726 Worthington Forest Place Unit 4 Columbus, OH 43229

Salem Village NeighborhoodEstimated Value: $130,000 - $136,000

2

Beds

2

Baths

1,188

Sq Ft

$111/Sq Ft

Est. Value

About This Home

This home is located at 726 Worthington Forest Place Unit 4, Columbus, OH 43229 and is currently estimated at $132,431, approximately $111 per square foot. 726 Worthington Forest Place Unit 4 is a home located in Franklin County with nearby schools including Salem Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2015

Sold by

Anglin Chelsey

Bought by

Anglin Greg

Current Estimated Value

Purchase Details

Closed on

Feb 20, 2015

Sold by

Anglin Greg

Bought by

Anglin Greg and Anglin Chelsey

Purchase Details

Closed on

Jan 30, 2013

Sold by

Federal Home Loan Mortgage Assn

Bought by

Anglin Greg

Purchase Details

Closed on

Jan 10, 2013

Sold by

Komminsk Brad L

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Feb 9, 2006

Sold by

Cassie Richard G and Cassie Connie C

Bought by

Komminsk Brad L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,350

Interest Rate

6.34%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Apr 6, 2001

Sold by

Rgc-2 Income Properties Ltd Partnership

Bought by

Cassie Richard G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,000

Interest Rate

7.18%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Dec 31, 1987

Bought by

Rgc-2 Income Properties

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anglin Greg | -- | None Available | |

| Anglin Greg | -- | None Available | |

| Anglin Greg | $25,400 | None Available | |

| Federal Home Loan Mortgage Corporation | $25,000 | None Available | |

| Komminsk Brad L | $53,000 | Talon Group | |

| Cassie Richard G | $360,000 | -- | |

| Rgc-2 Income Properties | $431,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Komminsk Brad L | $50,350 | |

| Previous Owner | Cassie Richard G | $92,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,481 | $32,310 | $3,500 | $28,810 |

| 2023 | $1,462 | $32,305 | $3,500 | $28,805 |

| 2022 | $919 | $17,300 | $2,560 | $14,740 |

| 2021 | $921 | $17,300 | $2,560 | $14,740 |

| 2020 | $922 | $17,300 | $2,560 | $14,740 |

| 2019 | $740 | $11,900 | $1,750 | $10,150 |

| 2018 | $644 | $11,900 | $1,750 | $10,150 |

| 2017 | $672 | $11,900 | $1,750 | $10,150 |

| 2016 | $604 | $8,890 | $2,800 | $6,090 |

| 2015 | $550 | $8,890 | $2,800 | $6,090 |

| 2014 | $551 | $8,890 | $2,800 | $6,090 |

| 2013 | $264 | $8,890 | $2,800 | $6,090 |

Source: Public Records

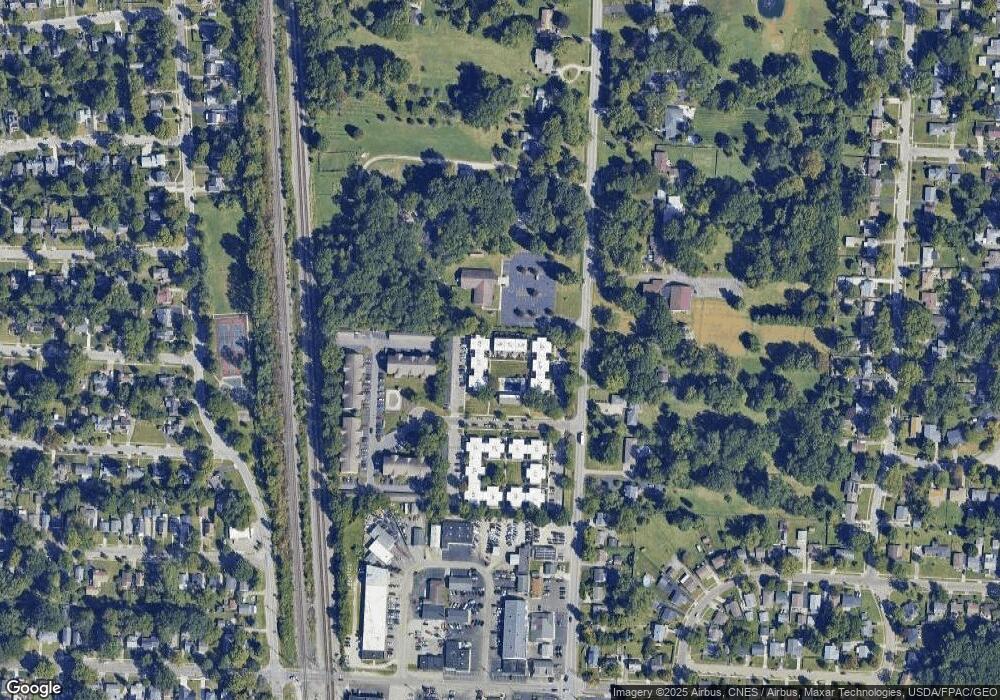

Map

Nearby Homes

- 734 Worthington Forest Place Unit 734

- 5475 Worthington Forest Pl E Unit 5475

- 627 S Selby Blvd

- 569 Chase Rd

- 582 E Lincoln Ave

- 964 Strimple Ave

- 5318 Eisenhower Rd

- 5579 Norcross Rd

- 5462 Roche Dr

- 5364 Sharon Ave

- 5548 Roche Dr

- 353 Kenbrook Dr

- 415 E South St

- 5415 Vinewood Ct

- 5480 Rockwood Ct Unit R1

- 292 Chase Rd

- 5584 Morning St

- 5674 Lindenwood Rd

- 340 E Dublin Granville Rd

- 4983 Almont Dr

- 726 Worthington Forest Place Unit 726

- 724 Worthington Forest Place Unit 724

- 730 Worthington Forest Place Unit 730

- 728 Worthington Forest Place

- 5502 Worthington Forest Place E Unit 5502

- 732 Worthington Forest Place Unit 732

- 5498 Worthington Forest Place E Unit 5498

- 738 Worthington Forest Place Unit 738

- 738 Worthington Forest Place Unit 4

- 5494 Worthington Forest Place E Unit 5494

- 736 Worthington Forest Place Unit 736

- 5500 Worthington Forest Place E Unit 5500

- 742 Worth Forest Place Unit BLDG 4

- 5496 Worthington Forest Place E Unit 5496

- 5496 Worthington Forest Place E Unit 3

- 740 Worthington Forest Place Unit 740

- 742 Worthington Forest Place Unit 742

- 5492 Worthington Forest Place E Unit 5492

- 744 Worthington Forest Place Unit 744

- 746 Worthington Forest Place Unit 746