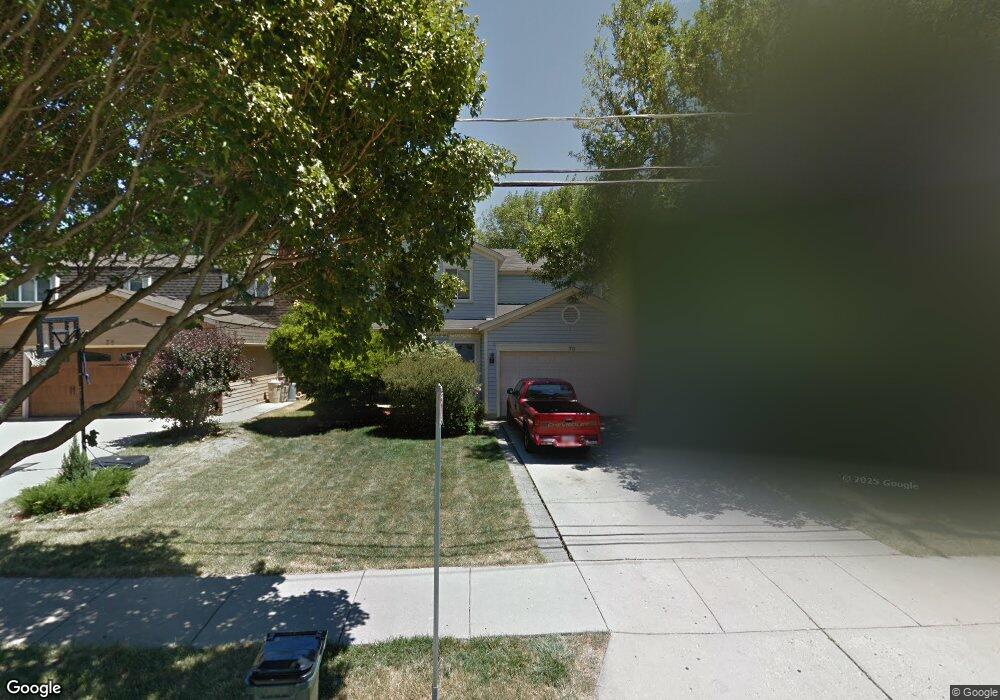

73 N Lambert Rd Glen Ellyn, IL 60137

Estimated Value: $537,000 - $637,000

4

Beds

3

Baths

2,032

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 73 N Lambert Rd, Glen Ellyn, IL 60137 and is currently estimated at $587,410, approximately $289 per square foot. 73 N Lambert Rd is a home located in DuPage County with nearby schools including Abraham Lincoln Elementary School, Hadley Junior High School, and Glenbard West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 21, 2006

Sold by

Velazquez Jose and Velazquez Maria

Bought by

Velazquez Jose and Velazquez Noemi

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Outstanding Balance

$191,403

Interest Rate

6.41%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$396,007

Purchase Details

Closed on

May 12, 2005

Sold by

Erickson Kevin D and Erickson Melissa A

Bought by

Velazquez Jose and Velazquez Maria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$276,000

Interest Rate

5.87%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Apr 19, 1996

Sold by

Knuepfer James R and Knuepfer Susan C

Bought by

Erickson Kevin D and Erickson Melissa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$179,900

Interest Rate

7.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Velazquez Jose | -- | Chicago Title Insurance Co | |

| Velazquez Jose | $345,000 | Greater Illinois Title | |

| Erickson Kevin D | $225,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Velazquez Jose | $320,000 | |

| Closed | Velazquez Jose | $276,000 | |

| Previous Owner | Erickson Kevin D | $179,900 | |

| Closed | Velazquez Jose | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,790 | $159,038 | $29,398 | $129,640 |

| 2023 | $10,303 | $146,390 | $27,060 | $119,330 |

| 2022 | $9,910 | $138,360 | $25,580 | $112,780 |

| 2021 | $9,529 | $135,070 | $24,970 | $110,100 |

| 2020 | $9,340 | $133,810 | $24,740 | $109,070 |

| 2019 | $9,130 | $130,280 | $24,090 | $106,190 |

| 2018 | $8,899 | $126,170 | $22,700 | $103,470 |

| 2017 | $8,763 | $121,510 | $21,860 | $99,650 |

| 2016 | $8,876 | $116,660 | $20,990 | $95,670 |

| 2015 | $8,851 | $111,290 | $20,020 | $91,270 |

| 2014 | $8,935 | $108,440 | $17,360 | $91,080 |

| 2013 | $8,698 | $108,760 | $17,410 | $91,350 |

Source: Public Records

Map

Nearby Homes

- 111 N Kenilworth Ave

- 53 N Main St

- 1000 S Lorraine Rd Unit 412

- 55 S Main St

- 562 Summerdale Ave

- 331 Lorraine St

- 1240 S Lorraine Rd Unit 1D

- 418 Hill Ave

- 121 S Parkside Ave

- 216 N Blanchard St

- 83 N Park Blvd

- 1010 E Illinois St

- 303 S President St

- 566 Glendale Ave

- 215 Orchard Ln

- 1643 Castbourne Ct

- 1411 College Ave

- 360 N Main St

- 606 Lakeview Terrace

- 615 N Blanchard St

- 75 N Lambert Rd

- 69 N Lambert Rd

- 67 N Lambert Rd

- 325 Illinois St

- 65 N Lambert Rd

- 72 Newton Ave

- 65 Newton Ave

- 74 Newton Ave

- 349 Illinois St

- 63 N Lambert Rd

- 324 Illinois St

- 66 N Lambert Rd

- 61 N Lambert Rd

- 74 N Lambert Rd

- 315 Illinois St

- 64 N Lambert Rd

- 60 N Lambert Rd

- 62 N Lambert Rd

- 340 Illinois St

- 89 N Lambert Rd