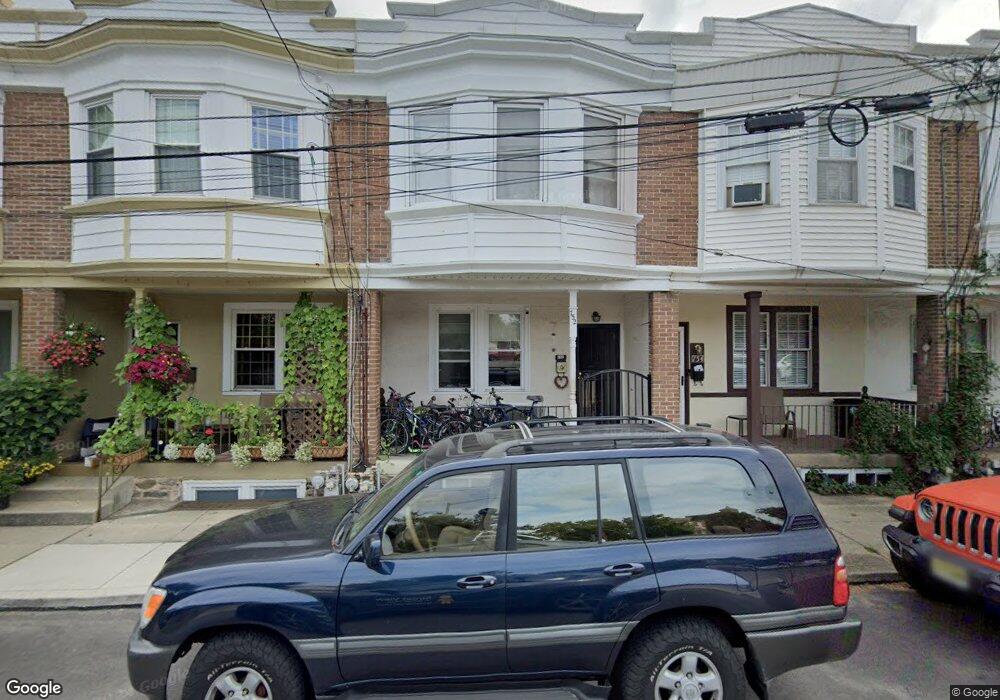

752 W Railroad Ave Bryn Mawr, PA 19010

Estimated Value: $276,518 - $395,000

3

Beds

1

Bath

918

Sq Ft

$347/Sq Ft

Est. Value

About This Home

This home is located at 752 W Railroad Ave, Bryn Mawr, PA 19010 and is currently estimated at $318,880, approximately $347 per square foot. 752 W Railroad Ave is a home located in Montgomery County with nearby schools including Welsh Valley Middle School, Harriton Senior High School, and The Shipley School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2014

Sold by

Maternia Emil and Maternia Donna

Bought by

Schiavio Milica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,390

Outstanding Balance

$139,454

Interest Rate

4.02%

Mortgage Type

New Conventional

Estimated Equity

$179,426

Purchase Details

Closed on

Jul 23, 2013

Sold by

Salvati Vincent and Salvati Vincenzo Anthony

Bought by

Maternia Emil and Maternia Donna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,927

Interest Rate

3.95%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 22, 1999

Sold by

Quigley Luisa Salvati and Baruzzi Natalie Salvati

Bought by

Salvati Vincent and Salvati Vincenzo Anthony

Purchase Details

Closed on

Apr 1, 1998

Sold by

Salvati Vincenzo and Salvati Neysa

Bought by

Quigley Luisa Salvati and Baruzzi Natalie Salvati

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schiavio Milica | $187,000 | None Available | |

| Maternia Emil | $178,570 | None Available | |

| Salvati Vincent | -- | National Title Agency | |

| Quigley Luisa Salvati | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schiavio Milica | $181,390 | |

| Previous Owner | Maternia Emil | $133,927 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,360 | $80,480 | $22,920 | $57,560 |

| 2024 | $3,360 | $80,480 | $22,920 | $57,560 |

| 2023 | $3,220 | $80,480 | $22,920 | $57,560 |

| 2022 | $3,161 | $80,480 | $22,920 | $57,560 |

| 2021 | $3,089 | $80,480 | $22,920 | $57,560 |

| 2020 | $3,014 | $80,480 | $22,920 | $57,560 |

| 2019 | $2,961 | $80,480 | $22,920 | $57,560 |

| 2018 | $2,960 | $80,480 | $22,920 | $57,560 |

| 2017 | $2,852 | $80,480 | $22,920 | $57,560 |

| 2016 | $2,820 | $80,480 | $22,920 | $57,560 |

| 2015 | $2,630 | $80,480 | $22,920 | $57,560 |

| 2014 | $2,630 | $80,480 | $22,920 | $57,560 |

Source: Public Records

Map

Nearby Homes

- 741 County Line Rd

- 75 S Merion Ave

- 145 Landover Rd

- 258 Lee Cir

- 27 S Merion Ave

- 815 Penn St

- 173 Clemson Rd

- 50 Prospect Ave

- 28 S Warner Ave

- 732 Buck Ln

- 922 Montgomery Ave Unit B2

- 601 Montgomery Ave Unit 204

- 530 New Gulph Rd

- 501 College Ave

- 390 S Bryn Mawr Ave

- 1030 E Lancaster Ave Unit 216

- 1030 E Lancaster Ave Unit 923

- 432 Montgomery Ave Unit 401

- 449 Montgomery Ave Unit 112

- 432 W Montgomery Ave Unit 402

- 754 W Railroad Ave

- 750 W Railroad Ave

- 756 W Railroad Ave

- 748 W Railroad Ave

- 758 W Railroad Ave

- 746 W Railroad Ave

- 755 W County Line Rd

- 755 County Line Rd

- 759 W County Line Rd

- 753 County Line Rd

- 760 W Railroad Ave

- 740 W Railroad Ave

- 751 W County Line Rd

- 751 County Line Rd

- 762 W Railroad Ave

- 749 County Line Rd

- 749 W County Line Rd

- 738 W Railroad Ave

- 736 W Railroad Ave

- 736 W Railroad Ave