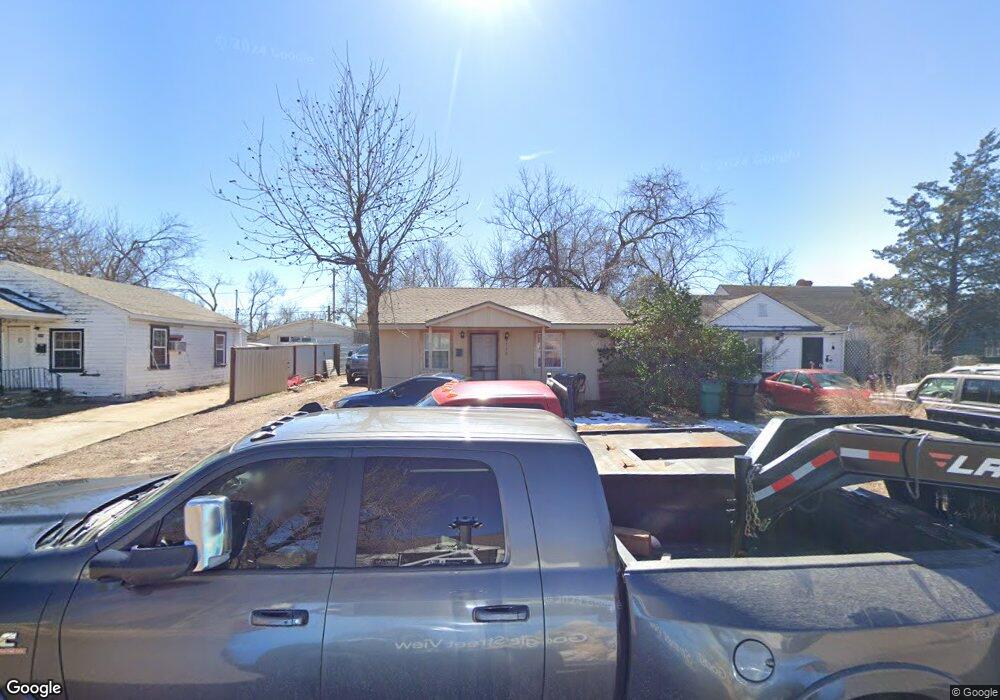

728 SW 32nd St Oklahoma City, OK 73109

Capitol Hill NeighborhoodEstimated Value: $62,000 - $125,000

1

Bed

1

Bath

736

Sq Ft

$119/Sq Ft

Est. Value

About This Home

This home is located at 728 SW 32nd St, Oklahoma City, OK 73109 and is currently estimated at $87,786, approximately $119 per square foot. 728 SW 32nd St is a home located in Oklahoma County with nearby schools including Adelaide Lee Elementary School, Capitol Hill Middle School, and Capitol Hill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 30, 2020

Sold by

Guijarro Ehrique and Guijarro Elena

Bought by

Garcia Armalio David and Saldivar Brenda L

Current Estimated Value

Purchase Details

Closed on

Oct 24, 2011

Sold by

Medina Maria Magdalena

Bought by

Guijarro Enrique

Purchase Details

Closed on

Jan 8, 2007

Sold by

Martinez Jose Mendez

Bought by

Medina Maria Magdalena

Purchase Details

Closed on

Dec 15, 2006

Sold by

Ruf Katherine A

Bought by

Martinez Jose Mendez

Purchase Details

Closed on

Apr 18, 2005

Sold by

Ruf Katherine A

Bought by

Martinez Jose Mendez

Purchase Details

Closed on

Jan 19, 1998

Sold by

Tennyson Dora M

Bought by

Ruf Katherine A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garcia Armalio David | $32,500 | None Available | |

| Guijarro Enrique | -- | None Available | |

| Medina Maria Magdalena | -- | None Available | |

| Martinez Jose Mendez | $15,000 | None Available | |

| Martinez Jose Mendez | $15,000 | -- | |

| Ruf Katherine A | $13,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Martinez Jose Mendez | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $717 | $6,366 | $1,309 | $5,057 |

| 2023 | $717 | $6,063 | $1,478 | $4,585 |

| 2022 | $651 | $5,775 | $1,597 | $4,178 |

| 2021 | $618 | $5,500 | $931 | $4,569 |

| 2020 | $522 | $4,608 | $929 | $3,679 |

| 2019 | $495 | $4,389 | $895 | $3,494 |

| 2018 | $473 | $4,180 | $0 | $0 |

| 2017 | $460 | $4,069 | $900 | $3,169 |

| 2016 | $461 | $4,069 | $900 | $3,169 |

| 2015 | $447 | $3,908 | $900 | $3,008 |

| 2014 | -- | $3,823 | $900 | $2,923 |

Source: Public Records

Map

Nearby Homes

- 617 SW 35th St

- 607 SW 31st St

- 520 SW 31st St

- 505 SW 30th St

- 115 SW 28th St

- 1033 SW Binkley St

- 3215 S Harvey Ave

- 3225 S Douglas Ave

- 1028 SW 28th St

- 325 SW 40th St

- 605 SW 26th St

- 1141 SW Binkley St

- 8 SW 41st St

- 1128 SW Grand Blvd

- 1044 SW 26th St

- 2416 S Shartel Ave

- 1116 SW 38th St

- 520 SW 24th St

- 3107 S Broadway Ave

- 4113 S Harvey Ave