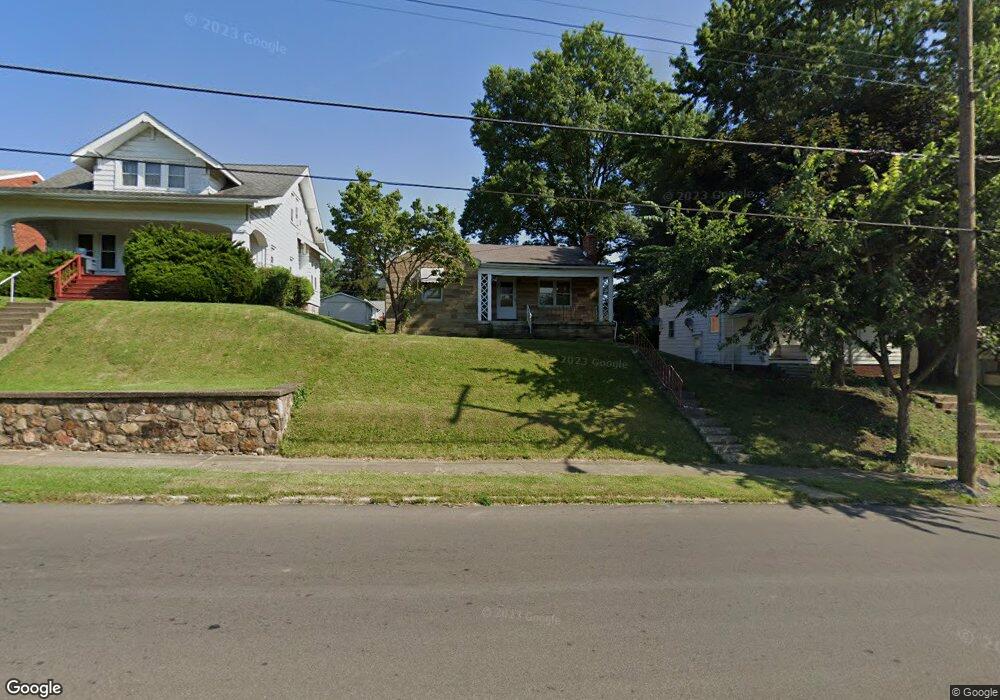

736 W 4th St Mansfield, OH 44906

Estimated Value: $96,000 - $132,000

3

Beds

1

Bath

1,187

Sq Ft

$94/Sq Ft

Est. Value

About This Home

This home is located at 736 W 4th St, Mansfield, OH 44906 and is currently estimated at $112,037, approximately $94 per square foot. 736 W 4th St is a home located in Richland County with nearby schools including Goal Digital Academy, Mansfield Elective Academy, and Interactive Media & Construction (IMAC) Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2004

Sold by

Fugitt Pamela S

Bought by

Rolle Stephen H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,850

Outstanding Balance

$31,396

Interest Rate

5.74%

Mortgage Type

FHA

Estimated Equity

$80,641

Purchase Details

Closed on

Dec 13, 2002

Sold by

Shrf Billy F Lott Pr

Bought by

Rugitt Pamela S

Purchase Details

Closed on

Sep 30, 1997

Sold by

Augustine Richard A

Bought by

Lott Billy F and Lott Theresa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,800

Interest Rate

7.63%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rolle Stephen H | $67,900 | Southern Title | |

| Rugitt Pamela S | $41,000 | -- | |

| Lott Billy F | $38,750 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rolle Stephen H | $66,850 | |

| Previous Owner | Lott Billy F | $36,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $856 | $18,280 | $1,810 | $16,470 |

| 2023 | $856 | $18,280 | $1,810 | $16,470 |

| 2022 | $855 | $15,300 | $1,750 | $13,550 |

| 2021 | $861 | $15,300 | $1,750 | $13,550 |

| 2020 | $880 | $15,300 | $1,750 | $13,550 |

| 2019 | $976 | $15,300 | $1,750 | $13,550 |

| 2018 | $962 | $15,300 | $1,750 | $13,550 |

| 2017 | $955 | $15,300 | $1,750 | $13,550 |

| 2016 | $974 | $15,430 | $3,690 | $11,740 |

| 2015 | $930 | $15,430 | $3,690 | $11,740 |

| 2014 | $918 | $15,430 | $3,690 | $11,740 |

| 2012 | $350 | $15,440 | $3,890 | $11,550 |

Source: Public Records

Map

Nearby Homes

- 237 Helen Ave

- 914 W 4th St

- 96 Helen Ave

- 611 Park Ave W

- 688 Mcpherson St

- 0 State Route 314 Unit 9067316

- 0 State Route 314 Unit 225021979

- 80 Rowland Ave

- 21 Glenwood Blvd

- 41 Parkwood Blvd

- 120 Gettings Place

- 24 Stewart Ave S

- 37 S Linden Rd

- 71 Glenwood Blvd

- 406 Sherman Place

- 955 Mcpherson St

- 0 W Fourth St - Trimble Lenox

- 118 Parkwood Blvd

- 129 Fairlawn Ave

- 135 Fairlawn Ave