7383 Bridge Point Pass Cincinnati, OH 45248

Estimated Value: $458,000 - $544,000

4

Beds

3

Baths

3,744

Sq Ft

$131/Sq Ft

Est. Value

About This Home

This home is located at 7383 Bridge Point Pass, Cincinnati, OH 45248 and is currently estimated at $491,641, approximately $131 per square foot. 7383 Bridge Point Pass is a home located in Hamilton County with nearby schools including Charles W Springmyer Elementary School, Bridgetown Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2008

Sold by

David Kevin J

Bought by

Murray Brian D and Murray Carlene D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Outstanding Balance

$187,937

Interest Rate

6.1%

Mortgage Type

Unknown

Estimated Equity

$303,704

Purchase Details

Closed on

Feb 16, 2007

Sold by

Fischer Single Family Homes Ii Llc

Bought by

David Kevin J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,938

Interest Rate

6.28%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 26, 2006

Sold by

Grand Communities Ltd

Bought by

Fischer Single Family Homes Ii Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Murray Brian D | $370,000 | Advanced Land Title Agency | |

| David Kevin J | -- | Homestead Title Agency Ltd | |

| Fischer Single Family Homes Ii Llc | $71,500 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Murray Brian D | $296,000 | |

| Previous Owner | David Kevin J | $320,938 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,414 | $142,531 | $22,750 | $119,781 |

| 2023 | $7,237 | $142,531 | $22,750 | $119,781 |

| 2022 | $6,793 | $113,418 | $19,600 | $93,818 |

| 2021 | $6,099 | $113,418 | $19,600 | $93,818 |

| 2020 | $6,176 | $113,418 | $19,600 | $93,818 |

| 2019 | $6,046 | $101,266 | $17,500 | $83,766 |

| 2018 | $6,055 | $101,266 | $17,500 | $83,766 |

| 2017 | $5,704 | $101,266 | $17,500 | $83,766 |

| 2016 | $6,026 | $106,838 | $17,325 | $89,513 |

| 2015 | $6,078 | $106,838 | $17,325 | $89,513 |

| 2014 | $6,086 | $106,838 | $17,325 | $89,513 |

| 2013 | $5,743 | $107,916 | $17,500 | $90,416 |

Source: Public Records

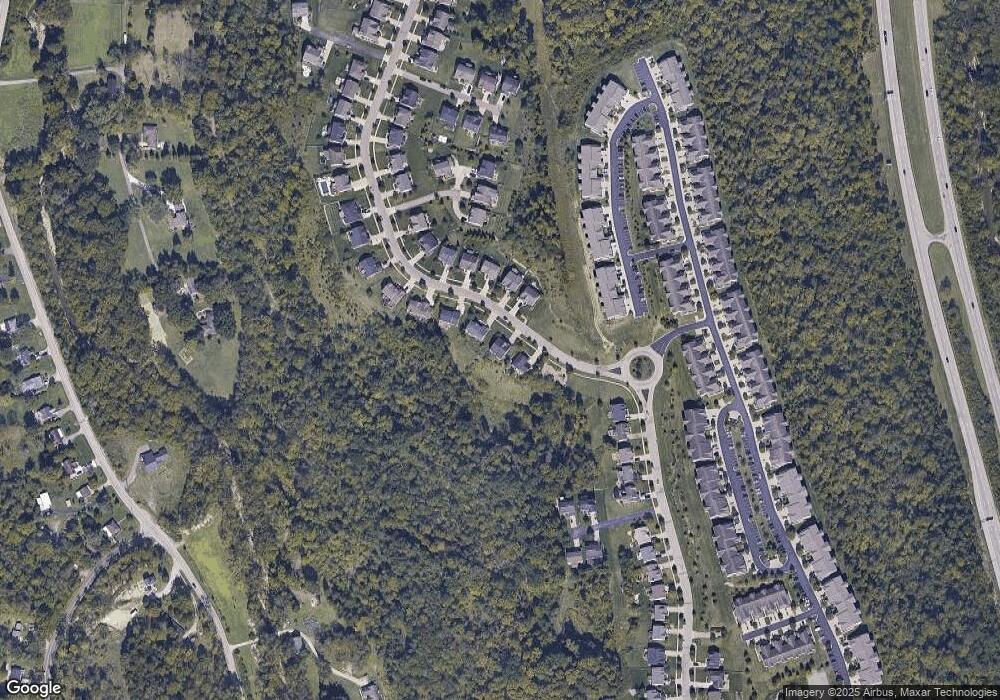

Map

Nearby Homes

- 7787 Skyview Cir

- 7979 Oakbridge Way

- 8001 Oakbridge Way

- 8060 Bridge Point Dr

- 8041 Oakbridge Way

- 6780 Harrison Ave

- 6765 Verde Ridge Dr Unit 20C

- 5632 Sarahs Oak Dr

- 6864 Ruwes Oak Dr

- SHELBURN Plan at Janson Woods

- BRENNAN Plan at Janson Woods

- STRATTON Plan at Janson Woods

- QUENTIN Plan at Janson Woods

- VANDERBURGH Plan at Janson Woods

- BUCHANAN Plan at Janson Woods

- ASH LAWN Plan at Janson Woods

- ALDEN Plan at Janson Woods

- BENNETT Plan at Janson Woods

- LYNDHURST Plan at Janson Woods

- 7007 Boulder Path Dr

- 7377 Bridge Point Pass

- 7389 Bridge Point Pass

- 7384 Bridge Point Pass

- 7395 Bridge Point Pass

- 7388 Bridge Point Pass

- 7392 Bridge Point Pass

- 7392 Bridge Point Pass Unit 172

- 7401 Bridge Point Pass

- 7396 Bridge Point Pass

- 7400 Bridge Point Pass

- 7407 Bridge Point Pass

- 7909 Oakbridge Way Unit 1-302

- 7905 Oakbridge Way Unit 1-301

- 7907 Oakbridge Way Unit 1-300

- 7901 Oakbridge Way Unit 1-201

- 7911 Oakbridge Way Unit 1-102

- 7903 Oakbridge Way Unit 1-101

- 7921 Oakbridge Way Unit 1-305

- 7925 Oakbridge Way Unit 1-304

- 7929 Oakbridge Way Unit 1-204

Your Personal Tour Guide

Ask me questions while you tour the home.