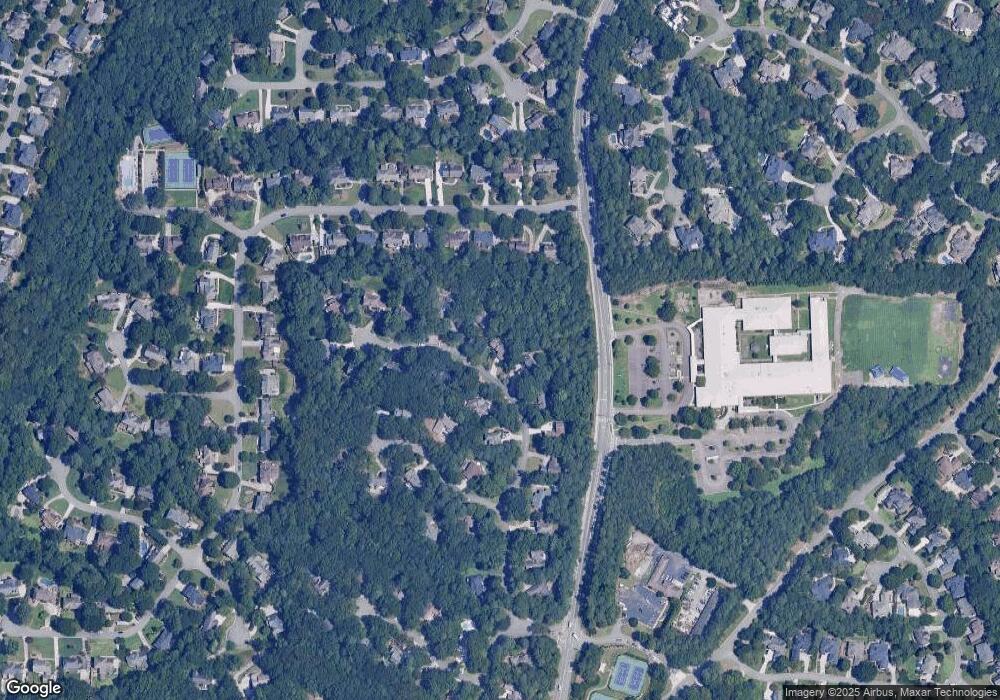

Map

Nearby Homes

- 2045 Northwick Pass Way

- 9510 Stoney Ridge Ln

- 515 Oak Bridge Trail

- 545 Oak Bridge Trail

- 2100 Northwick Pass Way

- 375 N Peak Dr

- 352 N Peak Dr

- 8870 Old Southwick Pass

- 3450 Merganser Ln

- 9675 Almaviva Dr

- 3535 Merganser Ln Unit 2

- 9695 Almaviva Dr

- 3765 Redcoat Way

- 340 Mount Mitchell Way

- 9715 Almaviva Dr

- 6092 Carlisle Ln

- 1055 Leadenhall St

- 2001 Tavistock Ct

- 1285 Stuart Ridge

- 1050 Bedford Gardens Dr

- 725 Wheeler Peak Way

- 705 Wheeler Peak Way Unit 2

- 3695 Aubusson Trace

- 3685 Aubusson Trace Unit 1

- 695 Wheeler Peak Way

- 3675 Aubusson Trace

- 735 Wheeler Peak Way

- 720 Wheeler Peak Way Unit 2

- 3665 Aubusson Trace

- 730 Wheeler Peak Way

- 685 Wheeler Peak Way

- 1091 Abingdon Ln

- 745 Wheeler Peak Way

- 710 Wheeler Peak Way

- 3655 Aubusson Trace

- 645 Mt Victoria

- 645 Mount Victoria Place

- 3690 Aubusson Trace

- 3680 Aubusson Trace

- 675 Wheeler Peak Way