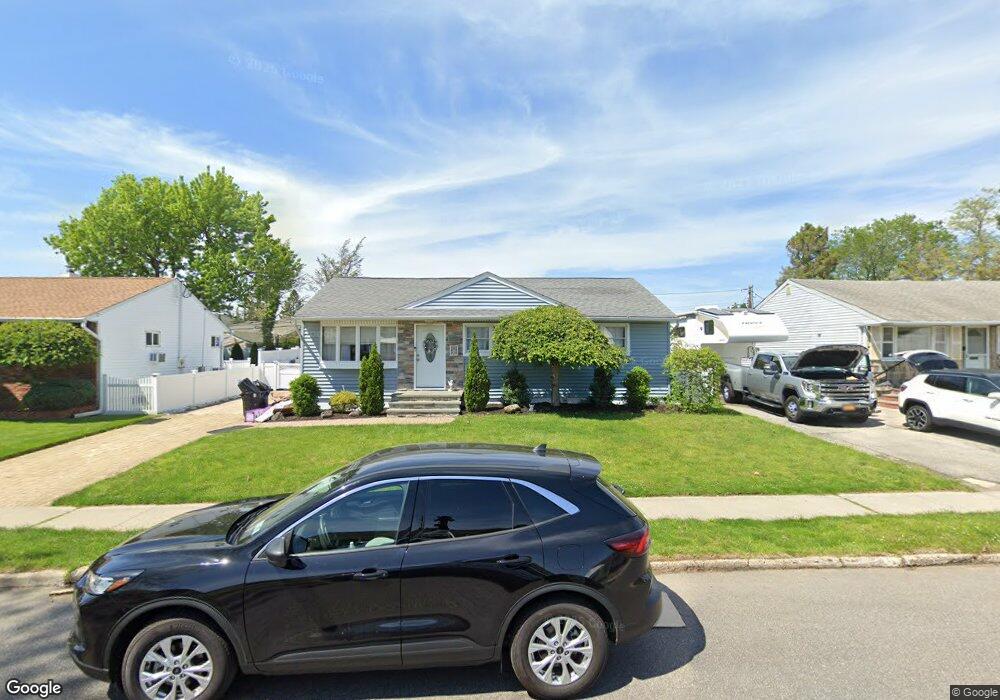

732 Seabury Ave Franklin Square, NY 11010

Estimated Value: $711,000 - $783,465

--

Bed

1

Bath

1,335

Sq Ft

$560/Sq Ft

Est. Value

About This Home

This home is located at 732 Seabury Ave, Franklin Square, NY 11010 and is currently estimated at $747,233, approximately $559 per square foot. 732 Seabury Ave is a home located in Nassau County with nearby schools including Grace Lutheran School and Hebrew Academy of Nassau County (HANC).

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 20, 2015

Sold by

Devlin Patrick and Devlin Catherine

Bought by

Devlin Patrick and Devlin Catherine

Current Estimated Value

Purchase Details

Closed on

Oct 5, 2011

Sold by

Devlin Patrick

Bought by

Devlin Patrick and Devlin Catherine

Purchase Details

Closed on

Oct 30, 2009

Sold by

Groce Darrel Joseph and Ruth L Groce Living Trust

Bought by

Devlin Patrick and Devlin Catherine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,000

Interest Rate

4.98%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 16, 2004

Sold by

Wayne Fuel Service Corp

Bought by

Ttk & J Inc

Purchase Details

Closed on

Nov 3, 1998

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Devlin Patrick | $100,000 | Fidelity National Title | |

| Devlin Patrick | -- | -- | |

| Devlin Patrick | $350,000 | -- | |

| Ttk & J Inc | $220,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Devlin Patrick | $219,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,561 | $461 | $183 | $278 |

| 2024 | $3,887 | $469 | $186 | $283 |

| 2023 | $10,052 | $515 | $204 | $311 |

| 2022 | $10,052 | $521 | $207 | $314 |

| 2021 | $12,637 | $524 | $208 | $316 |

| 2020 | $9,809 | $593 | $473 | $120 |

| 2019 | $8,926 | $635 | $401 | $234 |

| 2018 | $9,067 | $803 | $0 | $0 |

| 2017 | $6,619 | $803 | $507 | $296 |

| 2016 | $10,696 | $803 | $507 | $296 |

| 2015 | $3,800 | $803 | $507 | $296 |

| 2014 | $3,800 | $803 | $507 | $296 |

| 2013 | $3,552 | $803 | $507 | $296 |

Source: Public Records

Map

Nearby Homes

- 726 Meisser St

- 708 Anderson Ave

- 816 Anderson Ave

- 807 Cypress Dr

- 600 Dogwood Ave

- 818 Palmetto Dr

- 865 Third Ave

- 73 Parkview Place

- 89 Parkview Place

- 993 Ferngate Dr

- 850 First Ave

- 771 Maple Place

- 791 Caryl St

- 81 Gerard Ave W

- 1048 Windermere Rd

- 911 First Ave

- 1027 Windermere Rd

- 1047 Windermere Rd

- 56 Adair Ct

- 95 Dogwood Ave

- 738 Seabury Ave

- 726 Seabury Ave

- 737 Craft Ave

- 744 Seabury Ave

- 720 Seabury Ave

- 735 Craft Ave

- 739 Craft Ave

- 733 Seabury Ave

- 739 Seabury Ave

- 727 Seabury Ave

- 714 Seabury Ave

- 721 Seabury Ave

- 745 Seabury Ave

- 741 Craft Ave

- 733 Craft Ave

- 727 Craft Ave

- 715 Seabury Ave

- 751 Seabury Ave

- 762 Seabury Ave

- 734 Brower Ave