727 N 17th St Unit JUN Altoona, PA 16601

East Juniata NeighborhoodEstimated Value: $159,000 - $189,000

3

Beds

2

Baths

1,008

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 727 N 17th St Unit JUN, Altoona, PA 16601 and is currently estimated at $173,899, approximately $172 per square foot. 727 N 17th St Unit JUN is a home located in Blair County with nearby schools including Shady Pond School and Faith Tabernacle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2020

Sold by

Wilt Gregory A and Mcclellan Dawn M

Bought by

Wilt Gregory A and Wilt Dawn M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,000

Outstanding Balance

$45,900

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$127,999

Purchase Details

Closed on

May 30, 2008

Sold by

Santone Randy L and Santone Amy L

Bought by

Wilt Gregory A and Mcclellan Dawn M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,200

Interest Rate

5.91%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilt Gregory A | -- | Universal Setmnt Svcs Of Pa | |

| Wilt Gregory A | $134,000 | Realty Abstract Services Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilt Gregory A | $64,000 | |

| Closed | Wilt Gregory A | $107,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,384 | $124,800 | $23,000 | $101,800 |

| 2024 | $2,109 | $124,800 | $23,000 | $101,800 |

| 2023 | $1,954 | $124,800 | $23,000 | $101,800 |

| 2022 | $1,926 | $124,800 | $23,000 | $101,800 |

| 2021 | $1,926 | $124,800 | $23,000 | $101,800 |

| 2020 | $1,923 | $124,800 | $23,000 | $101,800 |

| 2019 | $1,879 | $124,800 | $23,000 | $101,800 |

| 2018 | $1,826 | $124,800 | $23,000 | $101,800 |

| 2017 | $7,895 | $124,800 | $23,000 | $101,800 |

| 2016 | $394 | $12,310 | $1,090 | $11,220 |

| 2015 | $394 | $12,310 | $1,090 | $11,220 |

| 2014 | $394 | $12,310 | $1,090 | $11,220 |

Source: Public Records

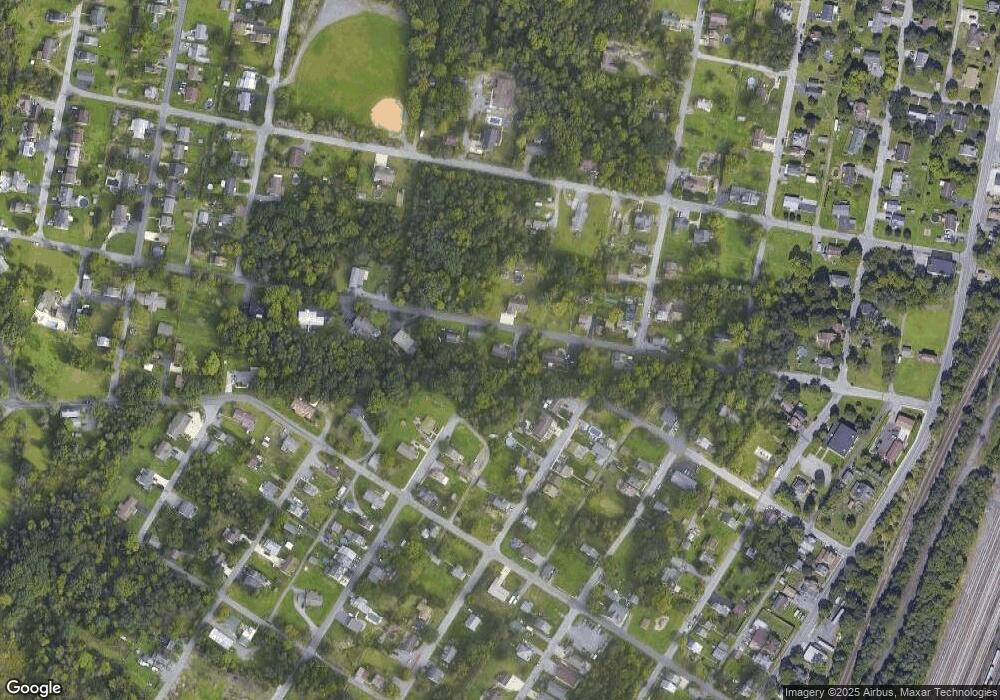

Map

Nearby Homes

- 417 N 12th St

- 1320-1324 N 4th Ave

- 184 Sandy Run Rd

- 0 Foxglove Rd Unit PABR2000124

- 000 Foxglove Rd

- 625 N 5th Ave

- 619 N 6th Ave

- 621 N 10th Ave

- 600 N 6th Ave

- 509-511 N 6th Ave

- 110 California Dr

- 711 N 4th St Unit JUN

- 1647 Saint Francis Ln

- 1105 N 3rd St Unit JUN

- 211 N 9th Ave

- 1603 Olde Dominion Dr

- 604 N 2nd St

- 254 Asbury Ln Unit 2

- 1113 Broadway

- 803 Park Blvd

- 1701 N 7 1/2 Ave

- 719 N 17th St Unit JUN

- 1533 N 7th Ave Unit 39

- 1525 N 7th Ave Unit 31

- 1521 N 7th Ave Unit 23

- 1523 N 7th Ave

- 801 N 17th St

- 1514 N 8th Ave

- 1619 N 7th Ave

- 1510 N 8th Ave Unit 12

- 1608 N 8th Ave Unit 14

- 1528 N 7th Ave Unit 32

- 1524 N 7th Ave Unit 26

- 1705 N 7th Ave Unit 11

- 1504 N 8th Ave Unit 8

- 1514 N 7th Ave Unit 18

- 1520 N 7th Ave Unit 22

- 1713 N 7th Ave Unit 15

- 1509 N 7th Ave

- 1612 N 9th Ave Unit 18