7513 144th Avenue Ct E Unit 52 Sumner, WA 98390

Estimated Value: $529,000 - $540,321

2

Beds

2

Baths

1,716

Sq Ft

$311/Sq Ft

Est. Value

About This Home

This home is located at 7513 144th Avenue Ct E Unit 52, Sumner, WA 98390 and is currently estimated at $532,830, approximately $310 per square foot. 7513 144th Avenue Ct E Unit 52 is a home located in Pierce County with nearby schools including Maple Lawn Elementary School, Sumner Middle School, and Sumner High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2017

Sold by

Hinshaw Gayl M and Hinshaw Betty Doolittle

Bought by

Mcmeen Liane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,000

Outstanding Balance

$177,967

Interest Rate

4.1%

Mortgage Type

New Conventional

Estimated Equity

$354,863

Purchase Details

Closed on

Nov 2, 2007

Sold by

Hinshaw Paul D

Bought by

Hinshaw Gayl M

Purchase Details

Closed on

May 11, 2001

Sold by

Hinshaw Duane E

Bought by

Hinshaw Duane E and Revocable Trust Of Duane E Hinshaw

Purchase Details

Closed on

May 15, 1997

Sold by

Hinshaw Lena R

Bought by

Hinshaw Duane E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,000

Interest Rate

8.5%

Purchase Details

Closed on

May 5, 1997

Sold by

Crest Builders Inc

Bought by

Hinshaw Duane E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,000

Interest Rate

8.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcmeen Liane | $267,219 | Fidelity National Title | |

| Hinshaw Gayl M | -- | None Available | |

| Hinshaw Duane E | -- | -- | |

| Hinshaw Duane E | -- | -- | |

| Hinshaw Duane E | $180,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcmeen Liane | $214,000 | |

| Previous Owner | Hinshaw Duane E | $126,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,582 | $491,900 | $200,000 | $291,900 |

| 2024 | $4,582 | $475,900 | $188,500 | $287,400 |

| 2023 | $4,582 | $442,600 | $188,500 | $254,100 |

| 2022 | $4,442 | $448,200 | $206,800 | $241,400 |

| 2021 | $4,464 | $338,500 | $133,800 | $204,700 |

| 2019 | $3,596 | $321,500 | $117,300 | $204,200 |

| 2018 | $3,747 | $287,800 | $100,700 | $187,100 |

| 2017 | $3,186 | $264,700 | $83,000 | $181,700 |

| 2016 | $2,569 | $208,500 | $62,300 | $146,200 |

| 2014 | $1,289 | $192,800 | $65,200 | $127,600 |

| 2013 | $1,289 | $173,100 | $59,400 | $113,700 |

Source: Public Records

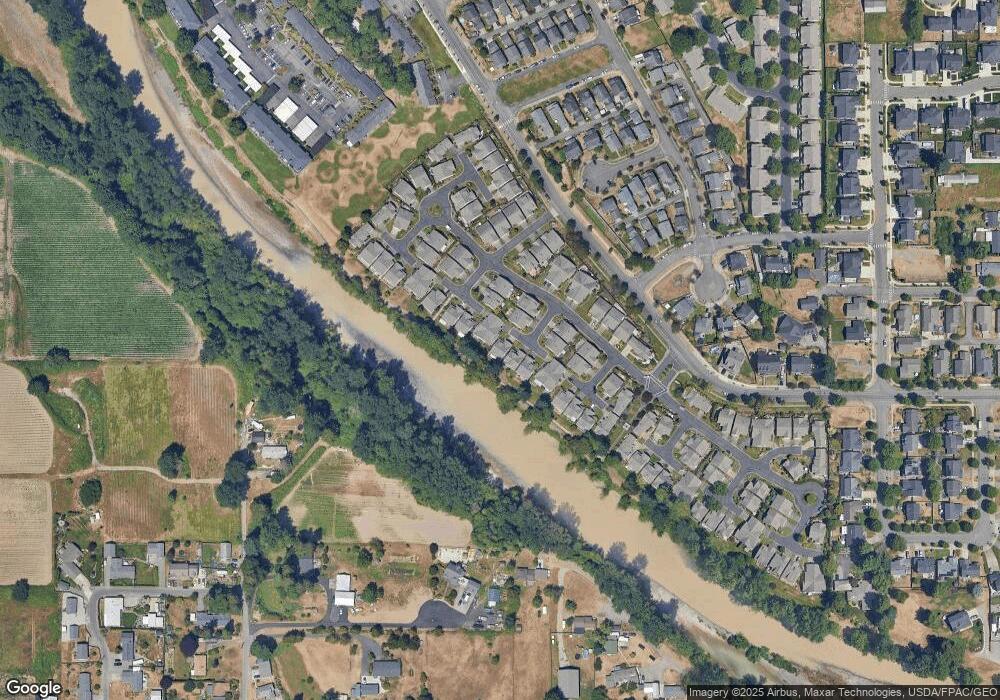

Map

Nearby Homes

- 7526 145th Ave E Unit 41

- 7613 145th Avenue Ct E Unit 36

- 7608 145th Avenue Ct E Unit 30

- 7620 146th Avenue Ct E

- 7703 146th Avenue Ct E

- 7115 143rd Ave E

- 14717 73rd St E

- 7104 141st Ave E

- 7024 141st Ave E

- 1211 Maybell St

- 15108 74th St E

- 14001 70th St E

- 908 Willow St

- 416 Meade Ave

- 324 Valley Ave E

- 414 Sumner Ave

- 8608 143rd Avenue Ct E Unit 14

- 8401 State Route 162 E

- 8705 143rd Avenue Ct E Unit 48

- 1118 Thompson St

- 7511 144th Avenue Ct E Unit 53

- 7430 144th Ave E Unit 58

- 7514 144th Avenue Ct E Unit 50

- 7505 144th Av Ct E

- 7432 144th Ave E Unit 59

- 7428 144th Ave E Unit 57

- 7503 144th Av Ct E

- 7503 144th Avenue Ct E Unit 55

- 7506 144th Avenue Ct E Unit 48

- 7523 145th Ave E Unit 44

- 7510 144th Avenue Ct E Unit 49

- 7426 144th Ave E Unit 56

- 7504 144th Avenue Ct E Unit 47

- 8303 144th Ave E Unit XX

- 7515 145th Ave E

- 7527 145th Ave E Unit 43

- 7433 144th Ave E Unit 61

- 14415 Riverwalk Dr E Unit 93

- 7513 145th Ave E