735 W 1650 N Pleasant Grove, UT 84062

Estimated Value: $894,000 - $1,031,000

6

Beds

4

Baths

3,727

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 735 W 1650 N, Pleasant Grove, UT 84062 and is currently estimated at $960,794, approximately $257 per square foot. 735 W 1650 N is a home located in Utah County with nearby schools including Manila Elementary School, Pleasant Grove Junior High School, and Pleasant Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2022

Sold by

Chipman Family Trust

Bought by

White Kevin and White Angela

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$753,600

Outstanding Balance

$715,904

Interest Rate

5.25%

Mortgage Type

New Conventional

Estimated Equity

$244,890

Purchase Details

Closed on

Jul 7, 2021

Sold by

Chipman Zachary and Chipman Haley A

Bought by

Chipman Zachary and Chipman Haley Alise

Purchase Details

Closed on

Dec 3, 2014

Sold by

Chipman Haley A

Bought by

Chipman Zachary and Chipman Haley A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,914

Interest Rate

3.95%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| White Kevin | -- | Backman Title Services | |

| Chipman Zachary | -- | None Available | |

| Chipman Zachary | -- | Artisan Title | |

| Chipman Haley A | -- | Artisan Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | White Kevin | $753,600 | |

| Previous Owner | Chipman Haley A | $304,914 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,807 | $485,705 | $420,300 | $462,800 |

| 2024 | $3,807 | $454,245 | $0 | $0 |

| 2023 | $3,694 | $451,275 | $0 | $0 |

| 2022 | $3,630 | $441,265 | $0 | $0 |

| 2021 | $3,036 | $562,000 | $239,200 | $322,800 |

| 2020 | $2,868 | $520,400 | $221,500 | $298,900 |

| 2019 | $2,689 | $504,600 | $205,700 | $298,900 |

| 2018 | $2,563 | $454,700 | $189,900 | $264,800 |

| 2017 | $2,426 | $229,130 | $0 | $0 |

| 2016 | $2,505 | $228,470 | $0 | $0 |

| 2015 | $2,365 | $204,270 | $0 | $0 |

| 2014 | $1,508 | $129,000 | $0 | $0 |

Source: Public Records

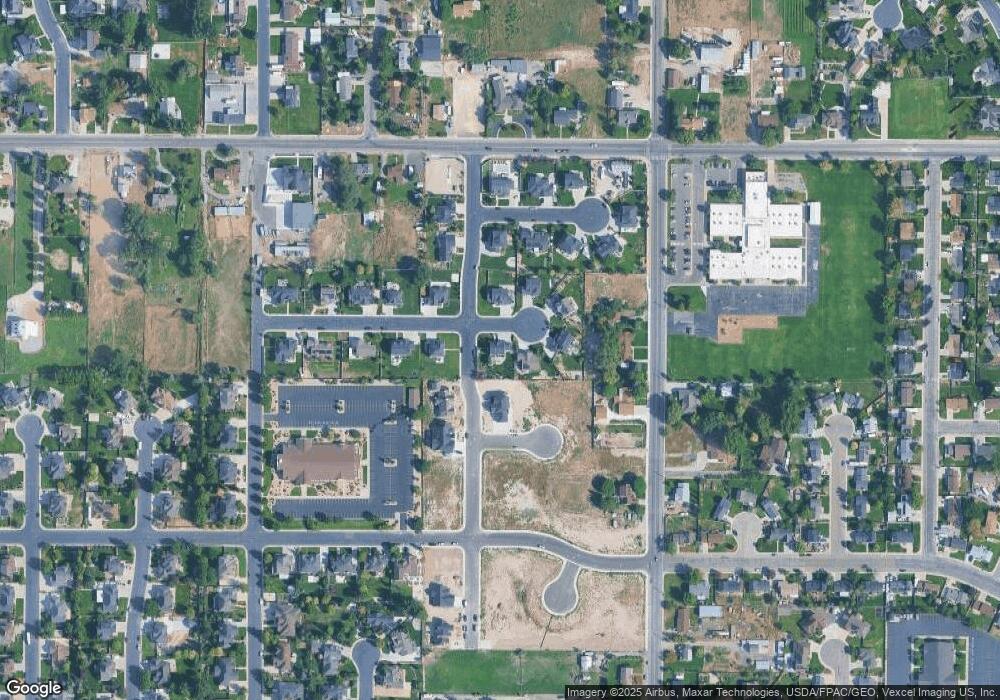

Map

Nearby Homes

- 674 W 1590 N Unit 11

- 731 W 1590 N Unit 15

- 1534 N 750 W Unit 16

- Konlee Plan at Makin Dreams

- Alexa Plan at Makin Dreams

- Callahan Plan at Makin Dreams

- Hailey Plan at Makin Dreams

- Alydia Plan at Makin Dreams

- Addison Plan at Makin Dreams

- Julia Plan at Makin Dreams

- 1531 N 750 W Unit 4

- Aaron Plan at Makin Dreams

- Amie Plan at Makin Dreams

- Nora Plan at Makin Dreams

- Emmet Plan at Makin Dreams

- Quinn Plan at Makin Dreams

- Chelsea Plan at Makin Dreams

- Jenni Plan at Makin Dreams

- Dakota Plan at Makin Dreams

- Lennon Plan at Makin Dreams