739 Elm Ave Langhorne, PA 19047

Estimated Value: $422,000 - $517,000

4

Beds

2

Baths

1,548

Sq Ft

$307/Sq Ft

Est. Value

About This Home

This home is located at 739 Elm Ave, Langhorne, PA 19047 and is currently estimated at $474,684, approximately $306 per square foot. 739 Elm Ave is a home located in Bucks County with nearby schools including Hoover Elementary School, Maple Point Middle School, and Neshaminy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2007

Sold by

Chase George T and Chase Jeannine C

Bought by

Pitcher George R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$285,246

Interest Rate

6.65%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 28, 2007

Sold by

Milner Robert

Bought by

Chase George T and Chase Jeannine C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$285,246

Interest Rate

6.65%

Mortgage Type

FHA

Purchase Details

Closed on

May 25, 2000

Sold by

Milner Robert

Bought by

Chase George T and Chase Jeannine C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,250

Interest Rate

8.14%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pitcher George R | $287,500 | Lawyers Title Insurance Corp | |

| Chase George T | $500 | None Available | |

| Chase George T | $144,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Pitcher George R | $285,246 | |

| Previous Owner | Chase George T | $137,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,750 | $26,410 | $1,890 | $24,520 |

| 2024 | $5,750 | $26,410 | $1,890 | $24,520 |

| 2023 | $5,658 | $26,410 | $1,890 | $24,520 |

| 2022 | $5,510 | $26,410 | $1,890 | $24,520 |

| 2021 | $5,510 | $26,410 | $1,890 | $24,520 |

| 2020 | $5,444 | $26,410 | $1,890 | $24,520 |

| 2019 | $4,931 | $24,470 | $1,890 | $22,580 |

| 2018 | $4,841 | $24,470 | $1,890 | $22,580 |

| 2017 | $4,717 | $24,470 | $1,890 | $22,580 |

| 2016 | $4,717 | $24,470 | $1,890 | $22,580 |

| 2015 | $4,906 | $24,470 | $1,890 | $22,580 |

| 2014 | $4,906 | $24,470 | $1,890 | $22,580 |

Source: Public Records

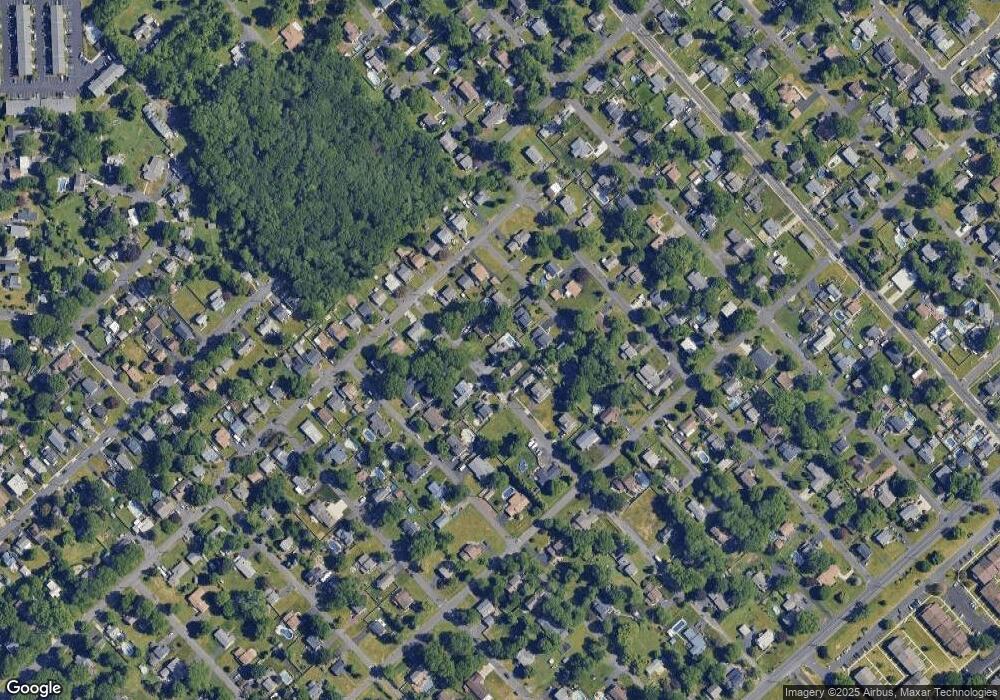

Map

Nearby Homes

- 747 Elm Ave

- 815 Harrison Ave

- 547 Hulmeville Ave

- 160 Bellevue Ave

- 409 Fairview Ave

- 590 Gables Ct

- L:070 Trenton Rd

- 35 W Lincoln Hwy

- 24 W Lincoln Hwy

- 927 Bellevue Ave

- 56 W Lincoln Hwy

- 440 Dehaven Ave

- 21 Downhill Rd

- 283 Snowball Dr

- 0 Durham Rd

- 801 E Parker St Unit B2

- 14 Harp Rd

- 524 Washington Ave

- 3200 Ellington Ct

- 18 Harvest Rd