716 E Franklin Lima, OH 45804

Fifth Ward NeighborhoodEstimated Value: $66,000 - $73,000

3

Beds

1

Bath

1,423

Sq Ft

$48/Sq Ft

Est. Value

About This Home

This home is located at 716 E Franklin, Lima, OH 45804 and is currently estimated at $68,333, approximately $48 per square foot. 716 E Franklin is a home located in Allen County with nearby schools including Freedom Elementary School, Lima North Middle School, and Lima West Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 4, 2013

Sold by

First Federal Bank Of The Midwest

Bought by

Price Vivan White

Current Estimated Value

Purchase Details

Closed on

Feb 4, 2010

Sold by

First Federal Bank Of The Midwest

Bought by

Cameron Real Estate Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,000

Interest Rate

5.2%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Oct 6, 2009

Sold by

Laws Benjamin R

Bought by

First Federal Bank Of The Midwest

Purchase Details

Closed on

Jun 7, 1996

Sold by

Cole Craig

Bought by

Cole Craig

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,760

Interest Rate

7.97%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 15, 1993

Sold by

Ford Robert Junior

Bought by

Henderson Joe T

Purchase Details

Closed on

Aug 1, 1967

Bought by

Ford Robert Junior

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Price Vivan White | $5,700 | None Available | |

| Cameron Real Estate Llc | $60,000 | Attorney | |

| First Federal Bank Of The Midwest | $12,000 | Attorney | |

| Cole Craig | $27,500 | -- | |

| Henderson Joe T | $13,500 | -- | |

| Ford Robert Junior | $8,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cameron Real Estate Llc | $133,000 | |

| Previous Owner | Cole Craig | $27,760 |

Source: Public Records

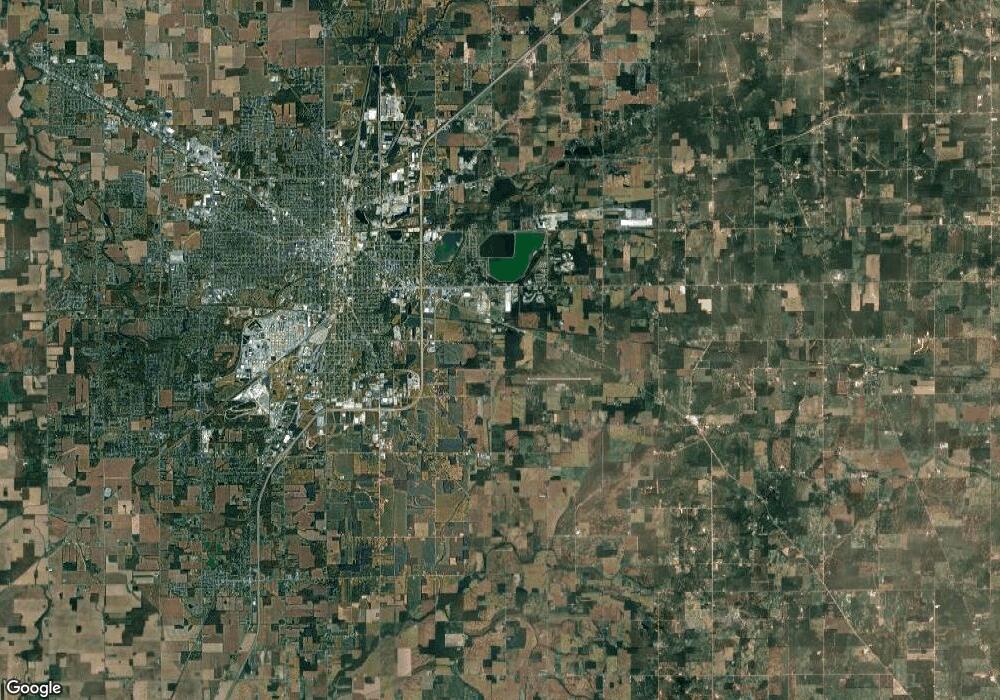

Map

Nearby Homes

- 00 E Albert St

- 0 E Albert St

- 725 E Vine St

- 801 E Vine St

- 721 E Albert St

- 812 E Vine St

- 706 E Kibby St

- 0 E Vine St

- 915 Michael Ave

- 546 Orena Ave

- 638 Harrison Ave

- 520 Orena Ave

- 439 E Albert St

- 1127 E Franklin

- 1008 Fairview Ave

- 1125 S Sugar St

- 817 E Eureka St

- 6 Oakwood Place

- 650 S Dewey Ave

- 610 Linden St

- 718 Franklin St

- 714 Franklin St

- 712 Franklin St

- 720 Franklin St

- 710 Franklin St

- 715 Dingledine Ave

- 715 E Dingledine

- 717 Dingledine Ave

- 713 Dingledine Ave

- 711 Dingledine Ave

- 708 Franklin St

- 717 Franklin St

- 719 Franklin St

- 715 Franklin St

- 711 Franklin St

- 709 Dingledine Ave

- 713 Franklin St

- 719 Dingledine Ave