7595 Mount Hood Unit 12027 Dayton, OH 45424

Estimated Value: $96,000 - $115,000

3

Beds

2

Baths

1,496

Sq Ft

$70/Sq Ft

Est. Value

About This Home

This home is located at 7595 Mount Hood Unit 12027, Dayton, OH 45424 and is currently estimated at $104,646, approximately $69 per square foot. 7595 Mount Hood Unit 12027 is a home located in Montgomery County with nearby schools including Wayne High School and Huber Heights Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2008

Sold by

Rtb Properties Llc

Bought by

Sexton John A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,400

Outstanding Balance

$27,835

Interest Rate

6.04%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$76,811

Purchase Details

Closed on

Feb 24, 2006

Sold by

Gray Nancy L and Gray Darren P

Bought by

Rtb Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,500

Interest Rate

6.22%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sexton John A | $57,900 | Attorney | |

| Rtb Properties Llc | -- | None Available | |

| Gray Nancy L | $45,000 | None Available | |

| Hensley Keith A | $40,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sexton John A | $43,400 | |

| Previous Owner | Gray Nancy L | $40,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,255 | $23,720 | $4,480 | $19,240 |

| 2023 | $1,255 | $23,720 | $4,480 | $19,240 |

| 2022 | $1,008 | $14,820 | $2,800 | $12,020 |

| 2021 | $1,011 | $14,820 | $2,800 | $12,020 |

| 2020 | $1,012 | $14,820 | $2,800 | $12,020 |

| 2019 | $1,011 | $13,100 | $2,800 | $10,300 |

| 2018 | $1,015 | $13,100 | $2,800 | $10,300 |

| 2017 | $1,009 | $13,100 | $2,800 | $10,300 |

| 2016 | $971 | $12,610 | $2,800 | $9,810 |

| 2015 | $958 | $12,610 | $2,800 | $9,810 |

| 2014 | $958 | $12,610 | $2,800 | $9,810 |

| 2012 | -- | $20,140 | $4,480 | $15,660 |

Source: Public Records

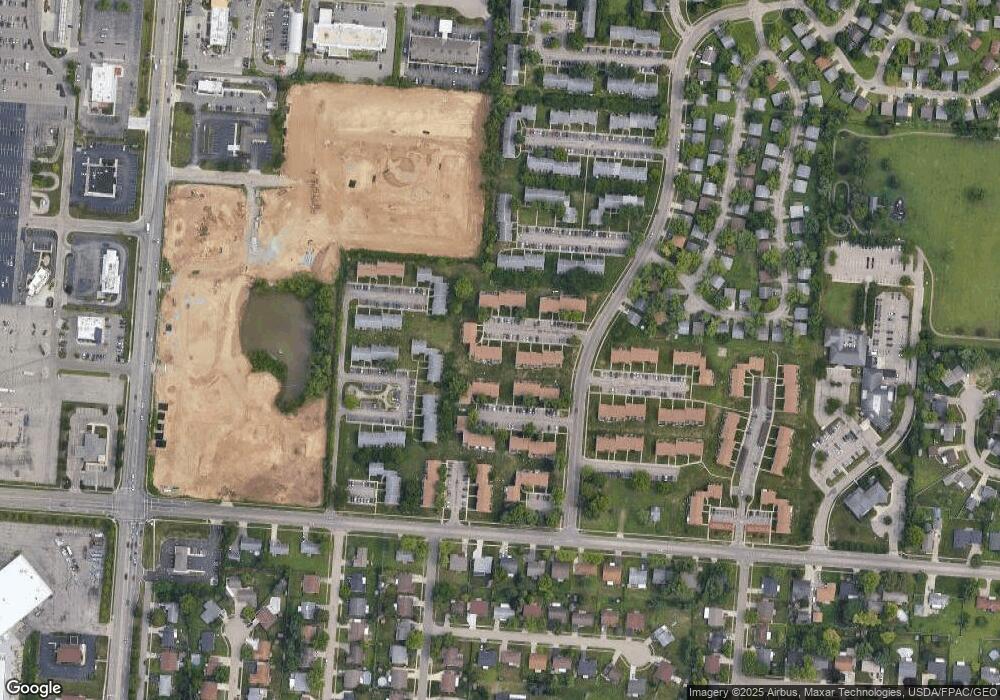

Map

Nearby Homes

- 5580 Clagston Ct

- 7247 Camrose Ct

- 6150 Taylorsville Rd

- 5582 Camerford Dr

- 6447 Highbury Rd

- 7833 Harshmanville Rd

- 5631 Longford Rd

- 7854 Harshmanville Rd

- 7866 Harshmanville Rd

- 7150 Harshmanville Rd

- 5873 Troy Villa Blvd Unit 20174

- 7371 Damascus Dr

- 5637 Troy Villa Blvd Unit 20088

- 7126 Mandrake Dr

- 6089 Green Knolls Dr

- 4834 Lodgeview Dr

- 6851 Locustview Dr

- 8436 Indian Mound Dr

- 4815 Flagstone Ct

- 6245 Longford Rd

- 7599 Mount Hood Unit 12029

- 7597 Mount Hood Unit 12028

- 7605 Mount Hood Unit 12032

- 7591 Mount Hood Unit 12054

- 7601 Mount Hood Unit 12030

- 7589 Mount Hood Unit 12053

- 7603 Mount Hood Unit 12031

- 7587 Mount Hood Unit 12052

- 7585 Mount Hood Unit 12051

- 7607 Mount Hood Unit 12033

- 7623 Mount Hood Unit 12040

- 7621 Mount Hood Unit 12039

- 7583 Mount Hood Unit 12050

- 7559 Mount Hood Unit 12026

- 7563 Mount Hood Unit 12055

- 7557 Mount Hood Unit 12025

- 7615 Mount Hood Unit 12036

- 7581 Mount Hood Unit 12049

- 7555 Mount Hood Unit 12024

- 7613 Mount Hood Unit 12035