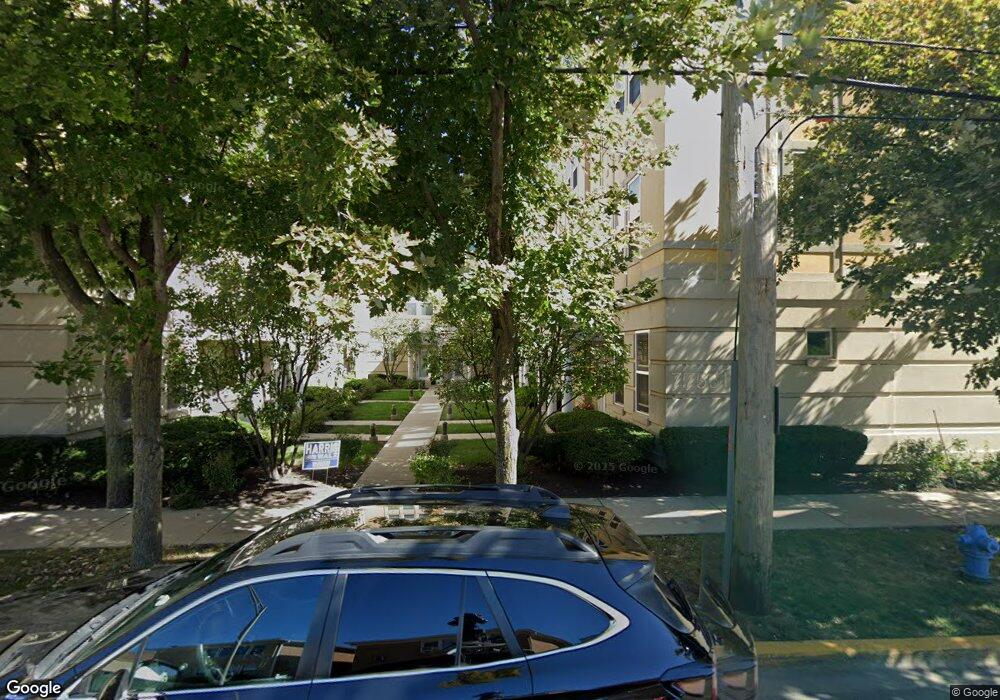

7531 Brown Ave Unit 103 Forest Park, IL 60130

Estimated Value: $356,000 - $407,000

2

Beds

2

Baths

68,202

Sq Ft

$6/Sq Ft

Est. Value

About This Home

This home is located at 7531 Brown Ave Unit 103, Forest Park, IL 60130 and is currently estimated at $384,089, approximately $5 per square foot. 7531 Brown Ave Unit 103 is a home located in Cook County with nearby schools including Garfield Elementary School, Field Stevenson Elementary School, and Forest Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2019

Sold by

Hunt Lashonda A

Bought by

Trankina Vincent and Trankina Lori

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,000

Outstanding Balance

$87,157

Interest Rate

3.62%

Mortgage Type

New Conventional

Estimated Equity

$296,932

Purchase Details

Closed on

Feb 22, 2016

Sold by

Kelly Maryanne

Bought by

Hunt Lashonda A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,400

Interest Rate

3.37%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 4, 2003

Sold by

Kelly Maryanne

Bought by

Kelly Maryanne and Maryanne Kelly Declaration Of Trust

Purchase Details

Closed on

Jun 29, 1998

Sold by

Brown Street Ltd Partnership

Bought by

Kelly Maryanne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,300

Interest Rate

7.18%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trankina Vincent | $299,000 | Liberty Title & Escrow Co | |

| Hunt Lashonda A | $263,000 | Attorney | |

| Kelly Maryanne | -- | -- | |

| Kelly Maryanne | -- | -- | |

| Kelly Maryanne | $186,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trankina Vincent | $114,000 | |

| Previous Owner | Hunt Lashonda A | $210,400 | |

| Previous Owner | Kelly Maryanne | $148,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,030 | $32,703 | $1,565 | $31,138 |

| 2023 | $7,901 | $32,703 | $1,565 | $31,138 |

| 2022 | $7,901 | $28,201 | $1,760 | $26,441 |

| 2021 | $7,560 | $28,200 | $1,760 | $26,440 |

| 2020 | $9,355 | $28,200 | $1,760 | $26,440 |

| 2019 | $8,240 | $26,830 | $1,603 | $25,227 |

| 2018 | $8,068 | $26,830 | $1,603 | $25,227 |

| 2017 | $7,911 | $26,830 | $1,603 | $25,227 |

| 2016 | $8,592 | $26,474 | $1,447 | $25,027 |

| 2015 | $8,413 | $26,474 | $1,447 | $25,027 |

| 2014 | $8,273 | $26,474 | $1,447 | $25,027 |

| 2013 | $5,624 | $20,020 | $1,447 | $18,573 |

Source: Public Records

Map

Nearby Homes

- 7415 Dixon St

- 407 Ashland Ave Unit 3G

- 435 William St Unit 205

- 435 William St Unit 607

- 410 Ashland Ave Unit 1A

- 414 Clinton Place Unit 302

- 213 Ashland Ave

- 547 Jackson Ave

- 534 Lathrop Ave

- 7240 Franklin St Unit 2A

- 7241 Franklin St Unit B

- 133 Ashland Ave

- 414 Franklin Ave Unit 3A

- 7449 Washington St Unit 207

- 7421 Washington St

- 7251 Randolph St Unit C6

- 310 Lathrop Ave Unit P52

- 314 Lathrop Ave Unit 502

- 314 Lathrop Ave Unit 604

- 314 Lathrop Ave Unit 507

- 7531 Brown Ave Unit D

- 7531 Brown Ave Unit 109

- 7531 Brown Ave Unit 105

- 7531 Brown Ave Unit 106

- 7531 Brown Ave Unit 110

- 7531 Brown Ave Unit 107

- 7531 Brown Ave Unit 104

- 7531 Brown Ave Unit 108

- 7531 Brown Ave Unit 102

- 7531 Brown Ave Unit 101

- 7531 Brown Ave Unit B

- 7531 Brown Ave Unit A

- 7531 Brown Ave Unit J

- 7531 Brown Ave Unit F

- 7531 Brown Ave Unit G

- 7531 Brown Ave Unit H

- 7531 Brown Ave Unit C

- 7531 Brown Ave Unit E

- 7541 Brown Ave

- 7541 Brown Ave Unit 209