7518 NE 228th St Battle Ground, WA 98604

Estimated Value: $760,541 - $884,000

3

Beds

2

Baths

2,360

Sq Ft

$344/Sq Ft

Est. Value

About This Home

This home is located at 7518 NE 228th St, Battle Ground, WA 98604 and is currently estimated at $811,885, approximately $344 per square foot. 7518 NE 228th St is a home located in Clark County with nearby schools including Daybreak Primary School, Daybreak Middle School, and Prairie High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 15, 2014

Sold by

Jespersen David and Jespersen Jamie

Bought by

Hattrick John and Hattrick Cara

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$406,600

Outstanding Balance

$310,818

Interest Rate

4.1%

Mortgage Type

New Conventional

Estimated Equity

$501,067

Purchase Details

Closed on

Dec 14, 2011

Sold by

New Tradition Homes Inc

Bought by

Jespersen David and Jespersen Jamie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$339,080

Interest Rate

3.75%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 9, 2009

Sold by

Helmes Development Inc

Bought by

New Tradition Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hattrick John | $427,719 | Clark County Title | |

| Jespersen David | $347,900 | First American Title | |

| New Tradition Homes Inc | -- | Accommodation |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hattrick John | $406,600 | |

| Previous Owner | Jespersen David | $339,080 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,617 | $671,120 | $191,206 | $479,914 |

| 2024 | $5,151 | $633,787 | $191,206 | $442,581 |

| 2023 | $5,657 | $651,659 | $194,190 | $457,469 |

| 2022 | $5,484 | $656,229 | $197,122 | $459,107 |

| 2021 | $5,400 | $590,736 | $193,274 | $397,462 |

| 2020 | $5,340 | $511,445 | $174,033 | $337,412 |

| 2019 | $4,609 | $495,753 | $175,957 | $319,796 |

| 2018 | $5,554 | $486,257 | $0 | $0 |

| 2017 | $4,722 | $452,549 | $0 | $0 |

| 2016 | $4,601 | $414,472 | $0 | $0 |

| 2015 | $4,714 | $371,640 | $0 | $0 |

| 2014 | -- | $363,466 | $0 | $0 |

| 2013 | -- | $303,145 | $0 | $0 |

Source: Public Records

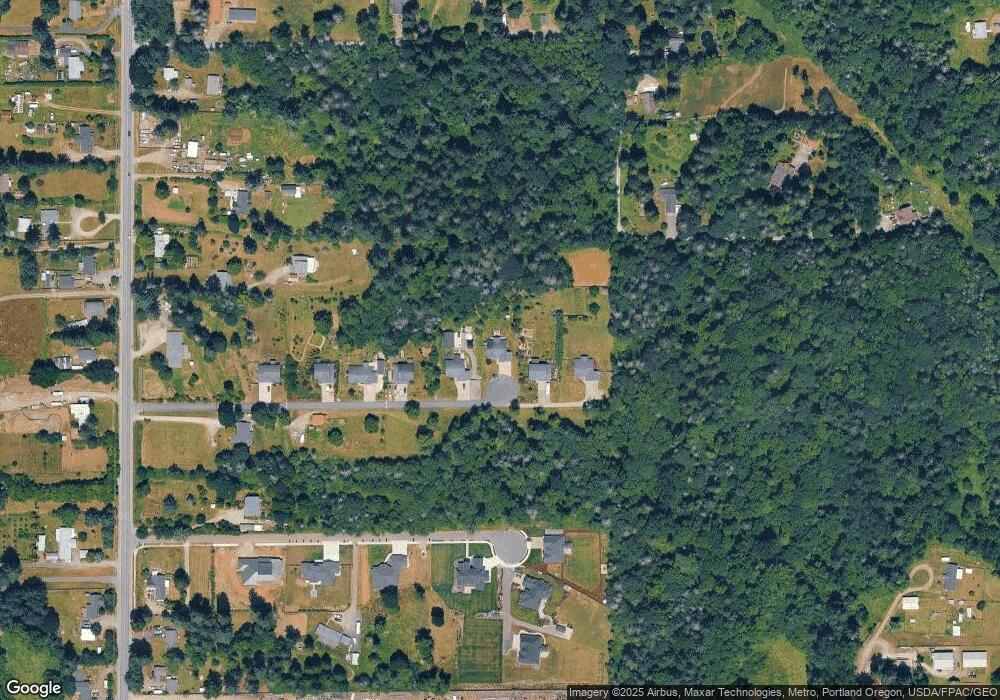

Map

Nearby Homes

- 23001 NE 82nd Ave

- 23422 NE 72nd Ave

- 23403 NE 92nd Ave

- 23615 NE 92nd Ave

- 5711 NE 246th St

- 3009 NW 9th St

- 151 NW 30th Ave

- 1410 NW 30th Ave

- 2812 NW 14th St

- 344 NW 29th Way

- 810 NW 25th Ave

- 2514 W Main St

- 1210 NW 24th Ave

- 2401 NW 10th Way

- 1523 NW 25th Ave

- 5610 NE 199th St

- 1718 NW 25th Ave

- 2507 SW 5th Way

- 2200 NW 5th St

- 2307 SW 5th Cir

- 7518 NE 228th St Unit 7

- 7602 NE 228th St

- 7602 NE 228th St Unit 8

- 7508 NE 228th St

- 7612 NE 228th St Unit 9

- 7416 NE 228th St Unit 5

- 7416 NE 228th St

- 7406 NE 228th St

- 7406 NE 228th St Unit 4

- 7320 NE 228th St

- 7320 NE 228th St Unit 3

- 22813 NE 72nd Ave

- 7525 NE 226th Cir

- 7525 NE 226th Cir Unit 9

- 7718 NE 229th St

- 7310 NE 228th St

- 7310 NE 228th St Unit 2

- 22601 NE 72nd Ave

- 7521 NE 226th Cir

- 22703 NE 72nd Ave