7200 SW 8th Ave Unit 121S Gainesville, FL 32607

Estimated Value: $142,572 - $144,000

2

Beds

2

Baths

1,070

Sq Ft

$134/Sq Ft

Est. Value

About This Home

This home is located at 7200 SW 8th Ave Unit 121S, Gainesville, FL 32607 and is currently estimated at $143,393, approximately $134 per square foot. 7200 SW 8th Ave Unit 121S is a home located in Alachua County with nearby schools including Myra Terwilliger Elementary School, Fort Clarke Middle School, and F.W. Buchholz High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2016

Sold by

Hersch Larry S

Bought by

Chandra Karan Julia and Chandra Karan

Current Estimated Value

Purchase Details

Closed on

Nov 16, 2015

Bought by

Karan and Karan Karan

Purchase Details

Closed on

Jul 28, 2003

Sold by

Fountain Jennifer M

Bought by

Hersch Larry S and Hersch Carol W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,400

Interest Rate

5.17%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 5, 2000

Sold by

Lee Joseph K and Querido Jane G

Bought by

Fountain Jennifer M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$53,469

Interest Rate

8.34%

Mortgage Type

FHA

Purchase Details

Closed on

May 21, 1998

Sold by

Sutton Doulgas Hoyt

Bought by

Lee Joseph K and Querido Jane G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,400

Interest Rate

7.11%

Purchase Details

Closed on

Apr 28, 1997

Sold by

Lamm Edwin R and Lamm Rosemarie S

Bought by

Sutton Douglas Hoyt

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,450

Interest Rate

7.95%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 1, 1984

Bought by

Karan and Karan Karan

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chandra Karan Julia | $47,500 | None Available | |

| Karan | $100 | -- | |

| Hersch Larry S | -- | Attorney | |

| Hersch Larry S | $75,500 | -- | |

| Fountain Jennifer M | $54,700 | -- | |

| Lee Joseph K | $49,200 | -- | |

| Sutton Douglas Hoyt | $49,000 | -- | |

| Karan | $46,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hersch Larry S | $60,400 | |

| Previous Owner | Fountain Jennifer M | $53,469 | |

| Previous Owner | Lee Joseph K | $48,400 | |

| Previous Owner | Sutton Douglas Hoyt | $48,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,006 | $132,000 | -- | $132,000 |

| 2023 | $2,006 | $115,000 | $0 | $115,000 |

| 2022 | $1,806 | $100,000 | $0 | $100,000 |

| 2021 | $1,603 | $80,000 | $0 | $80,000 |

| 2020 | $1,481 | $75,000 | $0 | $75,000 |

| 2019 | $1,393 | $68,000 | $0 | $68,000 |

| 2018 | $1,249 | $60,000 | $0 | $60,000 |

| 2017 | $1,044 | $41,000 | $0 | $41,000 |

| 2016 | $920 | $38,470 | $0 | $0 |

| 2015 | $848 | $34,980 | $0 | $0 |

| 2014 | $763 | $31,800 | $0 | $0 |

| 2013 | -- | $31,800 | $0 | $31,800 |

Source: Public Records

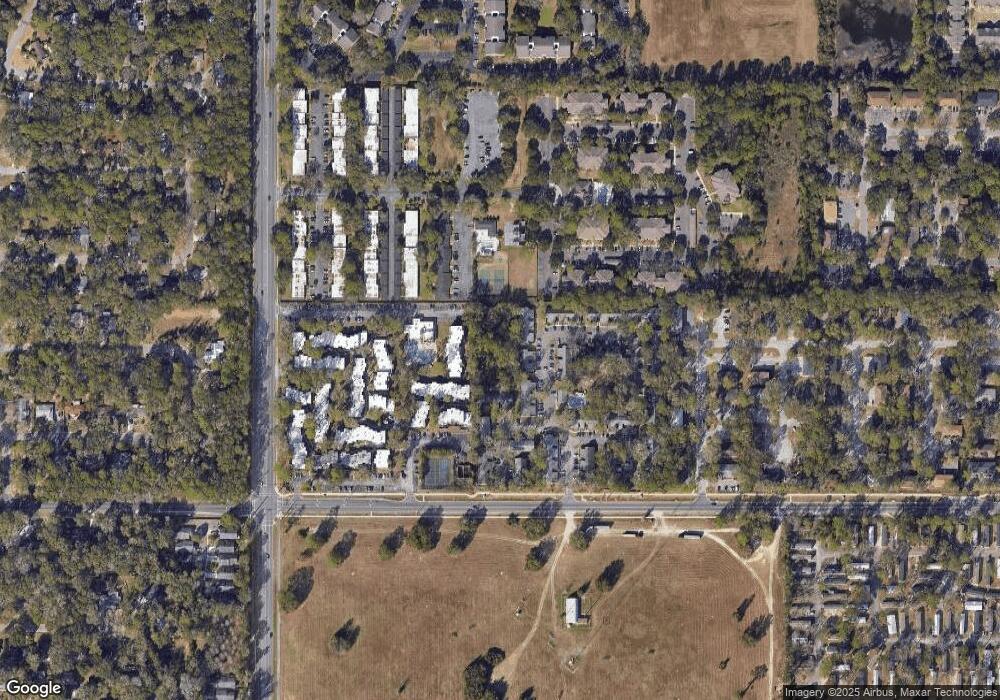

Map

Nearby Homes

- 7200 SW 8th Ave Unit P102

- 7200 SW 8th Ave Unit H49

- 7200 SW 8th Ave Unit D24

- 715 SW 75th St Unit 104

- 613 SW 75th St Unit 101

- 613 SW 75th St Unit 103

- 501 SW 75th St Unit H6

- 501 SW 75th St Unit F13

- 501 SW 75th St Unit E8

- 501 SW 75th St Unit D14

- 501 SW 75th St Unit G14

- 701 SW 75th St Unit 101

- 501 SW 75th Terrace

- 1004 SW 67th Dr

- 1018 SW 67 St

- 6734 SW 10th Ln

- 6726 SW 10th Ln

- 6718 SW 10th Ln

- 6710 SW 10th Ln

- 1021 SW 67 St

- 7200 SW 8th Ave Unit P101

- 7200 SW 8th Ave Unit T-131

- 7200 SW 8th Ave Unit T-131

- 7200 SW 8th Ave Unit C15

- 7200 SW 8th Ave Unit I52

- 7200 SW 8th Ave Unit H46

- 7200 SW 8th Ave Unit G41

- 7200 SW 8th Ave Unit O90

- 7200 SW 8th Ave Unit N88

- 7200 SW 8th Ave Unit 122S

- 7200 SW 8th Ave Unit J62

- 7200 SW 8th Ave Unit G42

- 7200 SW 8th Ave Unit N83

- 7200 SW 8th Ave Unit M76

- 7200 SW 8th Ave Unit E32

- 7200 SW 8th Ave Unit B13

- 7200 SW 8th Ave Unit P98

- 7200 SW 8th Ave Unit 126T

- 7200 SW 8th Ave Unit K66

- 7200 SW 8th Ave Unit K64