Estimated Value: $425,000 - $465,000

2

Beds

2

Baths

1,704

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 751 W Villa Ridge Way, Sandy, UT 84070 and is currently estimated at $444,972, approximately $261 per square foot. 751 W Villa Ridge Way is a home located in Salt Lake County with nearby schools including Sandy Elementary School, Jordan High, and Mount Jordan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2015

Sold by

Wells Norman C

Bought by

Wells Norman C and Wells Family Trust

Current Estimated Value

Purchase Details

Closed on

Sep 21, 2011

Sold by

Shuler Gayle G

Bought by

Wells Norman C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,550

Outstanding Balance

$14,086

Interest Rate

4.16%

Mortgage Type

New Conventional

Estimated Equity

$430,886

Purchase Details

Closed on

Apr 9, 2004

Sold by

Old Villa Inc

Bought by

Hunsaker Janet Bywater

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,450

Interest Rate

4.37%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wells Norman C | -- | None Available | |

| Wells Norman C | -- | Backman Title Services | |

| Hunsaker Janet Bywater | -- | Meridian Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wells Norman C | $160,550 | |

| Previous Owner | Hunsaker Janet Bywater | $132,450 | |

| Closed | Hunsaker Janet Bywater | $24,835 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,193 | $422,600 | $54,400 | $368,200 |

| 2024 | $2,193 | $405,500 | $52,200 | $353,300 |

| 2023 | $2,112 | $389,400 | $50,200 | $339,200 |

| 2022 | $2,119 | $381,800 | $49,200 | $332,600 |

| 2021 | $1,893 | $290,300 | $37,400 | $252,900 |

| 2020 | $1,770 | $255,900 | $37,400 | $218,500 |

| 2019 | $1,781 | $251,000 | $35,300 | $215,700 |

| 2018 | $1,564 | $229,500 | $35,300 | $194,200 |

| 2017 | $1,522 | $213,300 | $35,300 | $178,000 |

| 2016 | $1,523 | $206,400 | $51,700 | $154,700 |

| 2015 | $1,516 | $190,100 | $50,200 | $139,900 |

| 2014 | $1,458 | $179,200 | $47,700 | $131,500 |

Source: Public Records

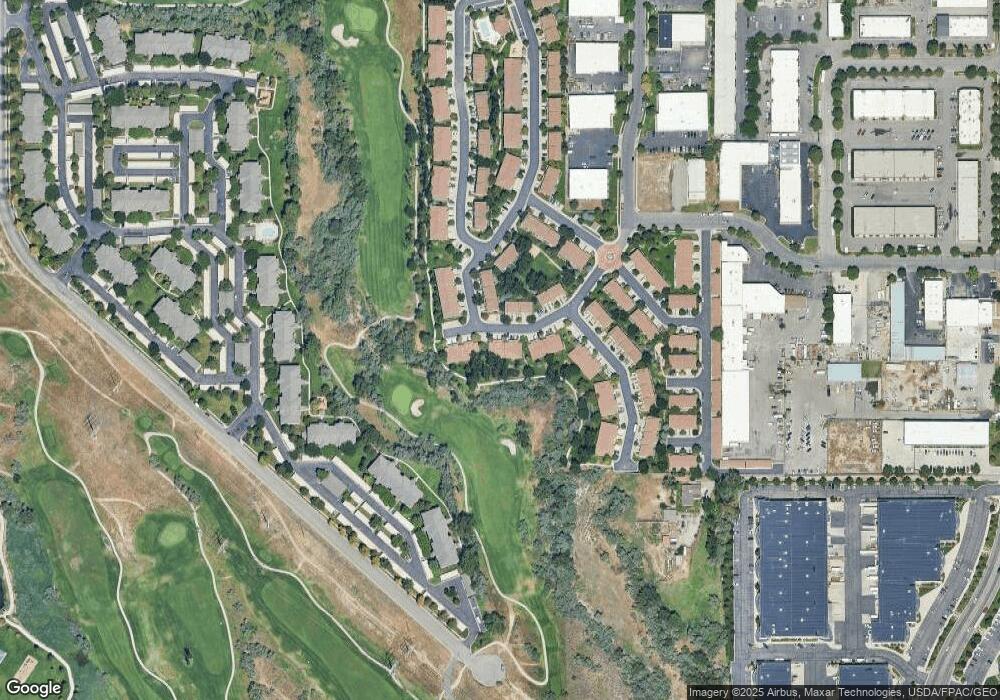

Map

Nearby Homes

- 9597 Hidden Point Dr

- 9345 Windflower Ln

- 885 W Chartres Ave

- 773 Club Oaks Dr

- 662 W Jefferson Cove

- 9332 S 455 W Unit 29

- 9847 S 1000 W

- 9837 Jordan Ridge Rd

- 9532 S Willow Trail Way

- 1116 W 9440 S

- 194 Albion Village Way Unit 402

- 9297 S Avignon Place

- 180 Albion Village Way Unit 201

- 9121 S Hidden Peak Dr

- 9420 S Streatham Rd

- 165 Albion Village Way Unit 201

- 8750 S 500 E

- 8405 S 700 E

- 9776 Amberwood Cir

- 1104 W 10125 S

- 751 Villa Ridge Way

- 747 W Villa Ridge Way

- 747 Villa Ridge Way

- 743 Villa Ridge Way

- 761 Villa Ridge Way

- 761 W Villa Ridge Way

- 739 Villa Ridge Way

- 765 Villa Ridge Way

- 765 W Villa Ridge Way

- 769 Villa Ridge Way

- 731 Villa Ridge Way

- 9609 S Hidden Point Dr

- 744 Villa Ridge Way

- 9609 Hidden Point Dr

- 773 W Villa Ridge Way

- 773 Villa Ridge Way

- 740 Villa Ridge Way

- 9605 S Hidden Point Dr

- 727 Villa Ridge Way

- 9605 Hidden Point Dr