735 Sparrow Ln Unit 4C1 Langhorne, PA 19047

Estimated Value: $273,000 - $319,000

2

Beds

1

Bath

998

Sq Ft

$286/Sq Ft

Est. Value

About This Home

This home is located at 735 Sparrow Ln Unit 4C1, Langhorne, PA 19047 and is currently estimated at $285,330, approximately $285 per square foot. 735 Sparrow Ln Unit 4C1 is a home located in Bucks County with nearby schools including Hoover Elementary School, Maple Point Middle School, and Neshaminy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2020

Sold by

Harris Amanda L and Kasperitis Amanda L

Bought by

Sullivan Lindsay Decou

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,300

Outstanding Balance

$163,854

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$121,476

Purchase Details

Closed on

Jun 1, 2015

Sold by

Devlin Michael

Bought by

Harris Amanda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,050

Interest Rate

3.65%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 31, 2006

Sold by

Graham Sally A

Bought by

Devlin Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,528

Interest Rate

6.37%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 29, 1998

Sold by

Pacitto Michael and Pacitto Jennifer L

Bought by

Graham Sally A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,000

Interest Rate

6.9%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sullivan Lindsay Decou | $190,000 | Trident Land Transfer Co Lp | |

| Harris Amanda L | $159,000 | None Available | |

| Devlin Michael | $174,900 | Lawyers Title Insurance Corp | |

| Graham Sally A | $72,500 | Lawyers Title Insurance Corp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sullivan Lindsay Decou | $184,300 | |

| Previous Owner | Harris Amanda L | $151,050 | |

| Previous Owner | Devlin Michael | $173,528 | |

| Previous Owner | Graham Sally A | $72,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,327 | $15,280 | -- | $15,280 |

| 2024 | $3,327 | $15,280 | $0 | $15,280 |

| 2023 | $3,274 | $15,280 | $0 | $15,280 |

| 2022 | $3,188 | $15,280 | $0 | $15,280 |

| 2021 | $3,188 | $15,280 | $0 | $15,280 |

| 2020 | $3,150 | $15,280 | $0 | $15,280 |

| 2019 | $3,079 | $15,280 | $0 | $15,280 |

| 2018 | $3,023 | $15,280 | $0 | $15,280 |

| 2017 | $2,946 | $15,280 | $0 | $15,280 |

| 2016 | $2,946 | $15,280 | $0 | $15,280 |

| 2015 | -- | $15,280 | $0 | $15,280 |

| 2014 | -- | $15,280 | $0 | $15,280 |

Source: Public Records

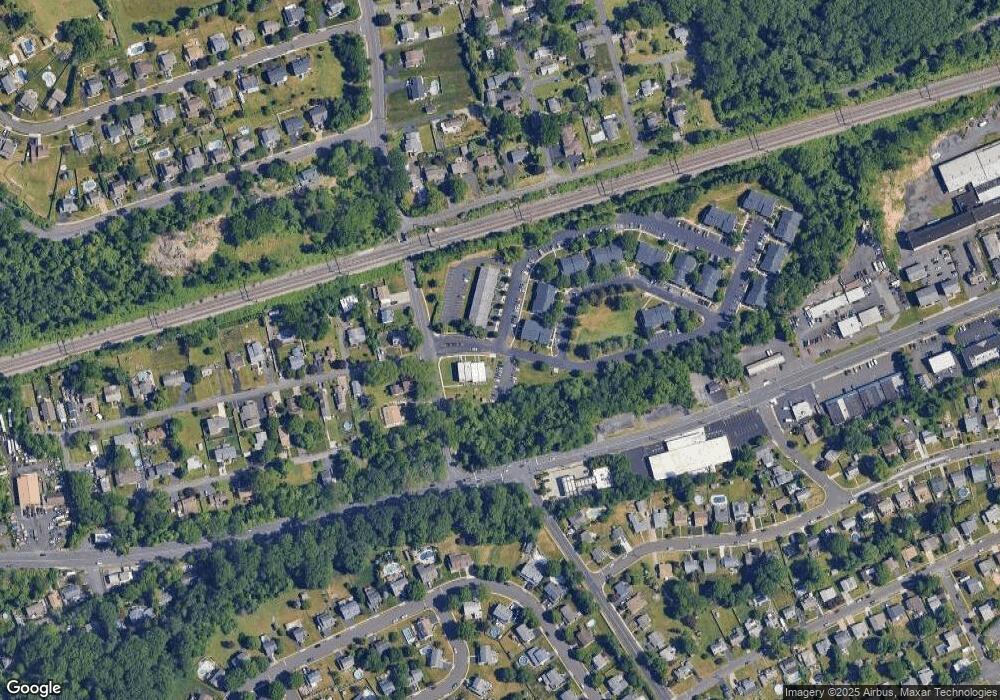

Map

Nearby Homes

- 801 E Parker St Unit B2

- 790 E Parker St Unit A1

- 731 Highland Ave

- 751 Duxbury Dr

- 56 W Lincoln Hwy

- 409 Fairview Ave

- 24 W Lincoln Hwy

- 2816 Avenue E

- 2823 Avenue E

- 547 Hulmeville Ave

- 565 Hulmeville Rd

- 0 Prospect Ave

- 1516 Fairview Ave

- 6504 Timothy Ct

- 1632 Winter Ave

- 6369 Powder Horn Ct

- 6351 Shewell Rd

- 3225 Ethan Allen Ct

- 710 Fox Ct

- 174 E Highland Ave

- 735 Sparrow Ln Unit C1

- 734 Sparrow Ln Unit B3

- 736 Sparrow Ln Unit C2

- 733 Sparrow Ln Unit 4B2

- 733 Sparrow Ln Unit B2

- 728 Sparrow Ln Unit E BLDG

- 728 Sparrow Ln Unit D1

- 728 Sparrow Ln Unit 4D1

- 731 Sparrow Ln Unit 4A2

- 731 Sparrow Ln Unit A2

- 729 Sparrow Ln

- 737 Sparrow Ln Unit E

- 737 Sparrow Ln Unit C3

- 737 Sparrow Ln Unit 4C3

- 732 Sparrow Ln

- 730 Sparrow Ln Unit A1

- 722 Sparrow Ln

- 723 Sparrow Ln Unit 3B2

- 720 Sparrow Ln Unit 3A1

- 747 Sparrow Ln Unit C3