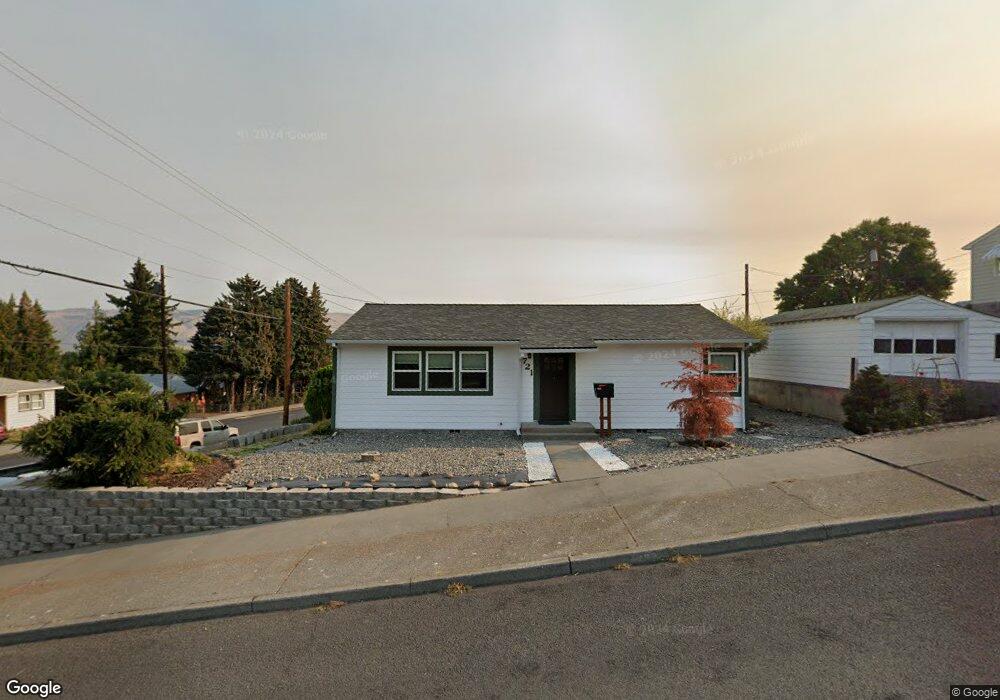

721 W 15th St the Dalles, OR 97058

Estimated Value: $289,000 - $305,990

2

Beds

1

Bath

1,025

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 721 W 15th St, the Dalles, OR 97058 and is currently estimated at $297,495, approximately $290 per square foot. 721 W 15th St is a home located in Wasco County with nearby schools including Colonel Wright Elementary School, The Dalles Middle School, and The Dalles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 20, 2012

Sold by

Smith Caleb R and Jp Morgan Chase Bank

Bought by

Homesales Inc

Current Estimated Value

Purchase Details

Closed on

May 2, 2011

Sold by

Smith Caleb R and Jpmorgan Chase Bank Na

Bought by

Homesales Inc

Purchase Details

Closed on

Feb 3, 2011

Sold by

Homesales Inc

Bought by

Hemenway Wesley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,551

Interest Rate

3.85%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 25, 2008

Sold by

Olsen Rebecca Lynn and Estate Of Deloris Margie Jones

Bought by

Smith Caleb R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,771

Interest Rate

5.64%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Homesales Inc | $110,500 | None Available | |

| Homesales Inc | $110,500 | -- | |

| Hemenway Wesley | -- | None Available | |

| Smith Caleb R | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hemenway Wesley | $107,551 | |

| Previous Owner | Smith Caleb R | $162,771 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,145 | $119,158 | -- | -- |

| 2023 | $2,082 | $115,688 | $0 | $0 |

| 2022 | $2,036 | $208,440 | $0 | $0 |

| 2021 | $1,974 | $202,369 | $0 | $0 |

| 2020 | $1,925 | $196,475 | $0 | $0 |

| 2019 | $2,033 | $190,752 | $0 | $0 |

| 2018 | $1,976 | $99,793 | $0 | $0 |

| 2017 | $1,914 | $96,886 | $0 | $0 |

| 2016 | $1,872 | $94,064 | $0 | $0 |

| 2015 | $1,767 | $91,324 | $0 | $0 |

| 2014 | $1,789 | $88,664 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 0 W 16th St

- 602 W 13th St

- 719 W 11th St

- 811 W 9th St

- 522 W 22nd St

- 906 Garrison St

- 990 W 8th Place

- 115 W Scenic Dr

- 608 W 6th St

- 417 Park Place

- 1832 Cherry Heights Rd

- 529 W 3rd Place

- 309 W 7th St

- 0 Sandstone Way

- 209 1/2 W 5th Place

- 2601 Ericksen Way

- 1606 W 10th St

- 1622 W 12th St

- 216 E 5th St

- 319 E 7th St

- 1508 Mount Hood St

- 717 W 15th St

- 1506 Mount Hood St

- 722 W 15th St

- 709 W 15th St

- 714 W 15th St

- 1515 Mt Hood

- 1515 Mount Hood St

- 714 W 14th St

- 718 W 14th St

- 1509 Mount Hood St

- 710 W 14th St

- 1601 Mount Hood St

- 703 W 15th St

- 804 W 14th St

- 708 W 15th St

- 704 W 14th St

- 809 W 15th St

- 0 Mount Hood St

- 1610 Mount Hood St