7434 Grand Bahama Dr Unit 7434 Columbus, OH 43085

Worthington Village North NeighborhoodEstimated Value: $307,000 - $327,000

2

Beds

4

Baths

1,448

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 7434 Grand Bahama Dr Unit 7434, Columbus, OH 43085 and is currently estimated at $317,365, approximately $219 per square foot. 7434 Grand Bahama Dr Unit 7434 is a home located in Franklin County with nearby schools including Worthington Estates Elementary School, Worthingway Middle School, and Thomas Worthington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2022

Sold by

Asmus Mitchell

Bought by

Quach David

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$271,600

Outstanding Balance

$258,042

Interest Rate

5.1%

Mortgage Type

New Conventional

Estimated Equity

$59,323

Purchase Details

Closed on

Apr 26, 2018

Sold by

Renee Robert

Bought by

Asmus Mitchell

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,500

Interest Rate

4.45%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 11, 2010

Sold by

Levon Christopher M and Crum Christopher

Bought by

Crum Roberta Renee and Crum Roberta

Purchase Details

Closed on

Jun 24, 2008

Sold by

Traditions At Worthington Woods Llc

Bought by

Crum Roberta and Crum Christopher

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,447

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Quach David | $295,000 | Stewart Title | |

| Asmus Mitchell | $205,000 | Chicago Title | |

| Crum Roberta Renee | -- | None Available | |

| Crum Roberta | $198,000 | Talon Group |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Quach David | $271,600 | |

| Previous Owner | Asmus Mitchell | $184,500 | |

| Previous Owner | Crum Roberta | $196,447 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,921 | $47,570 | $17,500 | $30,070 |

| 2023 | $2,793 | $47,565 | $17,500 | $30,065 |

| 2022 | $3,273 | $44,240 | $6,860 | $37,380 |

| 2021 | $3,020 | $44,240 | $6,860 | $37,380 |

| 2020 | $2,909 | $44,240 | $6,860 | $37,380 |

| 2019 | $2,423 | $33,250 | $4,900 | $28,350 |

| 2018 | $3,133 | $33,250 | $4,900 | $28,350 |

| 2017 | $3,045 | $33,250 | $4,900 | $28,350 |

| 2016 | $3,919 | $55,200 | $8,050 | $47,150 |

| 2015 | $3,920 | $55,200 | $8,050 | $47,150 |

| 2014 | $3,918 | $55,200 | $8,050 | $47,150 |

| 2013 | $2,293 | $64,925 | $9,450 | $55,475 |

Source: Public Records

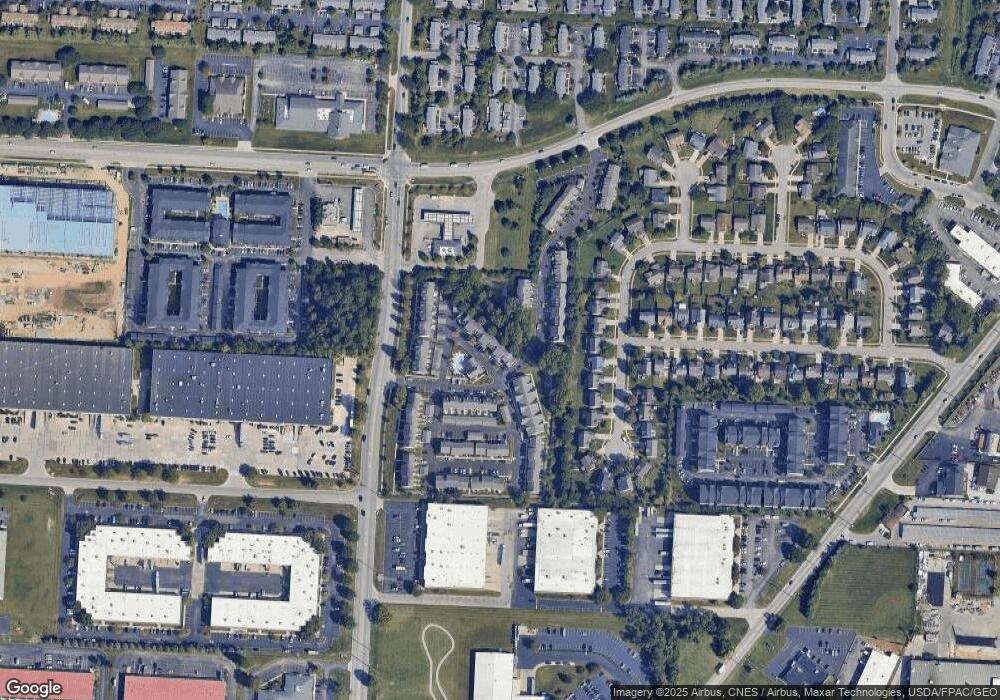

Map

Nearby Homes

- 906 Linkfield Dr

- 940 Larkfield Dr

- 716 Alta View Ct Unit 33

- 7634 Kelvinway Dr Unit 150

- 994 Annagladys Dr Unit M4

- 7649 Flynnway Dr Unit 139

- 7697 Barkwood Dr Unit 1D

- 7685 Whitneyway Dr Unit 17

- 7736 Garrison Dr Unit 242

- 1158 Worthington Woods Blvd

- 7803 Barkwood Dr Unit 11C

- 1222 Clement Dr

- 1026 Snohomish Ave

- 874 Sheldrake Ct Unit 21C

- 1223 Tranquil Dr

- 7889 Woodhouse Ln Unit 44B

- 874 Charnwood Ln Unit 5D

- 1133 Tillicum Dr

- 842 Soramill Ln Unit 46C

- 1335 Clement Dr

- 7438 Grand Bahama Dr

- 7434 Grand Bahama Dr

- 7442 Grand Bahama Dr

- 7446 Grand Bahama Dr Unit 7446

- 7450 Grand Bahama Dr Unit 7450

- 7407 Cayman Ln Unit 7407

- 7328 Cayman Ln Unit 7328

- 7324 Cayman Ln Unit 7324

- 7398 Grand Bahama Dr

- 7316 Cayman Ln Unit 7316

- 7312 Cayman Ln

- 7415 Cayman Ln Unit 7415

- 7396 Cayman Ln Unit 7396

- 7400 Cayman Ln Unit 7400

- 7308 Cayman Ln Unit 7308

- 7304 Cayman Ln

- 7404 Cayman Ln

- 7419 Cayman Ln Unit 7419

- 7300 Cayman Ln Unit 7300

- 7408 Cayman Ln Unit 7408