7420 Ravines Ave Las Vegas, NV 89131

Tule Springs NeighborhoodEstimated Value: $374,000 - $389,000

2

Beds

2

Baths

1,493

Sq Ft

$256/Sq Ft

Est. Value

About This Home

This home is located at 7420 Ravines Ave, Las Vegas, NV 89131 and is currently estimated at $382,483, approximately $256 per square foot. 7420 Ravines Ave is a home located in Clark County with nearby schools including Thomas O'Roarke Elementary School, Ralph Cadwallader Middle School, and Arbor View High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2011

Sold by

Herdt Mark A

Bought by

Herdt Mark A and The Herdt Family Trust

Current Estimated Value

Purchase Details

Closed on

Nov 8, 2010

Sold by

Webber Terrance L and Webber Gail A

Bought by

Herdt Mark A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,000

Outstanding Balance

$68,302

Interest Rate

4.18%

Mortgage Type

New Conventional

Estimated Equity

$314,181

Purchase Details

Closed on

Jun 11, 2010

Sold by

Webber Terrence L and Davis Gail A

Bought by

Webber Terrance L and Webber Gail A

Purchase Details

Closed on

Jun 24, 2008

Sold by

Webber Terrence L

Bought by

Webber Terrence L and Davis Gail A

Purchase Details

Closed on

Mar 20, 2006

Sold by

Webber Terrence L

Bought by

Davis Gail A

Purchase Details

Closed on

May 3, 2005

Sold by

Pn Ii Inc

Bought by

Webber Terrence L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,500

Interest Rate

5.99%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Herdt Mark A | -- | None Available | |

| Herdt Mark A | $132,000 | Old Republic Title Company | |

| Webber Terrance L | -- | None Available | |

| Webber Terrence L | $261,889 | None Available | |

| Davis Gail A | -- | None Available | |

| Webber Terrence L | $261,889 | Lawyers Title Of Nevada |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Herdt Mark A | $104,000 | |

| Previous Owner | Webber Terrence L | $209,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,840 | $103,384 | $28,700 | $74,684 |

| 2024 | $1,787 | $103,384 | $28,700 | $74,684 |

| 2023 | $1,787 | $98,140 | $30,450 | $67,690 |

| 2022 | $1,735 | $89,392 | $25,200 | $64,192 |

| 2021 | $1,685 | $75,867 | $23,450 | $52,417 |

| 2020 | $1,633 | $75,318 | $20,650 | $54,668 |

| 2019 | $1,585 | $73,752 | $19,600 | $54,152 |

| 2018 | $1,539 | $68,705 | $16,800 | $51,905 |

| 2017 | $2,056 | $62,172 | $14,000 | $48,172 |

| 2016 | $1,456 | $59,400 | $11,900 | $47,500 |

| 2015 | $1,453 | $45,612 | $9,450 | $36,162 |

| 2014 | $1,410 | $42,893 | $8,750 | $34,143 |

Source: Public Records

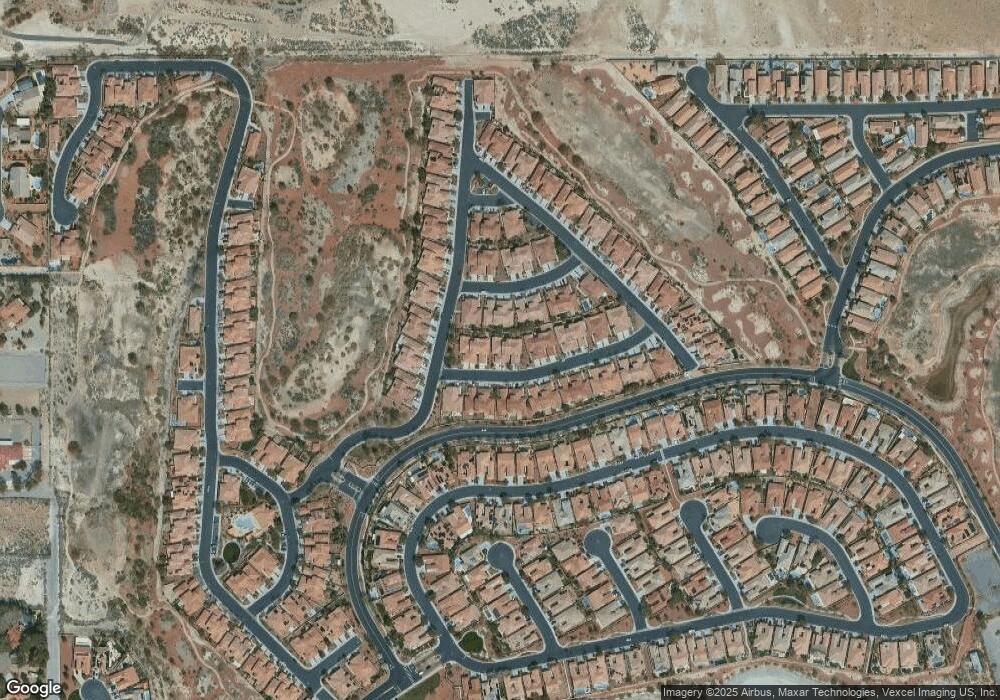

Map

Nearby Homes

- 7352 Ravines Ave

- 7341 Ravines Ave

- 8824 Martin Downs Place

- 7341 Royal Melbourne Dr

- 8633 Kennedy Heights Ct

- 8900 Echo Grande Dr

- 8648 Deering Bay Dr

- 8916 El Diablo St

- 8955 Sandy Isle Ct

- 8775 N Buffalo Dr

- 7650 Butterscotch Cir

- 7591 Kenwood Hills Ct

- 8536 Grand Palms Cir

- 7606 Kenwood Hills Ct

- 8517 Grand Palms Cir

- 8560 Grand Palms Cir

- 8824 Killians Greens Dr

- 7220 Fairwind Acres Place

- 8226 Mount Logan Ct

- 8301 Broad Peak Dr

- 7416 Ravines Ave

- 7424 Ravines Ave

- 7412 Ravines Ave

- 7428 Ravines Ave

- 7428 Ravines Ave

- 7428 Ravines Ave

- 7432 Ravines Ave

- 7408 Ravines Ave

- 7421 Quail Heights Ave

- 7421 Quail Heights Ave Unit n/a

- 7417 Quail Heights Ave

- 7425 Quail Heights Ave

- 7429 Quail Heights Ave

- 7404 Ravines Ave

- 7413 Quail Heights Ave

- 7433 Quail Heights Ave

- 7421 Ravines Ave

- 7425 Ravines Ave

- 7409 Quail Heights Ave

- 7429 Ravines Ave