735 W Jordan Ranch Rd Kingman, AR 86409

Estimated Value: $692,000 - $901,000

--

Bed

3

Baths

2,470

Sq Ft

$305/Sq Ft

Est. Value

About This Home

This home is located at 735 W Jordan Ranch Rd, Kingman, AR 86409 and is currently estimated at $752,336, approximately $304 per square foot. 735 W Jordan Ranch Rd is a home located in Mohave County with nearby schools including Cerbat Elementary School, Kingman Middle School, and Kingman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 30, 2022

Sold by

Allen Austin Jr Glen and Allen Deborah K

Bought by

Austin Family Living Trust

Current Estimated Value

Purchase Details

Closed on

Nov 18, 2019

Sold by

Main Construction And Landscape Llc

Bought by

Austin Glen A and Austin Deborah K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$434,000

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 14, 2018

Sold by

Sampson John E and Sampson Mikki L

Bought by

Main Construction And Landscape Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,000

Interest Rate

4.5%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Austin Family Living Trust | -- | None Listed On Document | |

| Austin Glen A | $483,500 | Pioneer Title Agency Inc | |

| Main Construction And Landscape Llc | $75,000 | Pioneer Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Austin Glen A | $434,000 | |

| Previous Owner | Main Construction And Landscape Llc | $153,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $2,158 | -- | -- | -- |

| 2025 | $4,196 | $53,299 | $0 | $0 |

| 2024 | $4,196 | $53,084 | $0 | $0 |

| 2023 | $4,196 | $51,067 | $0 | $0 |

| 2022 | $3,922 | $38,330 | $0 | $0 |

| 2021 | $3,893 | $27,246 | $0 | $0 |

| 2019 | $444 | $8,013 | $0 | $0 |

| 2018 | $450 | $8,772 | $0 | $0 |

| 2017 | $417 | $4,124 | $0 | $0 |

| 2016 | $398 | $4,124 | $0 | $0 |

| 2015 | $426 | $3,727 | $0 | $0 |

Source: Public Records

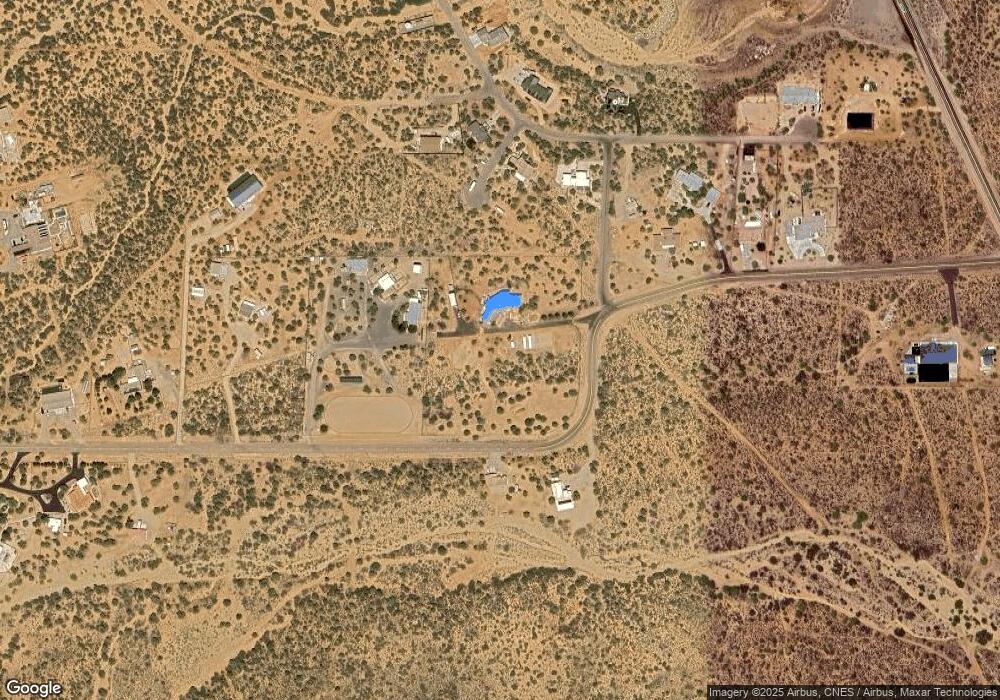

Map

Nearby Homes

- 0000 W Island Dr

- 5930 N Bull Mountain Dr

- TBD Bull Mountain Rd

- 6280 Palo Christo Dr

- 5537 N Storm Cloud Dr

- 1142 E Cactus Valley Dr

- 5537 N Emerald Springs Way

- 6323 N Cottontail Trail

- 000 N Cottontail Trail

- 6336 N Buckhorn Dr

- Lot 001A N Cottontail Trail

- 6295 N Jack Rabbit Dr

- 310-03-092 Cherum Rd

- 0000 Walapai Mining District

- 5432 Roadrunner Ave

- 0000 Calle Noria

- 000 Calle Noria

- Legacy 2374 Plan at Eagle View

- Joshua 1909 Plan at Eagle View

- 400 Camelback Blvd

- 735 W Jordan Ranch Rd

- LOT144 S Shore Dr

- 053 N South Shore Dr

- 769 W Jordan Ranch Rd

- na S Shore Dr

- 0 S Shore Dr

- 801 W Jordan Ranch Rd

- 761 W South Shore Dr

- 000 S Shore Dr

- Southshore Dr S Shore Dr

- 001 S Shore Dr

- 004 S Shore Dr

- 002 S Shore Dr

- 003 S Shore Dr

- 0000 W South Shore Dr

- TBD S Shore Dr

- TBD South Shore

- 747 W South Shore Dr

- 000 W South Shore Dr

- 805 W Jordan Ranch Rd