Estimated payment $350/month

Total Views

1,098

0.23

Acre

$260,435

Price per Acre

10,019

Sq Ft Lot

About This Lot

Great building lot in Marion Oaks Unit 10, adjoining lot 18 also available

Listing Agent

KIEFER REALTY, PA Brokerage Phone: 352-861-6000 License #3020554 Listed on: 02/20/2025

Property Details

Property Type

- Land

Est. Annual Taxes

- $378

Lot Details

- 10,019 Sq Ft Lot

- Lot Dimensions are 80x125

- Property is zoned R1

Additional Features

- City Views

- Septic Needed

Community Details

- No Home Owners Association

- Marion Oaks Subdivision

Listing and Financial Details

- Legal Lot and Block 19 / 953

- Assessor Parcel Number 8010-0953-19

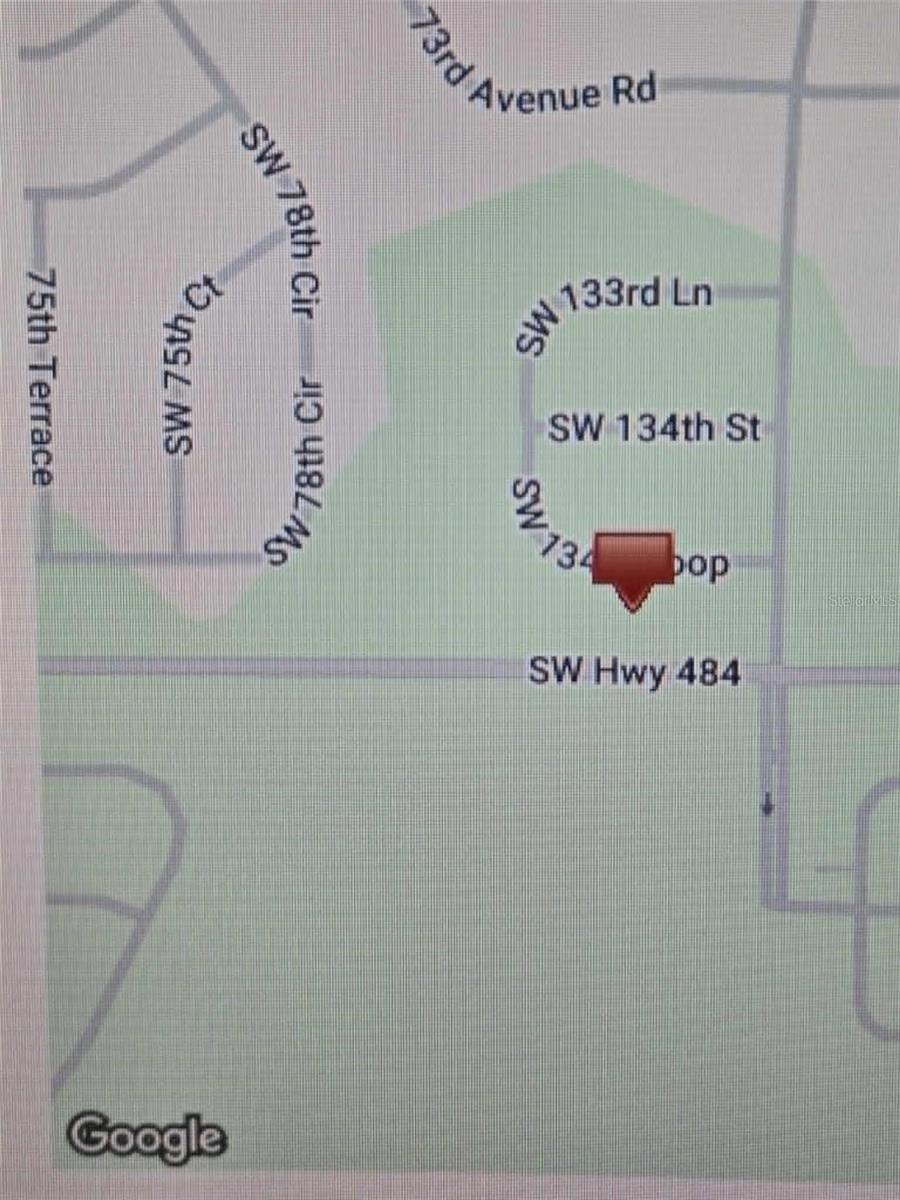

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $435 | $9,218 | -- | -- |

| 2024 | $378 | $8,380 | -- | -- |

| 2023 | $378 | $7,618 | $0 | $0 |

| 2022 | $277 | $6,925 | $0 | $0 |

| 2021 | $235 | $10,630 | $10,630 | $0 |

| 2020 | $215 | $8,400 | $8,400 | $0 |

| 2019 | $209 | $8,100 | $8,100 | $0 |

| 2018 | $191 | $6,700 | $6,700 | $0 |

| 2017 | $169 | $4,300 | $4,300 | $0 |

| 2016 | $178 | $4,114 | $0 | $0 |

| 2015 | $162 | $3,740 | $0 | $0 |

| 2014 | $157 | $3,400 | $0 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 02/20/2025 02/20/25 | For Sale | $59,900 | -- | -- |

Source: Stellar MLS

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Deed | $4,000 | -- | |

| Quit Claim Deed | -- | Attorney | |

| Warranty Deed | $47,500 | Brick City Title Ins Co Inc |

Source: Public Records

Source: Stellar MLS

MLS Number: OM695653

APN: 8010-0953-19

Nearby Homes

- 7370 SW 133rd Loop

- 7364 SW 133 Loop NE

- 7199 SW 135th Place

- 7075 SW 131st Loop

- 7161 SW 135th Place

- 75 Sw

- 13433 SW 75th Ct

- 7057 SW 131st Loop

- 7078 SW 134th St

- 13267 SW 79th Cir

- TBD SW 136th St

- TBA SW 136 St

- 13634 SW 79 Terrace Rd

- 13444 SW 76th Ct

- 13169 SW 73rd Avenue Rd

- 7098 SW 131st Loop

- 13155 SW 73rd Ave

- 13250 SW 79th Cir

- 13566 SW 76th Ct

- 7035 SW 131st Loop

- 7057 SW 131st Loop

- 13106 SW 72nd Terrace Rd

- 13094 SW 72nd Terrace Rd

- 13401 SW 77th Ave

- 13145 SW 78th Cir

- 13130 SW 78th Cir

- 7883 SW 138 Street Rd

- 7554 SW 129th Place

- 623 Marion Oaks Trail

- 12849 SW 73rd Avenue Rd

- 612 Marion Oaks Trail

- 12803 SW 73rd Terrace

- 8013 SW Hwy 484

- 13047 SW 79th Cir

- 586 Marion Oaks Trail

- 13505 SW 81 Cir

- 6605 SW 129th Loop

- 572 Marion Oaks Trail

- 8330 SW 136th St

- 8509 SW 136th Loop