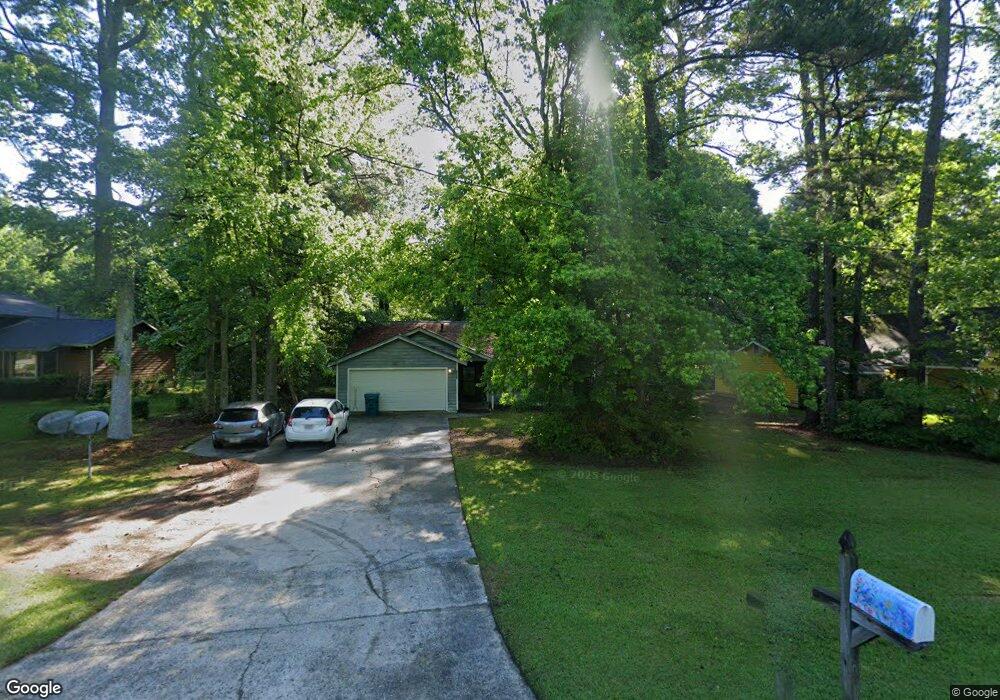

7326 Conkle Rd Unit 1 Jonesboro, GA 30236

Estimated Value: $228,231 - $282,000

3

Beds

2

Baths

1,742

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 7326 Conkle Rd Unit 1, Jonesboro, GA 30236 and is currently estimated at $259,808, approximately $149 per square foot. 7326 Conkle Rd Unit 1 is a home located in Clayton County with nearby schools including Mt. Zion Primary School, Mount Zion Elementary School, and M. D. Roberts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 21, 2006

Sold by

Blile David

Bought by

Blile Linda B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,950

Outstanding Balance

$78,575

Interest Rate

6.33%

Mortgage Type

FHA

Estimated Equity

$181,233

Purchase Details

Closed on

Oct 15, 1999

Sold by

Mixon Alan K and Mixon Cammy D

Bought by

Blile David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,239

Interest Rate

7.81%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 30, 1998

Sold by

Bouvette Sheryl

Bought by

Mixon Alan K and Mixon Cammy D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,135

Interest Rate

6.95%

Mortgage Type

FHA

Purchase Details

Closed on

May 8, 1997

Sold by

Bouvette Fay M

Bought by

Bouvette Sheryl

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blile Linda B | -- | -- | |

| Blile David | $93,000 | -- | |

| Mixon Alan K | $83,000 | -- | |

| Bouvette Sheryl | $5,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Blile Linda B | $131,950 | |

| Previous Owner | Blile David | $92,239 | |

| Previous Owner | Mixon Alan K | $81,135 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,234 | $66,360 | $7,200 | $59,160 |

| 2023 | $2,309 | $63,960 | $7,200 | $56,760 |

| 2022 | $1,708 | $52,640 | $7,200 | $45,440 |

| 2021 | $1,711 | $52,440 | $7,200 | $45,240 |

| 2020 | $1,566 | $48,278 | $7,200 | $41,078 |

| 2019 | $1,612 | $48,857 | $7,200 | $41,657 |

| 2018 | $1,666 | $50,170 | $7,200 | $42,970 |

| 2017 | $1,359 | $42,531 | $7,200 | $35,331 |

| 2016 | $1,165 | $37,778 | $7,200 | $30,578 |

| 2015 | $1,163 | $0 | $0 | $0 |

| 2014 | $1,104 | $36,845 | $7,200 | $29,645 |

Source: Public Records

Map

Nearby Homes

- 2282 Tiffany Ct

- 7326 Leland Ln

- 2295 Bedford Ct

- 2312 Coach Way

- 2158 Weybridge Dr

- 7455 Page Ct

- 7475 Danielle Ct

- 2254 Lisbon Ln

- 7519 Conkle Rd Unit 2

- 2084 Jadestone Ct

- 7583 Sunstone Dr

- 2115 Logan Dr

- 2238 Danver Ct

- 1938 Wrights Way

- 0 Adamson Pkwy

- 7621 Raleigh Ln

- 7581 Livingston Dr

- 7595 Teton Ct

- 7942 Rand Rd

- 7672 Echo Ln

- 7316 Conkle Rd

- 7334 Conkle Rd

- 7311 Carlton Ct

- 7344 Conkle Rd

- 7302 Conkle Rd

- 0 Carlton Ct Unit 7285011

- 0 Carlton Ct

- 2248 Winchester Dr

- 2258 Winchester Dr

- 2268 Winchester Dr

- 7294 Conkle Rd

- 7312 Carlton Ct

- 7322 Carlton Ct

- 2222 Cooper Way

- 7340 Cardif Place

- 2276 Winchester Dr

- 7365 Conkle Rd

- 2249 Camden Ct

- 7286 Conkle Rd

- 7324 Cardif Place