719 Deerfield Trail Unit 26 Springfield, OH 45503

Estimated Value: $285,000 - $292,000

3

Beds

3

Baths

1,745

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 719 Deerfield Trail Unit 26, Springfield, OH 45503 and is currently estimated at $287,640, approximately $164 per square foot. 719 Deerfield Trail Unit 26 is a home located in Clark County with nearby schools including Rolling Hills Elementary School, Northridge Middle School, and Kenton Ridge Middle & High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 13, 2018

Sold by

Griesmer Donna M and Griesmer Richard

Bought by

Kalinos Theodore V

Current Estimated Value

Purchase Details

Closed on

Jan 4, 2018

Sold by

Kalinos Theodore V and The Dorothy N Kalinos Irrevoca

Bought by

Kalinos Theodore V and Griesmer Donna M

Purchase Details

Closed on

Mar 16, 2017

Sold by

Kalinos Dorothy N

Bought by

Kalinos Theodore V

Purchase Details

Closed on

Feb 8, 2012

Sold by

Kalinos Dorothy N

Bought by

Kalinos Dorothy N and Kalinos Ted

Purchase Details

Closed on

Mar 1, 2007

Sold by

Hoppes Builders & Development Co

Bought by

Kalinos Dorothy N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,000

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kalinos Theodore V | -- | None Available | |

| Kalinos Theodore V | -- | None Available | |

| Kalinos Theodore V | -- | None Available | |

| Kalinos Dorothy N | -- | Attorney | |

| Kalinos Dorothy N | $167,900 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kalinos Dorothy N | $68,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,896 | $68,480 | $10,500 | $57,980 |

| 2023 | $2,896 | $68,480 | $10,500 | $57,980 |

| 2022 | $2,960 | $68,480 | $10,500 | $57,980 |

| 2021 | $2,960 | $59,100 | $8,750 | $50,350 |

| 2020 | $2,962 | $59,100 | $8,750 | $50,350 |

| 2019 | $3,019 | $59,100 | $8,750 | $50,350 |

| 2018 | $3,041 | $57,080 | $8,750 | $48,330 |

| 2017 | $2,607 | $54,352 | $8,750 | $45,602 |

| 2016 | $2,589 | $54,352 | $8,750 | $45,602 |

| 2015 | $2,664 | $53,008 | $8,750 | $44,258 |

| 2014 | $2,664 | $53,008 | $8,750 | $44,258 |

| 2013 | $2,602 | $53,008 | $8,750 | $44,258 |

Source: Public Records

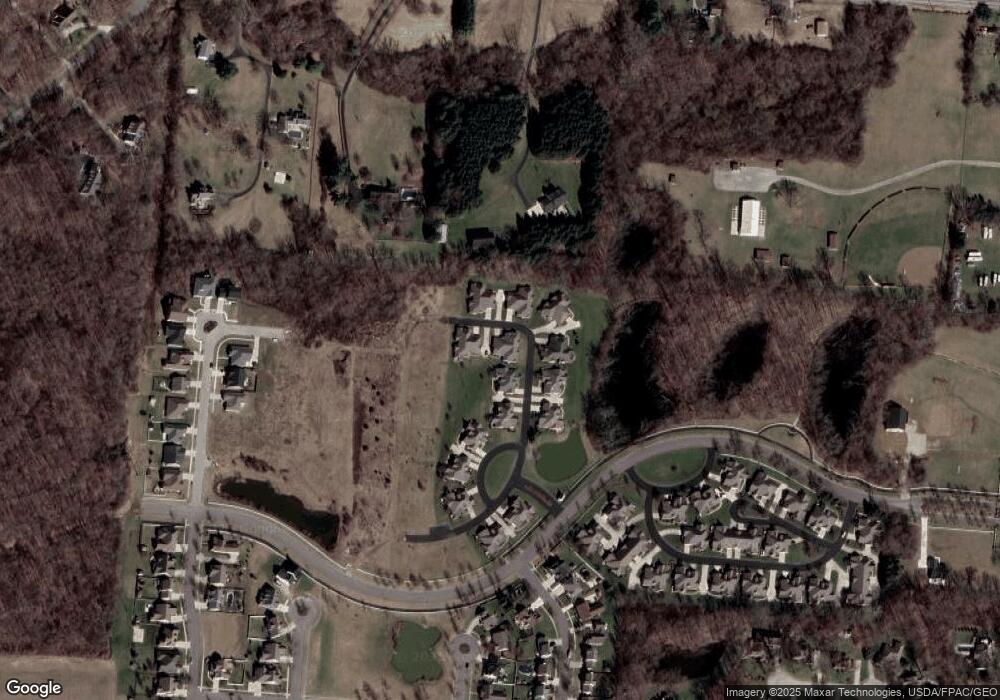

Map

Nearby Homes

- 4514 Dowden St

- 880 Brendle Trace Unit 28

- 916 Sawmill Ct

- 794 Donnelly Ave

- 593 Hiser Ave

- 970 Forest Edge Ave

- 4712 Cullen Ave

- 4622 W Ridgewood Rd

- 4109 Derr Rd

- 1461 Student Ave

- 1139 Greenoak Ct

- 5127 Stoneridge Dr

- 4512 Ridgewood Rd E

- 4446 Ridgewood Rd E Unit 3

- 5249 Taywell Dr

- 4740 Merrimont Ave

- 5220 Ridgewood Rd E

- 717 Deerfield Trail Unit 25

- 709 Deerfield Trail Unit 16

- 707 Deerfield Trail Unit 15

- 723 Deerfield Trail Unit 29

- 725 Deerfield Trail

- 710 Deerfield Trail Unit 19

- 718 Deerfield Trail Unit 23

- 706 Deerfield Trail Unit 17

- 712 Deerfield Trail Unit 20

- 722 Deerfield Trail Unit 27

- 722 Deerfield Trail

- 708 Deerfield Trail

- 714 Deerfield Trail

- 714 Deerfield Trail Unit 21

- 701 Deerfield Trail Unit 11

- 724 Deerfield Trail Unit 28

- 703 Deerfield Trail Unit 12

- 716 Deerfield Trail

- 702 Deerfield Trail Unit 13

- 704 Deerfield Trail Unit 14