7329 SW 26th Ct Unit 24 Davie, FL 33314

Fern Crest Village NeighborhoodEstimated Value: $204,353 - $271,000

2

Beds

2

Baths

1,080

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 7329 SW 26th Ct Unit 24, Davie, FL 33314 and is currently estimated at $244,588, approximately $226 per square foot. 7329 SW 26th Ct Unit 24 is a home located in Broward County with nearby schools including Tropical Elementary School, Seminole Middle School, and South Plantation High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 10, 2013

Sold by

Taylor Bean & Whitaker Mortgage Corporat

Bought by

Federal Home Loan Mortgage Corporation

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2013

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Desrochers Yezmin and Desrochers Roland

Purchase Details

Closed on

Dec 18, 2012

Sold by

Vidal Mario and Vidal Sandra M

Bought by

Taylor Bean & Whitaker Mortgage Corporat

Purchase Details

Closed on

Feb 19, 2002

Sold by

Greenberg Noel M

Bought by

Vidal Mario

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,125

Interest Rate

7.02%

Purchase Details

Closed on

May 4, 1994

Sold by

Fiske Michelle M and La Forge Michelle M

Bought by

Greenberg Noel M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Federal Home Loan Mortgage Corporation | -- | New House Title Llc | |

| Desrochers Yezmin | $73,000 | Attorney | |

| Taylor Bean & Whitaker Mortgage Corporat | $400 | None Available | |

| Vidal Mario | $87,500 | Enterprise Title Inc | |

| Greenberg Noel M | $45,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Vidal Mario | $83,125 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,245 | $184,320 | $18,430 | $165,890 |

| 2024 | $4,072 | $184,320 | $18,430 | $165,890 |

| 2023 | $4,072 | $160,690 | $0 | $0 |

| 2022 | $3,447 | $146,090 | $14,610 | $131,480 |

| 2021 | $3,189 | $134,390 | $13,440 | $120,950 |

| 2020 | $3,035 | $127,480 | $12,750 | $114,730 |

| 2019 | $2,785 | $124,480 | $12,450 | $112,030 |

| 2018 | $2,523 | $111,280 | $11,130 | $100,150 |

| 2017 | $2,272 | $92,470 | $0 | $0 |

| 2016 | $2,178 | $86,520 | $0 | $0 |

| 2015 | $2,058 | $78,660 | $0 | $0 |

| 2014 | $1,800 | $65,280 | $0 | $0 |

| 2013 | -- | $58,520 | $5,850 | $52,670 |

Source: Public Records

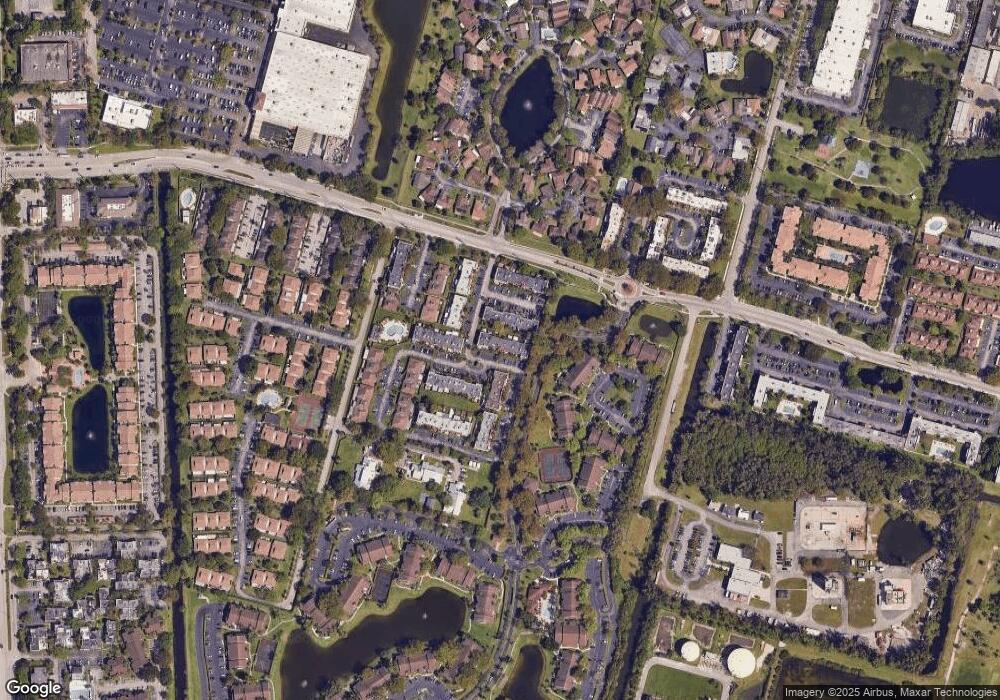

Map

Nearby Homes

- 2277 Nova Village Dr

- 7512 SW 26th Ct Unit 12

- 2259 Nova Village Dr

- 7521 SW 26th Ct Unit 77

- 2236 Nova Village Dr Unit na

- 2226 Nova Village Dr

- 2600 S University Dr Unit 229

- 2600 S University Dr Unit 326

- 2600 S University Dr Unit 218

- 2600 S University Dr Unit 129

- 2600 S University Dr Unit 111

- 2600 S University Dr Unit 107

- 2620 S University Dr Unit 109

- 2620 S University Dr Unit 111

- 2640 S University Dr Unit 129

- 2640 S University Dr Unit 113

- 2796 S University Dr Unit 2207

- 2796 S University Dr Unit 2104

- 2826 S University Dr Unit 3101

- 2774 S University Dr Unit 10A

- 7327 SW 26th Ct Unit 23

- 7331 SW 26th Ct Unit 25

- 7325 SW 26th Ct Unit 7325

- 7325 SW 26th Ct Unit 22

- 7333 SW 26th Ct Unit 26

- 7323 SW 26th Ct Unit 21

- 7335 SW 26th Ct Unit 27

- 7321 SW 26th Ct Unit 20

- 7337 SW 26th Ct Unit 28

- 7328 SW 25th Ct Unit 15

- 7330 SW 25th Ct

- 7333 SW 25th Ct Unit 6

- 2525 SW 73rd Terrace Unit 97

- 7332 SW 25th Ct Unit 2

- 7324 SW 25th Ct

- 7322 SW 25th Ct Unit 7322

- 7322 SW 25th Ct Unit 18

- 2605 SW 73rd Way

- 2605 SW 73rd Way Unit 29

- 2519 SW 25th Terrace Unit 98