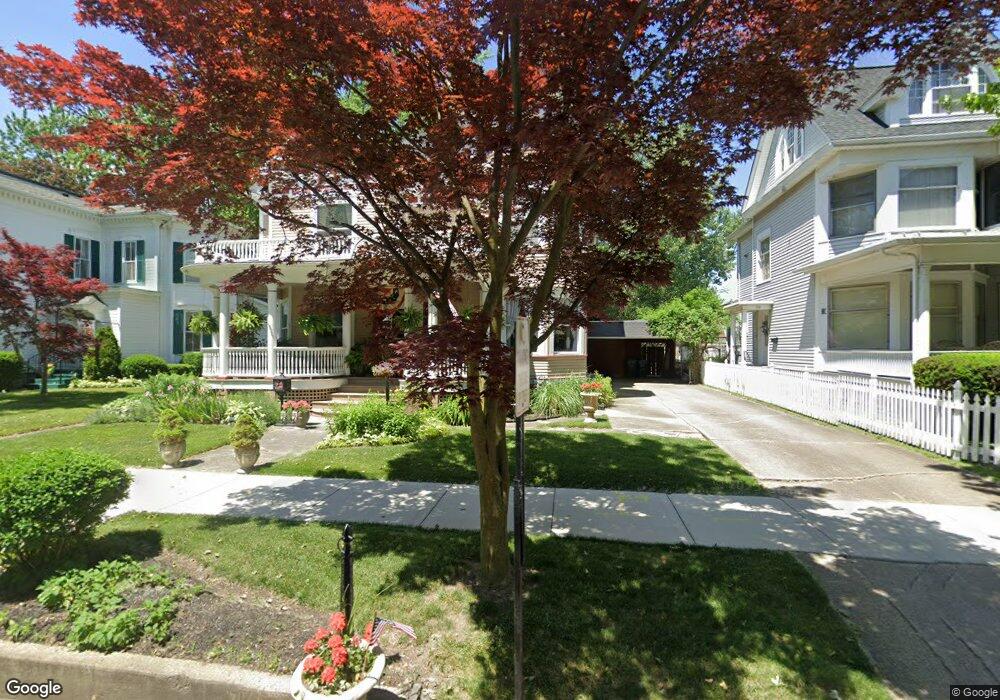

716 Birchard Ave Fremont, OH 43420

Estimated Value: $209,000 - $327,000

4

Beds

2

Baths

2,848

Sq Ft

$88/Sq Ft

Est. Value

About This Home

This home is located at 716 Birchard Ave, Fremont, OH 43420 and is currently estimated at $249,347, approximately $87 per square foot. 716 Birchard Ave is a home located in Sandusky County with nearby schools including Fremont Ross High School, Bishop Hoffman Catholic School - This is St Joe's School now, and St. Joseph School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 31, 2003

Sold by

Sharp Michael C and Sharp Bobbie D

Bought by

Fiegl Christopher P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,550

Outstanding Balance

$60,136

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$189,211

Purchase Details

Closed on

Jun 23, 1998

Sold by

Davis Ronald E

Bought by

Sharp Michael C and Sharp Bobbie D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,900

Interest Rate

7.22%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 17, 1996

Sold by

Chaney Douglas L

Bought by

Davis Ronald E and Davis Kathy A

Purchase Details

Closed on

Dec 16, 1994

Sold by

Vaffis Doris

Bought by

Chaney Douglas L and Chaney Harriet L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,700

Interest Rate

9.06%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fiegl Christopher P | $104,625 | Culbert Title Agency | |

| Sharp Michael C | $122,000 | -- | |

| Davis Ronald E | $122,000 | -- | |

| Chaney Douglas L | $95,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fiegl Christopher P | $125,550 | |

| Previous Owner | Sharp Michael C | $115,900 | |

| Previous Owner | Chaney Douglas L | $90,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,952 | $80,190 | $9,310 | $70,880 |

| 2023 | $2,952 | $63,640 | $7,390 | $56,250 |

| 2022 | $2,462 | $63,640 | $7,390 | $56,250 |

| 2021 | $2,542 | $63,640 | $7,390 | $56,250 |

| 2020 | $2,133 | $52,610 | $7,390 | $45,220 |

| 2019 | $2,130 | $52,610 | $7,390 | $45,220 |

| 2018 | $2,094 | $52,610 | $7,390 | $45,220 |

| 2017 | $2,053 | $50,440 | $7,390 | $43,050 |

| 2016 | $1,800 | $50,440 | $7,390 | $43,050 |

| 2015 | $1,770 | $50,440 | $7,390 | $43,050 |

| 2014 | $1,905 | $51,770 | $7,390 | $44,380 |

| 2013 | $2,152 | $51,770 | $7,390 | $44,380 |

Source: Public Records

Map

Nearby Homes

- 619 Hayes Ave

- 1037 Buckland Ave

- 1009 Napoleon St

- 1015 Hayes Ave

- 515 S Arch St

- 427 N Clover St

- 616 S Wood St

- 815 South St

- 501 Jackson St Unit 50

- 516 N Front St

- 208 E State St

- 1342 Mcpherson Blvd

- 625 Bush Place

- 1028 June St

- 224 Sandusky Ave Unit 226

- 1611 Mcpherson Blvd

- 340 340 Sandusky Ave

- 905 Twinn St

- 1013 Whittlesey St

- 711 Rawson Ave

- 710 Birchard Ave Unit 712

- 722 Birchard Ave

- 215 S Wood St

- 708 Birchard Ave

- 211 S Wood St

- 704 Birchard Ave

- 700 Birchard Ave

- 719 Birchard Ave Unit 1.2

- 719 Birchard Ave

- 800 Birchard Ave

- 212 S Wood St

- 719 Garrison St

- 717 Garrison St

- 719 721 Birchard Ave

- 711 Birchard Ave

- 210 S Wood St

- 707 Birchard Ave

- 705 Birchard Ave

- 711 Garrison St

- 309 S Wood St Unit 309