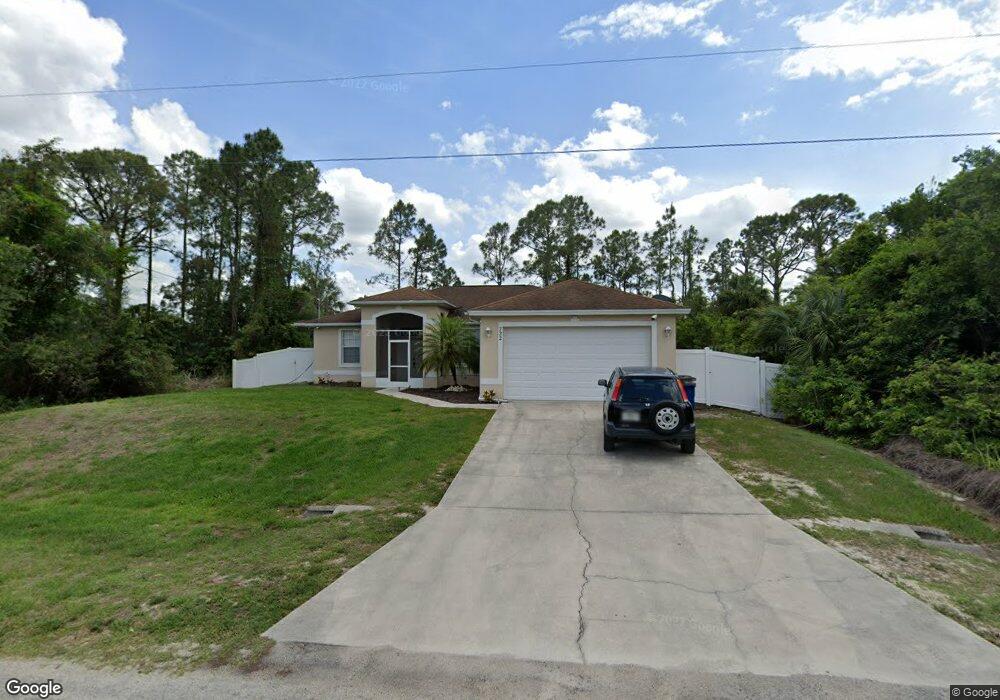

722 Theodore Vail St E Lehigh Acres, FL 33974

Eisenhower NeighborhoodEstimated Value: $274,214 - $312,000

3

Beds

2

Baths

1,713

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 722 Theodore Vail St E, Lehigh Acres, FL 33974 and is currently estimated at $294,804, approximately $172 per square foot. 722 Theodore Vail St E is a home located in Lee County with nearby schools including Lehigh Elementary School, The Alva School, and Gateway Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2017

Sold by

Lawson Donald D and Brady Krystal

Bought by

Nazario Joseph and Archilla Wanda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,083

Outstanding Balance

$133,741

Interest Rate

4.75%

Mortgage Type

FHA

Estimated Equity

$161,063

Purchase Details

Closed on

Aug 28, 2013

Sold by

Devlin Patrick M

Bought by

Mcmahon Paul and Mcmahon Amanda

Purchase Details

Closed on

Aug 21, 2012

Sold by

Marflax Investors Llc

Bought by

Devlin Patrick Mickey

Purchase Details

Closed on

Jul 26, 2011

Sold by

Ducran Lloyd

Bought by

Marflax Investors Llc

Purchase Details

Closed on

Jun 1, 2009

Sold by

Ducran Family Land Trust #722

Bought by

Ducran Lloyd

Purchase Details

Closed on

Sep 8, 2008

Sold by

Ducran Lloyd

Bought by

Abraham & Sweeney Pa and Ducran Family Land Trust #722

Purchase Details

Closed on

May 12, 1999

Sold by

Patty Dale F

Bought by

Ducran Lloyd

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nazario Joseph | $161,000 | Sunbelt Title Agency | |

| Mcmahon Paul | $110,000 | Florida Land Title Services | |

| Devlin Patrick Mickey | $45,000 | Florida Land Title Services | |

| Marflax Investors Llc | $35,200 | None Available | |

| Ducran Lloyd | -- | Attorney | |

| Abraham & Sweeney Pa | -- | Attorney | |

| Ducran Lloyd | $1,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nazario Joseph | $158,083 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,112 | $203,011 | $17,765 | $182,640 |

| 2024 | $2,859 | $233,744 | $13,606 | $216,644 |

| 2023 | $3,056 | $233,507 | $10,093 | $220,919 |

| 2022 | $2,859 | $169,033 | $0 | $0 |

| 2021 | $2,549 | $162,747 | $6,790 | $155,957 |

| 2020 | $2,363 | $139,696 | $4,300 | $135,396 |

| 2019 | $2,350 | $134,045 | $4,700 | $129,345 |

| 2018 | $2,371 | $134,856 | $4,400 | $130,456 |

| 2017 | $2,156 | $123,548 | $4,250 | $119,298 |

| 2016 | $1,947 | $102,427 | $6,841 | $95,586 |

| 2015 | $1,197 | $98,100 | $6,210 | $91,890 |

| 2014 | -- | $84,290 | $4,649 | $79,641 |

| 2013 | -- | $69,707 | $1,900 | $67,807 |

Source: Public Records

Map

Nearby Homes

- 521 Frank Jewett Ave S

- 523 Harry Thayer Ave S

- 737 Long Island St E

- 518 Harry Thayer Ave S

- 494 Lemhurst Ave S

- 512 Empire Ave S

- 736 Theodore Vail St E

- 510 Edward Hall Ave S

- 490 Lemhurst Ave S

- 483 Lemhurst Ave

- 514 Bronx Ave S

- 534 Empire Ave S

- 497 Lenox Ave E

- 524 Bronx Ave S

- 731 Chattman St E

- 748 Chattman St E

- 673 Chestnut St E

- 542 Upstate Ave S

- 752 Chattman St E

- 684 Kingsbury St E

- 722 Theodore Vail St E

- 720 Theodore Vail St E

- 723 Long Island St E

- 723 Theodore Vail St E

- 725 Theodore Vail St E Unit 1

- 721 Theodore Vail St E

- 719 Long Island St E

- 727 Long Island St E Unit 1

- 716 Theodore Vail St E

- 728 Theodore Vail St E Unit 1

- 719 Theodore Vail St E

- 729 Long Island St E

- 717 Theodore Vail St E

- 714 Theodore Vail St E Unit 7

- 714 Theodore Vail St E

- 715 Long Island St E

- 523 Genesee Ave S

- 517 Genesee Ave S

- 525 Genesee Ave S