751 N Randall Rd Unit A Aurora, IL 60506

Edgelawn Randall NeighborhoodEstimated Value: $193,000 - $210,770

3

Beds

2

Baths

1,116

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 751 N Randall Rd Unit A, Aurora, IL 60506 and is currently estimated at $202,943, approximately $181 per square foot. 751 N Randall Rd Unit A is a home located in Kane County with nearby schools including Mccleery Elementary School, Jefferson Middle School, and West Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 18, 2015

Sold by

Hill Worth

Bought by

Melendez Ricardo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$32,871

Interest Rate

5%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Apr 22, 2010

Sold by

Secretary Of Housing & Urban Development

Bought by

Hill Worth

Purchase Details

Closed on

Apr 11, 2008

Sold by

Guardian Jose S

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

May 17, 2006

Sold by

Guadian Jose

Bought by

Vega Beatriz Adriana

Purchase Details

Closed on

Dec 18, 2003

Sold by

Bern Norman A

Bought by

Guadian Jose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,302

Interest Rate

5.94%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 26, 1999

Sold by

Bern Sheila A

Bought by

Bern Norman A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Melendez Ricardo | $50,000 | None Available | |

| Hill Worth | -- | Stewart Title Company | |

| The Secretary Of Housing & Urban Develop | -- | None Available | |

| Vega Beatriz Adriana | -- | Chicago Title Insurance Co | |

| Guadian Jose | $77,500 | Chicago Title Insurance Comp | |

| Bern Norman A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Melendez Ricardo | $32,871 | |

| Previous Owner | Guadian Jose | $76,302 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,212 | $35,933 | $1,327 | $34,606 |

| 2023 | $2,065 | $32,106 | $1,186 | $30,920 |

| 2022 | $1,744 | $25,703 | $1,082 | $24,621 |

| 2021 | $1,314 | $20,378 | $1,007 | $19,371 |

| 2020 | $1,210 | $18,928 | $935 | $17,993 |

| 2019 | $930 | $15,509 | $866 | $14,643 |

| 2018 | $775 | $12,109 | $801 | $11,308 |

| 2017 | $799 | $8,030 | $738 | $7,292 |

| 2016 | $711 | $6,692 | $633 | $6,059 |

| 2015 | -- | $6,213 | $544 | $5,669 |

| 2014 | -- | $6,273 | $648 | $5,625 |

| 2013 | -- | $5,994 | $619 | $5,375 |

Source: Public Records

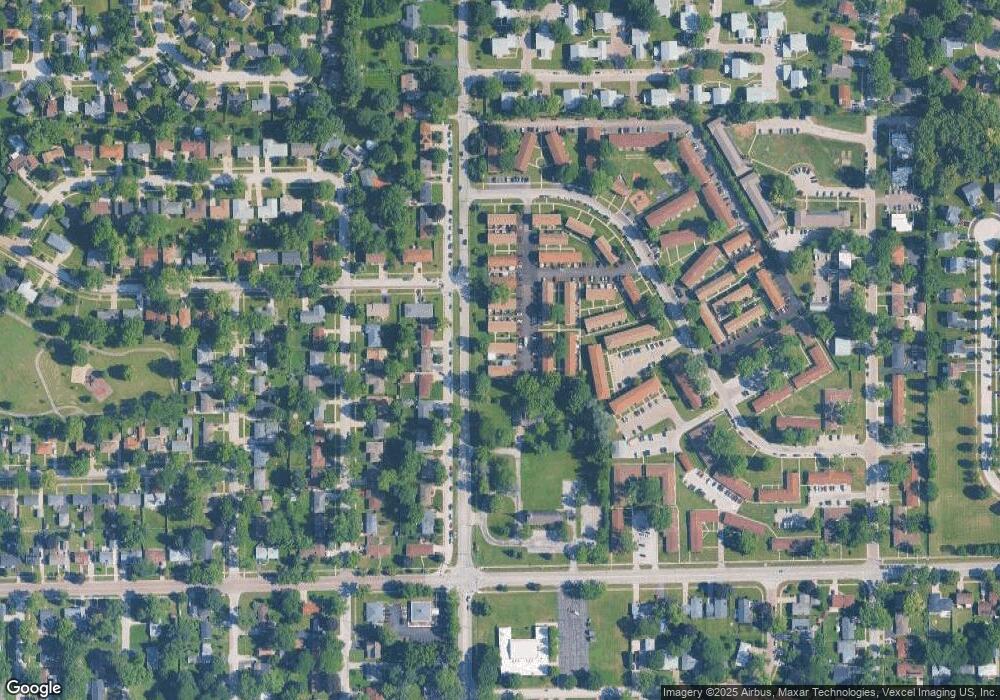

Map

Nearby Homes

- 1389 Monomoy St Unit B2

- 1351 Monomoy St Unit D

- 833 N Randall Rd Unit C4

- 1390 N Glen Cir Unit B

- 630 N Buell Ave

- 1104 New Haven Ave

- 972 Westgate Dr

- 865 N Fordham Ave

- 1035 Newcastle Ln

- 1296 Yellowpine Dr

- 781 N Elmwood Dr

- 795 N Elmwood Dr

- 1747 W Illinois Ave

- 1149 Newcastle Ln

- 113 Stonewood Place Unit 6D

- 1735 Greene Ct

- 1751 Greene Ct

- 943 Charles St

- 616 Morton Ave

- 231 W Downer Place

- 751 N Randall Rd Unit D

- 751 N Randall Rd Unit B

- 751 N Randall Rd Unit C

- 751 N Randall Rd

- 715 N Randall Rd Unit D

- 747 N Randall Rd Unit D

- 747 N Randall Rd Unit C

- 747 N Randall Rd Unit B

- 755 N Randall Rd Unit D

- 755 N Randall Rd Unit C

- 755 N Randall Rd Unit A

- 755 N Randall Rd Unit B

- 1358 Monomoy St Unit E

- 1358 Monomoy St Unit B

- 1358 Monomoy St Unit A

- 1358 Monomoy St Unit C

- 1358 Monomoy St

- 1358 Monomoy St Unit F

- 1358 Monomoy St Unit D

- 1370 Monomoy St Unit D