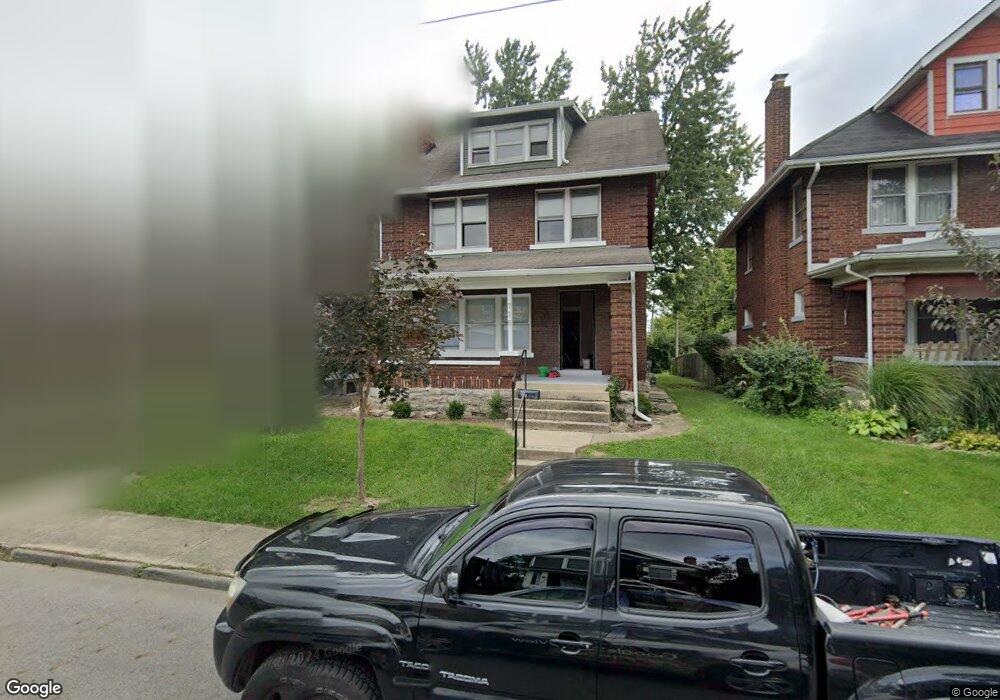

718 Kimball Place Columbus, OH 43205

Driving Park NeighborhoodEstimated Value: $223,000 - $328,000

3

Beds

1

Bath

1,807

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 718 Kimball Place, Columbus, OH 43205 and is currently estimated at $279,576, approximately $154 per square foot. 718 Kimball Place is a home located in Franklin County with nearby schools including Fairwood Alternative Elementary School, South High School, and Capital Collegiate Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2024

Sold by

Lrk Properties Llc

Bought by

Keeler Elizabeth and Keeler Lance R

Current Estimated Value

Purchase Details

Closed on

Aug 6, 2016

Sold by

Keeler Elizabeth

Bought by

L R K Properties Llc

Purchase Details

Closed on

Feb 5, 2016

Sold by

L R K Properties Llc

Bought by

Keeler Elizabeth

Purchase Details

Closed on

Mar 24, 2009

Sold by

Keeler Elizabeth and Keeler Robert

Bought by

L R K Properties Llc

Purchase Details

Closed on

Jul 9, 2002

Sold by

K C & Associates

Bought by

Tyler Karen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,000

Interest Rate

6.82%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 27, 2002

Sold by

Corbin Karin A and Corbin Mark

Bought by

Keller Robert and Keller Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,000

Interest Rate

6.82%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Feb 11, 2002

Sold by

Beneficial Mtg Corp

Bought by

Corbin Karin A

Purchase Details

Closed on

Sep 20, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Keeler Elizabeth | -- | None Listed On Document | |

| L R K Properties Llc | -- | Golden Title Box | |

| Keeler Elizabeth | -- | Golden Title Box | |

| L R K Properties Llc | -- | Golden Titl | |

| Tyler Karen | $73,000 | -- | |

| Keller Robert | $65,500 | -- | |

| Corbin Karin A | $23,900 | -- | |

| -- | $18,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tyler Karen | $71,000 | |

| Previous Owner | Keller Robert | $62,225 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,943 | $86,030 | $27,580 | $58,450 |

| 2023 | $4,073 | $86,030 | $27,580 | $58,450 |

| 2022 | $2,399 | $40,500 | $8,470 | $32,030 |

| 2021 | $2,176 | $40,500 | $8,470 | $32,030 |

| 2020 | $2,351 | $40,500 | $8,470 | $32,030 |

| 2019 | $1,889 | $30,380 | $6,510 | $23,870 |

| 2018 | $1,564 | $30,380 | $6,510 | $23,870 |

| 2017 | $1,625 | $30,380 | $6,510 | $23,870 |

| 2016 | $1,253 | $18,450 | $4,100 | $14,350 |

| 2015 | $1,152 | $18,450 | $4,100 | $14,350 |

| 2014 | $1,144 | $18,450 | $4,100 | $14,350 |

| 2013 | $594 | $19,425 | $4,305 | $15,120 |

Source: Public Records

Map

Nearby Homes

- 1328 Kent St

- 664-666 Bedford Ave

- 734 Linwood Ave

- 730 Miller Ave

- 778 Miller Ave

- 810 Miller Ave

- 0 Mooberry St

- 829-831 Studer Ave

- 1225 E Livingston Ave

- 668 Wilson Ave

- 1345 E Livingston Ave Unit 1347

- 1186-1188 E Livingston Ave Unit 1186

- 1390 E Livingston Ave

- 1356 Cole St

- 693 Kelton Ave

- 568-570 Kimball Place

- 851 Studer Ave

- 572 Linwood Ave

- 855 Studer Ave

- 555 Kimball Place Unit 557

- 714 Kimball Place

- 722 Kimball Place

- 730 Kimball Place

- 710 Kimball Place

- 734 Kimball Place

- 706 Kimball Place

- 738 Kimball Place

- 700 Kimball Place

- 717 Kimball Place

- 715 Kimball Place

- 740 Kimball Place Unit 742

- 721 Kimball Place

- 711 Kimball Place

- 694 Kimball Place

- 705 Kimball Place

- 1320 Gault St Unit 322

- 746 Kimball Place

- 699 Kimball Place

- 1325 Kent St

- 1331 Kent St