7507 S Osborne Rd Upper Marlboro, MD 20772

Estimated payment $1,662/month

About This Lot

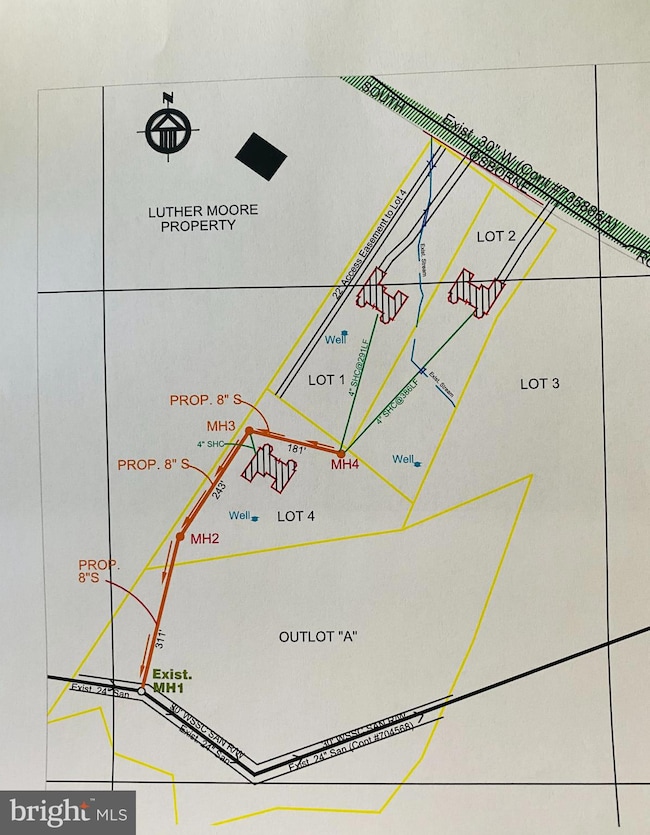

The Perfect Location South Osborne Road and Route 301. Build your Dreams on this private 2.25 Oasis. Zoned Residential. All Reasonable Offers. Choose your own Custom Builders should you Wish to Build YOUR DREAM HOME. LAND ONLY

Listing Agent

(240) 305-4893 aletheayourrealtor@gmail.com Fairfax Realty Premier Listed on: 07/29/2025

Property Details

Property Type

- Land

Est. Annual Taxes

- $1,069

Lot Details

- 2.29 Acre Lot

- The Lot Next to this lot is 2 Acres and for Sale as Well. $165k

- Property is zoned RA

Schools

- Melwood Elementary School

- Dr. Henry A. Wise High School

Community Details

- No Home Owners Association

Listing and Financial Details

- Assessor Parcel Number 17151761667

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,022 | $64,600 | $64,600 | -- |

| 2024 | $1,022 | $64,600 | $64,600 | $0 |

| 2023 | $1,022 | $64,600 | $64,600 | $0 |

| 2022 | $1,070 | $67,800 | $67,800 | $0 |

| 2021 | $1,070 | $66,167 | $0 | $0 |

| 2020 | $1,021 | $64,533 | $0 | $0 |

| 2019 | $901 | $62,900 | $62,900 | $0 |

| 2018 | $935 | $62,900 | $62,900 | $0 |

| 2017 | $997 | $62,900 | $0 | $0 |

| 2016 | -- | $62,900 | $0 | $0 |

| 2015 | $1,372 | $62,900 | $0 | $0 |

| 2014 | $1,372 | $95,800 | $0 | $0 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft | Prior Sale |

|---|---|---|---|---|---|

| 07/29/2025 07/29/25 | For Sale | $300,000 | +122.2% | -- | |

| 09/26/2022 09/26/22 | Sold | $135,000 | 0.0% | -- | View Prior Sale |

| 06/09/2022 06/09/22 | For Sale | $135,000 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Deed | $135,000 | Preferred Title | |

| Deed | $5,000 | -- | |

| Deed | $140,000 | -- |

Source: Bright MLS

MLS Number: MDPG2161480

APN: 15-1761667

- 7008 Brentwood Dr

- 12411 Sturdee Dr

- 7809 Croom Rd

- 7200 Sybaris Dr

- 7103 Aquinas Ave

- 0 Trumps Hill Rd Unit MDPG2125080

- 0 Trumps Hill Rd Unit MDPG2145194

- 8614 Trumps Hill Rd

- 8401 Old Colony Dr S

- 8610 Monmouth Dr

- 8500 Biscayne Ct

- 8407 Berwick Rd

- 12119 Wheeling Ave

- 12736 Wedgedale Ct

- 8801 Monmouth Dr

- 8604 Binghampton Place

- 7216 Purple Avens Ave

- 12528 Woodstock Dr E

- 10607 Chickory Ct

- 12458 Old Colony Dr

- 7701 Croom Rd

- 12500 Sturdee Dr

- 12740 Wedgedale Ct

- 7208 Purple Ave

- 8812 Woodstock Dr W

- 8911 Heathermore Blvd

- 9590 Crain Hwy

- 10407 Del Ray Ct

- 9922 Williamsburg Dr

- 9809 Hammer Ln

- 9701 Grandhaven Ave

- 6303 Soueid St

- 12308 Putters Ct

- 9004 Cavesson Way

- 10710 Tyrone Dr

- 11012 Mary Digges Place

- 6000 Soueid St

- 5103 Whittington Ln

- 11103 Tenbury Ct

- 4903 Ashford Dr