Estimated Value: $303,000 - $337,000

3

Beds

3

Baths

1,697

Sq Ft

$187/Sq Ft

Est. Value

About This Home

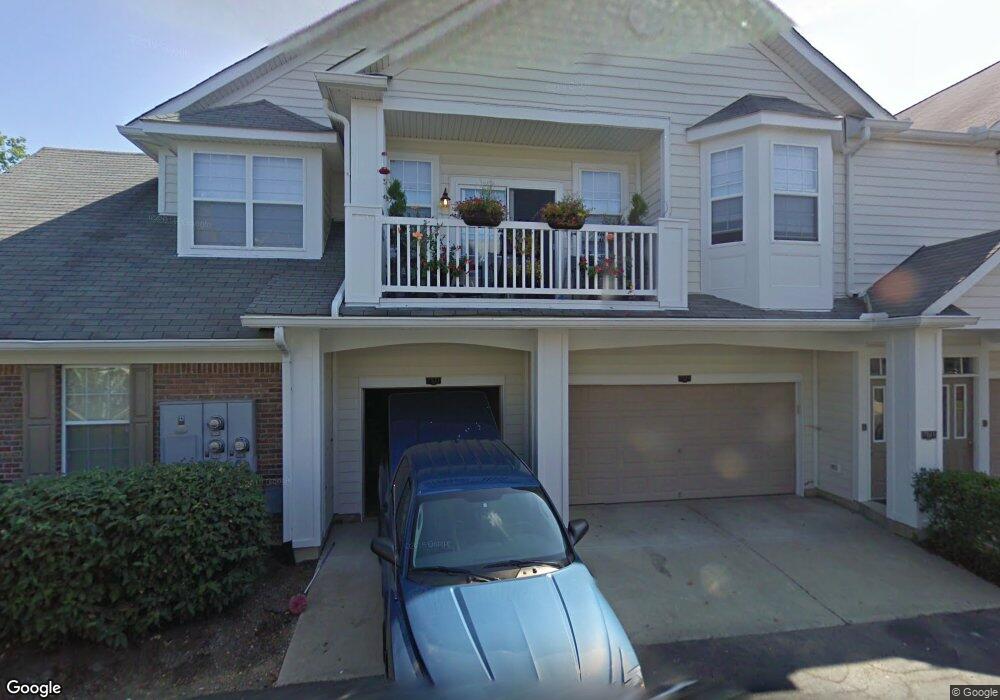

This home is located at 7521 Mansion Cir Unit D, Mason, OH 45040 and is currently estimated at $316,970, approximately $186 per square foot. 7521 Mansion Cir Unit D is a home located in Warren County with nearby schools including Mason Intermediate Elementary School, Mason Middle School, and William Mason High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 9, 2005

Sold by

Raitz Kimberly M and Raitz Kevin J

Bought by

Williams Duane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Outstanding Balance

$81,729

Interest Rate

5.93%

Mortgage Type

FHA

Estimated Equity

$235,241

Purchase Details

Closed on

Oct 27, 2000

Sold by

Yearout John

Bought by

Clift Kimberly M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,250

Interest Rate

7.9%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 28, 1999

Sold by

Towne Dev Group Ltd

Bought by

Yearout John A and Yearout Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,611

Interest Rate

6.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Williams Duane | $155,500 | First Title | |

| Clift Kimberly M | $142,250 | -- | |

| Yearout John A | $155,380 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Williams Duane | $152,000 | |

| Previous Owner | Clift Kimberly M | $132,250 | |

| Previous Owner | Yearout John A | $147,611 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,515 | $82,620 | $24,500 | $58,120 |

| 2023 | $3,162 | $62,352 | $10,762 | $51,590 |

| 2022 | $3,162 | $62,353 | $10,763 | $51,590 |

| 2021 | $3,007 | $62,353 | $10,763 | $51,590 |

| 2020 | $2,878 | $50,694 | $8,750 | $41,944 |

| 2019 | $2,666 | $50,694 | $8,750 | $41,944 |

| 2018 | $2,677 | $50,694 | $8,750 | $41,944 |

| 2017 | $2,327 | $40,653 | $6,703 | $33,950 |

| 2016 | $2,392 | $40,653 | $6,703 | $33,950 |

| 2015 | $2,398 | $40,653 | $6,703 | $33,950 |

| 2014 | $2,319 | $36,300 | $5,990 | $30,310 |

| 2013 | $2,324 | $53,070 | $8,750 | $44,320 |

Source: Public Records

Map

Nearby Homes

- 7489 Mansion Cir

- 7601 Mansion Cir

- 7609 Mansion Cir

- 4320 Crystal Ct

- 4251 S Shore Dr

- 4344 N Point Dr

- 4321 N Shore Dr

- 4344 N Point Ct Unit 202

- 4344 North Point

- 7754 Cove View Dr

- 4451 N Shore Dr

- 4027 Meadow Grove Ln

- 4487 N Shore Dr

- 4379 English Oak Ct Unit 38302

- 4431 English Oak Ct

- 4467 English Oak Ct

- 7362 Middleton Way

- 4465 Black Oak Ln

- 7826 Columbia Rd

- 4447 Hyacinth Dr

- 7521 Mansion Cir Unit F

- 7521 Mansion Cir Unit E

- 7521 Mansion Cir Unit C

- 7521 Mansion Cir Unit B

- 7521 Mansion Cir Unit A

- 7521 Mansion Cir

- C Mansion Cir

- 4004 S Shore Dr

- 7545 Mansion Cir

- 7545 Mansion Cir Unit F

- 7545 Mansion Cir Unit E

- 7545 Mansion Cir Unit D

- 7545 Mansion Cir Unit C

- 7545 Mansion Cir Unit B

- 7545 Mansion Cir Unit A

- 7492 Mansion Cir Unit F

- 7492 Mansion Cir Unit E

- 7492 Mansion Cir Unit D

- 7492 Mansion Cir Unit C

- 7492 Mansion Cir Unit B