7419 Black Beard Ct Russells Point, OH 43348

Estimated Value: $486,373 - $547,000

3

Beds

3

Baths

2,024

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 7419 Black Beard Ct, Russells Point, OH 43348 and is currently estimated at $520,343, approximately $257 per square foot. 7419 Black Beard Ct is a home located in Logan County with nearby schools including Indian Lake Elementary School, Indian Lake Middle School, and Indian Lake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 24, 2021

Sold by

Reynolds Frank L and Reynolds Ronda S

Bought by

Harrell Eric C and Harrell Jennifer E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,000

Outstanding Balance

$312,836

Interest Rate

3.14%

Mortgage Type

New Conventional

Estimated Equity

$207,507

Purchase Details

Closed on

Mar 2, 2018

Sold by

Neer Heather M and Donnell Patrick J O

Bought by

Reynolds Frank L and Reynolds Ronda S

Purchase Details

Closed on

May 21, 2013

Sold by

Reed Charles D and Reed Karen E

Bought by

Neer Heather M and Odonnell Patrick J

Purchase Details

Closed on

Sep 24, 2010

Bought by

Charles D Reed Trustee Etal

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harrell Eric C | $425,000 | None Available | |

| Reynolds Frank L | $288,500 | None Available | |

| Neer Heather M | -- | -- | |

| Charles D Reed Trustee Etal | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harrell Eric C | $340,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,443 | $147,580 | $50,750 | $96,830 |

| 2023 | $6,443 | $147,580 | $50,750 | $96,830 |

| 2022 | $6,790 | $101,780 | $35,000 | $66,780 |

| 2021 | $5,015 | $101,780 | $35,000 | $66,780 |

| 2020 | $5,021 | $85,460 | $35,000 | $50,460 |

| 2019 | $5,061 | $85,460 | $35,000 | $50,460 |

| 2018 | $3,997 | $85,460 | $35,000 | $50,460 |

| 2016 | $3,686 | $83,060 | $35,000 | $48,060 |

| 2014 | $3,696 | $83,060 | $35,000 | $48,060 |

| 2013 | $3,500 | $83,060 | $35,000 | $48,060 |

| 2012 | $3,259 | $73,360 | $22,750 | $50,610 |

Source: Public Records

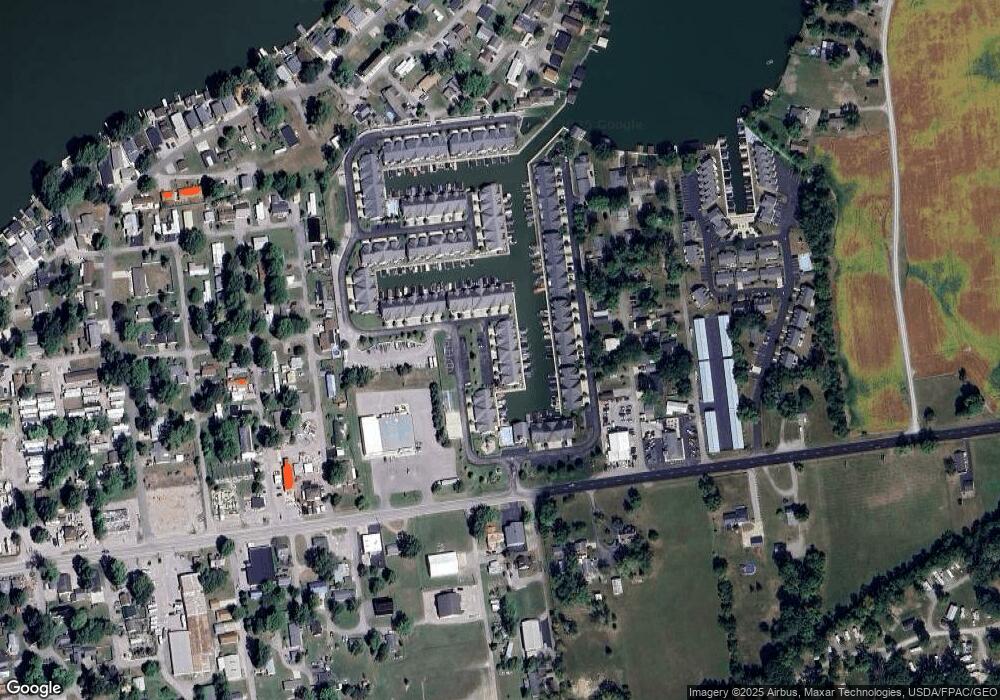

Map

Nearby Homes

- 7490 Sir Francis Drake Ave

- 7932 Anne Bonny Ct Unit 13C

- 7535 Township Road 269

- 8312 Ohio 366 Unit 25

- 8312 Ohio 366 Unit 26

- 8128 Midway Dr

- 7062 Clark Dr

- 7063 Clark Dr

- 7109 Hancock Dr

- 7889 Park Dr

- 7917 Hickory Ave

- 7933 Hickory Ave

- 7842 Hickory Ave

- 7655 Kooteney St

- 7225 Ohio 368

- 0 Edgewater Ave

- 0 Maple Unit 1040900

- 0 Crystal Beach Island Unit 225020350

- 0 Towpath Unit 1039398

- 8844 Chautauqua Blvd

- 7415 Black Beard Ct

- 7415 Black Beard Ct Unit 7c

- 7445 Black Beard Ct

- 7451 Black Beard Ct

- 7451 Blackbeard Ct Unit 8-D

- 7419 Blackbeard Ct Unit 7 - D

- 7419 Black Beard Ct Unit 7-D

- 7409 Black Beard Ct

- 7425 Black Beard Ct

- 7425 Black Beard Ct Unit 7E

- 7403 Black Beard Ct

- 7403 Blackbeard Ct Unit 7-A

- 7431 Black Beard Ct

- 7431 Black Beard Ct Unit 7f

- 7665 Marion Dr

- 7415 Blackbeard Ct Unit 7C

- 0 Blackbeard Ct Unit 7-D

- 7372 Sir Francis Drake Ave

- 7372 Sir Francis Drake Ave Unit 6-D