Estimated Value: $224,354 - $254,000

3

Beds

3

Baths

1,466

Sq Ft

$165/Sq Ft

Est. Value

About This Home

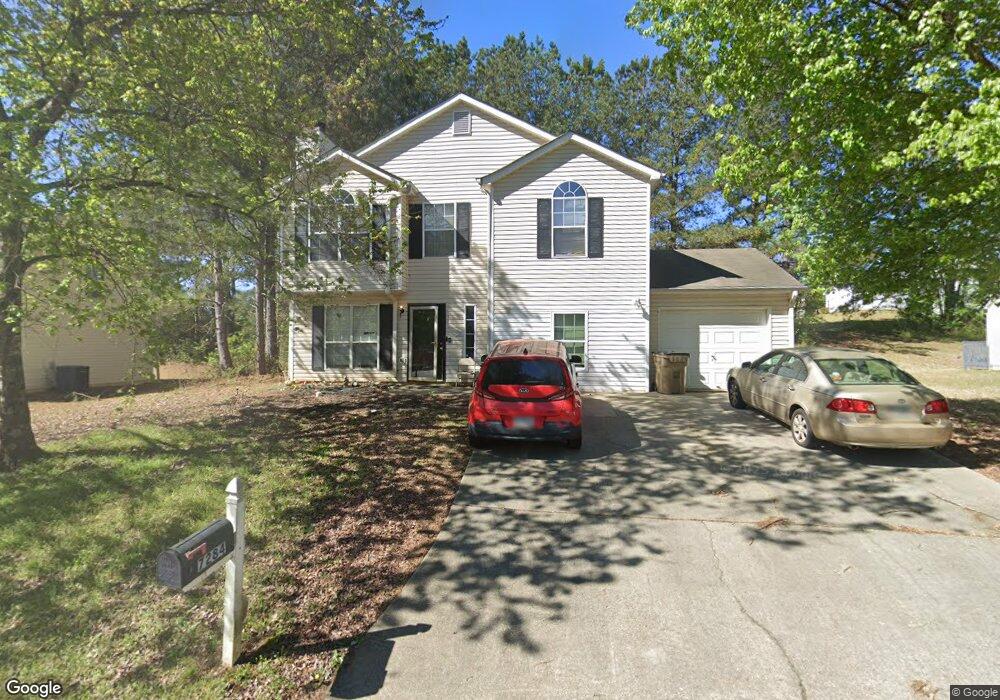

This home is located at 7284 New Dale Rd, Rex, GA 30273 and is currently estimated at $242,589, approximately $165 per square foot. 7284 New Dale Rd is a home located in Clayton County with nearby schools including Roberta T. Smith Elementary School, Rex Mill Middle School, and Mount Zion High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2021

Sold by

Ribbon Home Spv Ii Llc

Bought by

Lencrerot Kalen and Lencrerot Keisha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,000

Outstanding Balance

$115,388

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$127,201

Purchase Details

Closed on

Apr 13, 2021

Sold by

Jones Mekeya L

Bought by

Ribbon Home Spv Ii Llc

Purchase Details

Closed on

Dec 10, 2004

Sold by

Jones Sultan M

Bought by

Jones Mekeya Lashawn

Purchase Details

Closed on

Sep 29, 1998

Sold by

Gt Architecture Constract

Bought by

Jones Sultan M and Jones Mekeya L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,969

Interest Rate

6.95%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lencrerot Kalen | $177,000 | -- | |

| Ribbon Home Spv Ii Llc | $177,000 | -- | |

| Jones Mekeya Lashawn | $103,000 | -- | |

| Jones Sultan M | $99,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lencrerot Kalen | $127,000 | |

| Previous Owner | Jones Sultan M | $100,969 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,565 | $88,680 | $7,200 | $81,480 |

| 2023 | $3,202 | $88,680 | $7,200 | $81,480 |

| 2022 | $2,424 | $70,800 | $7,160 | $63,640 |

| 2021 | $2,160 | $53,720 | $7,200 | $46,520 |

| 2020 | $1,920 | $47,064 | $7,200 | $39,864 |

| 2019 | $1,687 | $40,630 | $6,400 | $34,230 |

| 2018 | $1,597 | $38,412 | $6,400 | $32,012 |

| 2017 | $1,426 | $34,101 | $6,400 | $27,701 |

| 2016 | $1,289 | $30,753 | $6,400 | $24,353 |

| 2015 | $1,279 | $0 | $0 | $0 |

| 2014 | $1,039 | $25,156 | $6,400 | $18,756 |

Source: Public Records

Map

Nearby Homes

- 6870 Diamond Dr

- 7106 Oakwood Cir Unit 1

- 6891 Dresden Dr

- 3552 Topaz Terrace

- 3401 Mosswood Ln

- 3535 Henley St

- 3700 Hudson Ct

- 7027 Biscayne Blvd

- 3353 Medina Dr

- 0 Lakeland Rd Unit 7648836

- 0 Lakeland Rd Unit 10603417

- 6702 Saganaw Dr

- 3189 Glen Hollow Dr

- 3315 Canterbury Trail

- 6646 Creek Turn Dr

- 0 Daniel Dr Unit 10628491

- 6750 Sunset Hills Blvd

- 6674 Sunset Valley Cir

- 3140 Glen Hollow Dr

- 3145 Deerfield Way

- 7292 New Dale Rd

- 7276 New Dale Rd

- 7276 New Dale Rd Unit III

- 7180 Oakwood Cir

- 7186 Oakwood Cir

- 7174 Oakwood Cir

- 7289 New Dale Rd Unit 3

- 7300 New Dale Rd

- 7281 New Dale Rd Unit 52

- 7281 New Dale Rd

- 7297 New Dale Rd Unit III

- 0 Oakwood Cir Unit 8661424

- 0 Oakwood Cir Unit 3203789

- 0 Oakwood Cir Unit 7192321

- 7168 Oakwood Cir Unit III

- 7260 New Dale Rd

- 7308 New Dale Rd Unit 3

- 7305 New Dale Rd

- 3573 Mosswood Ln Unit III

- 3610 Mosswood Ln