7578 Avalon Blvd Fairburn, GA 30213

Estimated Value: $239,000 - $272,000

3

Beds

3

Baths

1,566

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 7578 Avalon Blvd, Fairburn, GA 30213 and is currently estimated at $255,640, approximately $163 per square foot. 7578 Avalon Blvd is a home located in Fulton County with nearby schools including Oakley Elementary School, Bear Creek Middle School, and Creekside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2020

Sold by

Opendoor Property Trust I

Bought by

Talabi Olawale

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,000

Outstanding Balance

$93,074

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$162,566

Purchase Details

Closed on

Jan 24, 2020

Sold by

Robinson Lashelle D

Bought by

Opendoor Property Trust I

Purchase Details

Closed on

Oct 21, 2019

Sold by

Robinson Diane D

Bought by

Davis Lashelle D Robinson

Purchase Details

Closed on

May 30, 2006

Sold by

Robinson Lashelle D

Bought by

Robinson Lashelle D and Robinson Diane D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,528

Interest Rate

7.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Talabi Olawale | $150,000 | -- | |

| Opendoor Property Trust I | $158,000 | -- | |

| Davis Lashelle D Robinson | -- | -- | |

| Robinson Lashelle D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Talabi Olawale | $105,000 | |

| Previous Owner | Robinson Lashelle D | $97,528 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $67 | $106,520 | $21,600 | $84,920 |

| 2023 | $2,843 | $100,720 | $22,480 | $78,240 |

| 2022 | $966 | $81,520 | $13,320 | $68,200 |

| 2021 | $933 | $58,200 | $14,720 | $43,480 |

| 2020 | $2,157 | $53,000 | $13,320 | $39,680 |

| 2019 | $2,055 | $52,040 | $13,080 | $38,960 |

| 2018 | $1,852 | $46,520 | $10,200 | $36,320 |

| 2017 | $1,141 | $28,000 | $7,360 | $20,640 |

| 2016 | $1,141 | $28,000 | $7,360 | $20,640 |

| 2015 | $1,145 | $28,000 | $7,360 | $20,640 |

| 2014 | $1,207 | $28,000 | $7,360 | $20,640 |

Source: Public Records

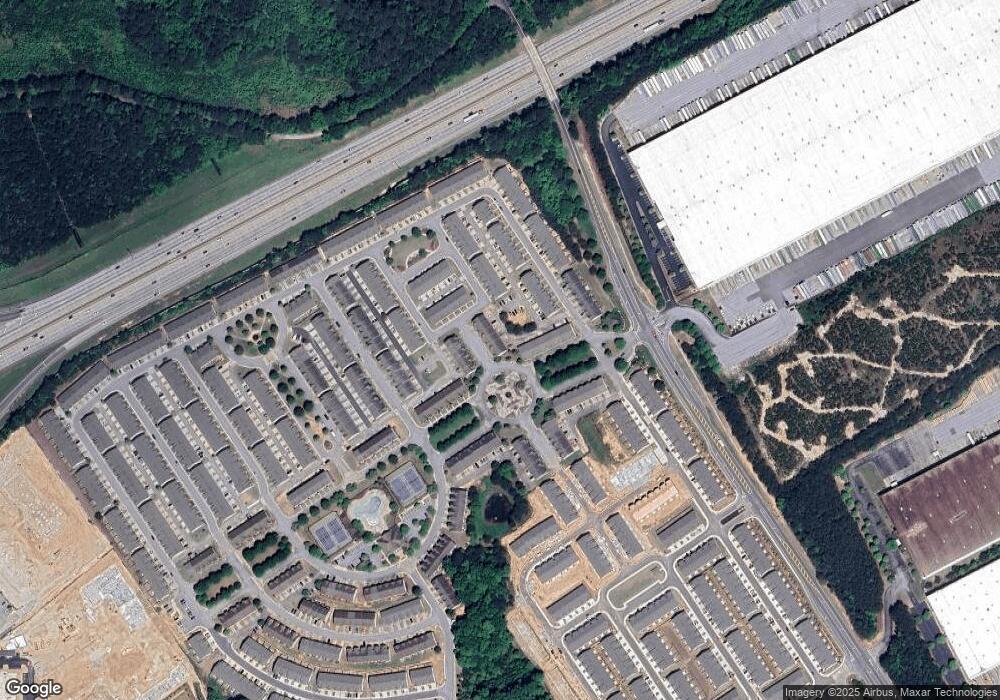

Map

Nearby Homes

- 340 Avalon Square

- 7621 Avalon Blvd

- 5569 Radford Loop

- 5531 Radford Loop

- 5365 Radford Loop

- 7640 Rutgers Cir

- 7767 Richmond Trail

- 7695 Baron Rd

- 7710 Bucknell Terrace

- 7808 Rutgers Cir

- 7673 Squire Ct

- 7699 Bucknell Terrace

- 5612 Festival Ave

- 5671 Radford Loop

- 5715 Radford Loop Unit 15

- 5713 Radford Loop

- 7641 Squire Ct

- 7753 Medieval St

- 7578 Avalon Blvd Unit 201

- 7574 Avalon Blvd

- 7574 Avalon Blvd Unit 202

- 7570 Avalon Blvd

- 0 Avalon Blvd Unit 3223937

- 0 Avalon Blvd Unit 3243434

- 0 Avalon Blvd Unit 3198557

- 0 Avalon Blvd Unit 8322468

- 0 Avalon Blvd Unit 8254178

- 0 Avalon Blvd Unit 8088344

- 0 Avalon Blvd Unit 8029884

- 0 Avalon Blvd Unit 7081219

- 0 Avalon Blvd Unit 8610914

- 0 Avalon Blvd Unit 8095160

- 0 Avalon Blvd Unit 3150174

- 0 Avalon Blvd Unit 8574294

- 0 Avalon Blvd Unit 8549488

- 0 Avalon Blvd Unit 8536704

- 0 Avalon Blvd Unit 8347700

- 0 Avalon Blvd Unit 7541849