739 Grand View Ln Unit 739 Aurora, OH 44202

Estimated Value: $388,392 - $415,000

3

Beds

3

Baths

1,936

Sq Ft

$208/Sq Ft

Est. Value

About This Home

This home is located at 739 Grand View Ln Unit 739, Aurora, OH 44202 and is currently estimated at $402,098, approximately $207 per square foot. 739 Grand View Ln Unit 739 is a home located in Portage County with nearby schools including Miller Elementary School, Craddock/Miller Elementary School, and Leighton Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 11, 2008

Sold by

Rupnow Rita W

Bought by

Blomquist Gordon Andrew and Blomquist Kathryn Louise

Current Estimated Value

Purchase Details

Closed on

Aug 10, 2004

Sold by

Rupnow Rita W

Bought by

Rupnow Rita W and Rita W Rupnow Living Trust

Purchase Details

Closed on

Jun 24, 2003

Sold by

Marina Svyadoshch Viktor Aleksandrovich

Bought by

Rupnow Donald C and Rupnow Rita W

Purchase Details

Closed on

Oct 30, 1997

Sold by

Lakes Of Aurora

Bought by

Svyadoshch Viktor and Yerastova Marina Yerastova

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$25,119

Interest Rate

7.51%

Mortgage Type

New Conventional

Estimated Equity

$376,979

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blomquist Gordon Andrew | $270,000 | None Available | |

| Rupnow Rita W | -- | -- | |

| Rupnow Donald C | $256,000 | Midland Title Security Inc | |

| Svyadoshch Viktor | $251,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Svyadoshch Viktor | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,316 | $128,730 | $12,250 | $116,480 |

| 2023 | $4,578 | $92,540 | $12,250 | $80,290 |

| 2022 | $4,166 | $92,540 | $12,250 | $80,290 |

| 2021 | $4,190 | $92,540 | $12,250 | $80,290 |

| 2020 | $4,026 | $83,930 | $12,250 | $71,680 |

| 2019 | $4,059 | $83,930 | $12,250 | $71,680 |

| 2018 | $4,035 | $76,690 | $10,500 | $66,190 |

| 2017 | $4,035 | $76,690 | $10,500 | $66,190 |

| 2016 | $3,636 | $76,690 | $10,500 | $66,190 |

| 2015 | $3,739 | $76,690 | $10,500 | $66,190 |

| 2014 | $3,815 | $76,690 | $10,500 | $66,190 |

| 2013 | $3,791 | $76,690 | $10,500 | $66,190 |

Source: Public Records

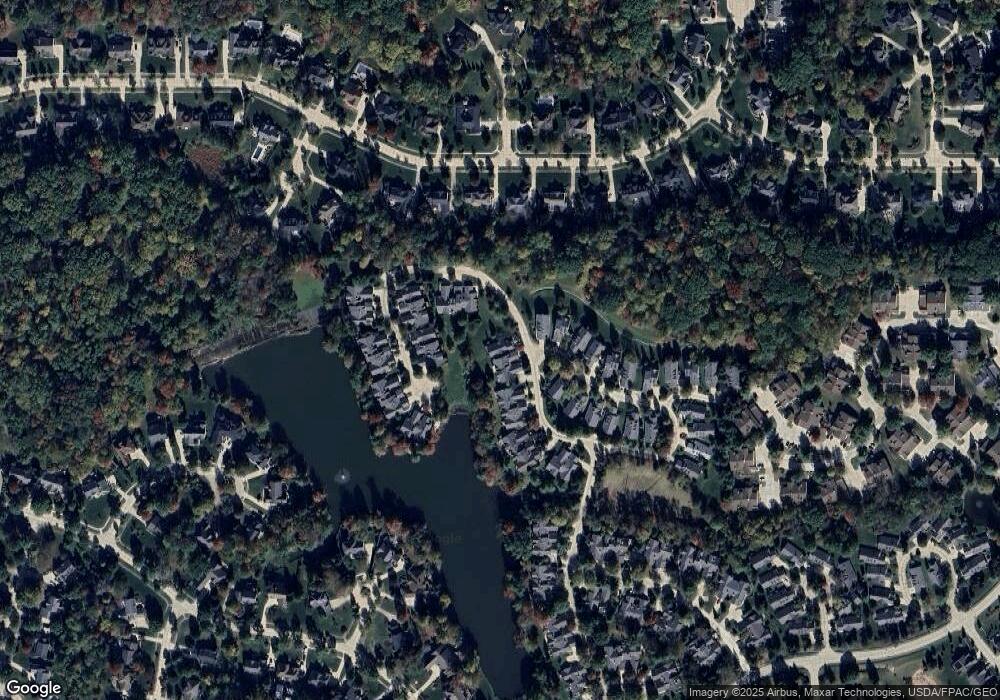

Map

Nearby Homes

- 316 High Bluff

- 225 Linwood Ln

- 436 Cochran Rd

- 180 Beaumont Trail

- 185 N Bissell Rd

- V/L W Garfield Rd

- 794 Robinhood Dr

- 777 Nancy Dr

- 915 Cimarron Oval

- 676 Nancy Dr

- 540 Bent Creek Oval

- 461 Ravine Dr Unit 2

- 982 W Garfield Rd

- 80 Lakeland Way

- 405 Club Dr W

- 0 Aurora Hill Dr Unit 3956102

- 350 Aspen Ct

- 622 Club Dr W

- 640 Club Dr W

- 580 Hardwick Dr

- 735 Grand View Ln

- 731 Grand View Ln

- 727 Grand View Ln

- 856 Holly Oak Ln Unit 856

- 901 Grand View Ln Unit 901

- 725 Grand View Ln Unit 725

- 852 Holly Oak Ln

- 965 Grand View Ln Unit 965

- 969 Grand View Ln Unit 969

- 905 Grand View Ln

- 905 Grand View Ln Unit 45-H

- 909 Grand View Ln Unit 909

- 721 Grand View Ln

- 973 Grand View Ln Unit 973

- 848 Holly Oak Ln

- 717 Grand View Ln

- 717 Grandview Ln

- 845 Holly Oak Ln Unit 845

- 843 Holly Oak Ln Unit 843

- 713 Grand View Ln