740 Heatherdown Way Buffalo Grove, IL 60089

Prairie Park-Lake County NeighborhoodEstimated Value: $568,000 - $629,000

5

Beds

3

Baths

2,437

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 740 Heatherdown Way, Buffalo Grove, IL 60089 and is currently estimated at $589,203, approximately $241 per square foot. 740 Heatherdown Way is a home located in Lake County with nearby schools including Prairie Elementary School, Twin Groves Middle School, and Adlai E Stevenson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2015

Sold by

Ting Zhu Wenye and Ting Si

Bought by

Liu Liping and Liu Jiuhong

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$302,400

Outstanding Balance

$109,002

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$480,201

Purchase Details

Closed on

Feb 17, 2012

Sold by

Ting Zhu Wenye and Ting Si

Bought by

Ting Zhu Wenye and Ting Si

Purchase Details

Closed on

Jan 13, 2004

Sold by

Geimer Michael J and Geimer Gloria J

Bought by

Ting Zhu Wenye and Ting Si

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$249,600

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Liu Liping | $378,000 | Ct | |

| Ting Zhu Wenye | -- | None Available | |

| Ting Zhu Wenye | $312,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Liu Liping | $302,400 | |

| Previous Owner | Ting Zhu Wenye | $249,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $14,204 | $162,990 | $37,478 | $125,512 |

| 2023 | $13,080 | $146,469 | $33,679 | $112,790 |

| 2022 | $13,080 | $131,441 | $30,223 | $101,218 |

| 2021 | $12,584 | $130,024 | $29,897 | $100,127 |

| 2020 | $12,288 | $130,468 | $29,999 | $100,469 |

| 2019 | $12,119 | $129,987 | $29,888 | $100,099 |

| 2018 | $6,487 | $135,274 | $29,537 | $105,737 |

| 2017 | $12,014 | $132,117 | $28,848 | $103,269 |

| 2016 | $11,701 | $126,512 | $27,624 | $98,888 |

| 2015 | $11,393 | $118,313 | $25,834 | $92,479 |

| 2014 | $10,656 | $109,543 | $27,746 | $81,797 |

| 2012 | -- | $109,763 | $27,802 | $81,961 |

Source: Public Records

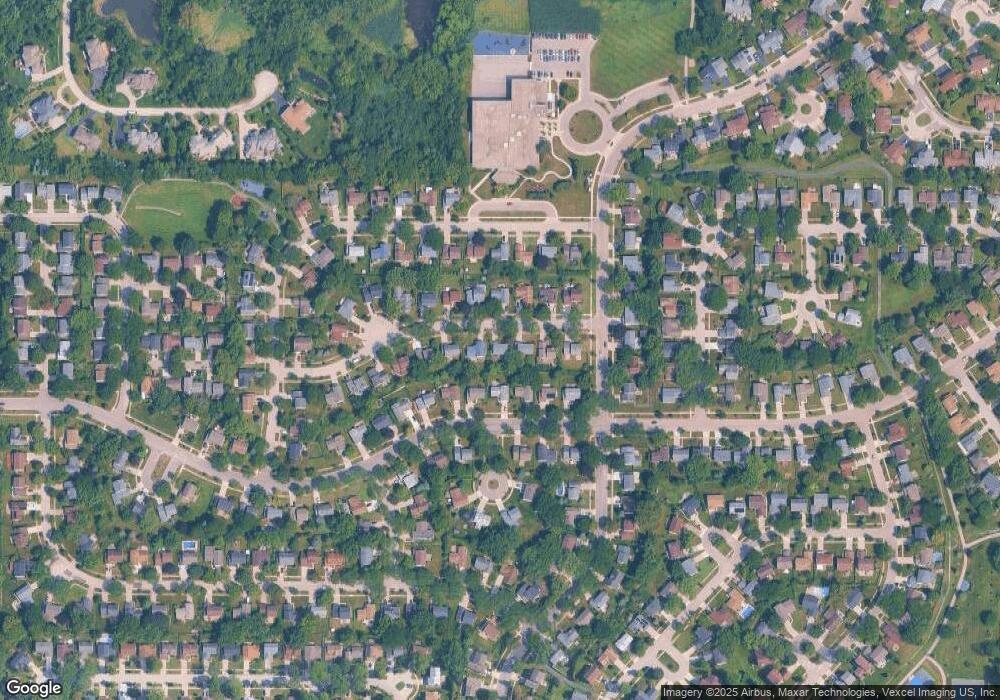

Map

Nearby Homes

- 327 Lasalle Ln

- 890 Knollwood Dr

- 1546 Brandywyn Ln

- 1265 Devonshire Rd

- 614 Lyon Ct

- 538 Lasalle Ct

- 437 Caren Dr

- 1141 Devonshire Rd

- 1032 Courtland Dr Unit 9

- 1118 Larraway Dr

- 950 Belmar Ln

- 1903 Sheridan Rd

- 5107 N Arlington Heights Rd

- 931 Shady Grove Ln

- 1901 Brandywyn Ln

- 1113 Lockwood Dr

- 12 Cloverdale Ct

- 5255 Danbury Ct

- 1998 Sheridan Ct

- 1324 Fairfax Ln Unit B32

- 730 Heatherdown Way

- 750 Heatherdown Way

- 731 Thompson Blvd

- 721 Thompson Blvd

- 761 Thompson Blvd

- 760 Heatherdown Way

- 741 Heatherdown Way

- 711 Thompson Blvd

- 731 Heatherdown Way

- 751 Heatherdown Way

- 771 Thompson Blvd

- 770 Heatherdown Way

- 710 Heatherdown Way Unit 2

- 721 Heatherdown Way

- 761 Heatherdown Way

- 701 Thompson Blvd

- 781 Thompson Blvd Unit 2

- 771 Heatherdown Way

- 711 Heatherdown Way

- 780 Heatherdown Way