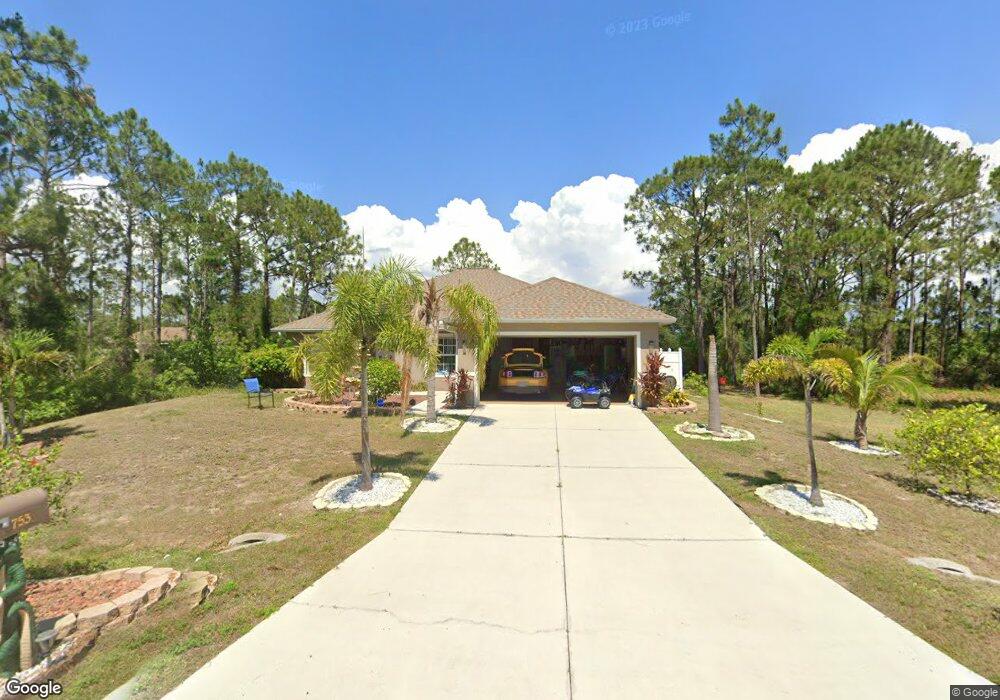

753 Anaconda Ave S Unit 5 Lehigh Acres, FL 33974

Eisenhower NeighborhoodEstimated Value: $270,000 - $393,000

4

Beds

2

Baths

1,971

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 753 Anaconda Ave S Unit 5, Lehigh Acres, FL 33974 and is currently estimated at $317,800, approximately $161 per square foot. 753 Anaconda Ave S Unit 5 is a home located in Lee County with nearby schools including Lehigh Elementary School, Gateway Elementary School, and The Alva School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2020

Sold by

Champion Sandra A

Bought by

Champion Sandra A and Miller Russell William

Current Estimated Value

Purchase Details

Closed on

Mar 7, 2011

Sold by

Pnc Mortgage

Bought by

Champion Sandra A

Purchase Details

Closed on

Aug 6, 2010

Sold by

Aleman Gilbert

Bought by

Pnc Mortgage

Purchase Details

Closed on

Sep 19, 2009

Sold by

Scout Homes Llc

Bought by

Scout Homes Llc

Purchase Details

Closed on

May 15, 2006

Sold by

Affordable Family Homes Inc

Bought by

Aleman Gilbert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Interest Rate

8.12%

Mortgage Type

Construction

Purchase Details

Closed on

Sep 16, 2005

Sold by

Mjd Group Inc

Bought by

Affordable Family Homes Inc

Purchase Details

Closed on

Feb 23, 2004

Sold by

Michaud Raymond

Bought by

Hitt Michael

Purchase Details

Closed on

Sep 25, 2003

Sold by

Hitt Michael

Bought by

Mjd Group Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Champion Sandra A | -- | Attorney | |

| Champion Sandra A | $48,000 | None Available | |

| Pnc Mortgage | -- | None Available | |

| Scout Homes Llc | -- | Attorney | |

| Aleman Gilbert | $48,600 | Builders Titlecorp Inc | |

| Affordable Family Homes Inc | $405,000 | East West Title | |

| Hitt Michael | -- | -- | |

| Mjd Group Inc | $8,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Aleman Gilbert | $255,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,351 | $205,763 | -- | -- |

| 2024 | $2,927 | $187,057 | -- | -- |

| 2023 | $3,294 | $170,052 | $0 | $0 |

| 2022 | $2,927 | $154,593 | $0 | $0 |

| 2021 | $2,476 | $163,022 | $4,250 | $158,772 |

| 2020 | $2,372 | $152,615 | $3,750 | $148,865 |

| 2019 | $2,301 | $146,145 | $3,700 | $142,445 |

| 2018 | $2,139 | $129,996 | $3,700 | $126,296 |

| 2017 | $2,071 | $128,401 | $4,000 | $124,401 |

| 2016 | $1,888 | $109,193 | $4,000 | $105,193 |

| 2015 | $1,720 | $92,913 | $2,900 | $90,013 |

| 2014 | $1,523 | $81,912 | $2,585 | $79,327 |

| 2013 | -- | $68,399 | $2,100 | $66,299 |

Source: Public Records

Map

Nearby Homes

- 745 Troy Ave S

- 706 Brazos St E

- 735 Troy Ave

- 817 Bahama Ave S

- 769 Bahama Ave S

- 852 Fuller Ave S Unit 7

- 727 Colyer St E

- 732 Troy Ave S

- 729 Colyer St E

- 734 Bahama Ave S

- 731 Colyer St E

- 827 Ontario Ave S

- 853 Ontario Ave S Unit 6

- 843 Ontario Ave S

- 760 Chelsea Ave S

- 735 Ontario Ave S

- 762 Ontario Ave S

- 757 Chelsea Ave S

- 709 Bering Ave S

- 729 Ontario Ave S

- 755 Anaconda Ave S

- 750 Barnum Ave S Unit 28

- 750 Barnum Ave S

- 748 Barnum Ave S Unit 5

- 756 Barnum Ave S

- 756 Anaconda Ave S Unit 8

- 747 Anaconda Ave S

- 759 Anaconda Ave S

- 758 Anaconda Ave S

- 758 Barnum Ave S

- 479 Colyer St E

- 705 Fox Trail Ct

- 705 Fox Trail Ct

- 747 Barnum Ave S

- 757 Barnum Ave S

- 760 Barnum Ave S

- 705 Colyer St E

- 750 Breamer Ave S

- 762 Anaconda Ave S Unit 11

- 762 Anaconda Ave S