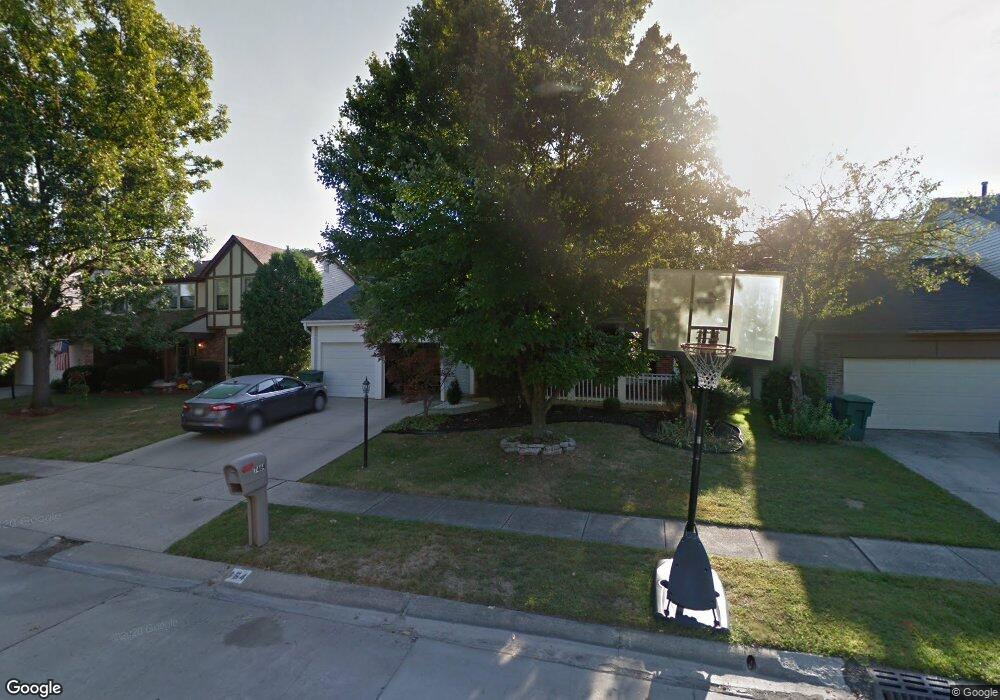

7464 Gardengate Place Dublin, OH 43016

Olde Sawmill NeighborhoodEstimated Value: $419,964 - $472,000

4

Beds

3

Baths

2,100

Sq Ft

$214/Sq Ft

Est. Value

About This Home

This home is located at 7464 Gardengate Place, Dublin, OH 43016 and is currently estimated at $449,241, approximately $213 per square foot. 7464 Gardengate Place is a home located in Franklin County with nearby schools including Olde Sawmill Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2020

Sold by

Gibson Jason V and Kiener Gibson Mary

Bought by

Gibson Jason V and Kiener Gibson Mary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$246,568

Outstanding Balance

$218,723

Interest Rate

3%

Mortgage Type

VA

Estimated Equity

$230,518

Purchase Details

Closed on

Jun 22, 2011

Sold by

Arthur Lorraine and Arthur Lorraine C

Bought by

Gibson Jason V and Kiener Mary E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,316

Interest Rate

4.67%

Mortgage Type

VA

Purchase Details

Closed on

Mar 31, 1999

Sold by

Arthur Jay P

Bought by

Arthur Lorraine

Purchase Details

Closed on

Apr 15, 1988

Bought by

Arthur Jay P

Purchase Details

Closed on

Aug 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gibson Jason V | -- | Orange Coast Lender Services | |

| Gibson Jason V | $177,500 | Quality Oho | |

| Arthur Lorraine | -- | -- | |

| Arthur Jay P | $79,200 | -- | |

| -- | $18,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gibson Jason V | $246,568 | |

| Closed | Gibson Jason V | $181,316 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,449 | $123,170 | $32,760 | $90,410 |

| 2024 | $7,449 | $123,170 | $32,760 | $90,410 |

| 2023 | $7,345 | $123,165 | $32,760 | $90,405 |

| 2022 | $6,008 | $93,630 | $17,680 | $75,950 |

| 2021 | $6,105 | $93,630 | $17,680 | $75,950 |

| 2020 | $6,068 | $93,630 | $17,680 | $75,950 |

| 2019 | $5,610 | $76,620 | $14,740 | $61,880 |

| 2018 | $5,203 | $76,620 | $14,740 | $61,880 |

| 2017 | $5,179 | $76,620 | $14,740 | $61,880 |

| 2016 | $4,746 | $65,950 | $19,780 | $46,170 |

| 2015 | $4,775 | $65,950 | $19,780 | $46,170 |

| 2014 | $4,780 | $65,950 | $19,780 | $46,170 |

| 2013 | $2,426 | $65,940 | $19,775 | $46,165 |

Source: Public Records

Map

Nearby Homes

- 2423 Sutter Pkwy

- 2469 Sandstrom Dr

- 2456 Sanford Dr

- 2475 Slateshire Dr

- 2620 Cedar Lake Dr Unit 2620

- 2074 Hard Rd

- 1986 Sutter Pkwy

- 7887 Thornfield Ln Unit 50

- 7891 Thornfield Ln Unit 48

- 7912 Meadowhaven Blvd Unit 30

- 7853 Meadowhaven Blvd Unit 63

- 7847 Meadowhaven Blvd Unit 66

- 7746 Sagemeadow Ct

- 2001 Sawbury Blvd Unit 2001

- 2691 Sawmill Forest Ave

- 7898 Sarahurst Dr

- 7907 Sarahurst Dr

- 1908 Lost Valley Rd

- 7456 Mapleleaf Ct

- 2161 Heatherfield Ave

- 7472 Gardengate Place

- 7456 Gardengate Place

- 7480 Gardengate Place

- 7448 Gardengate Place

- 7461 Gardenview Place

- 7469 Gardenview Place

- 7453 Gardenview Place

- 7477 Gardenview Place

- 7440 Gardengate Place

- 7463 Gardengate Place

- 7471 Gardengate Place

- 7488 Gardengate Place

- 7479 Gardengate Place

- 7445 Gardenview Place

- 7485 Gardenview Place

- 7455 Gardengate Place

- 7447 Gardengate Place

- 7432 Gardengate Place

- 7437 Gardenview Place

- 7493 Gardenview Place