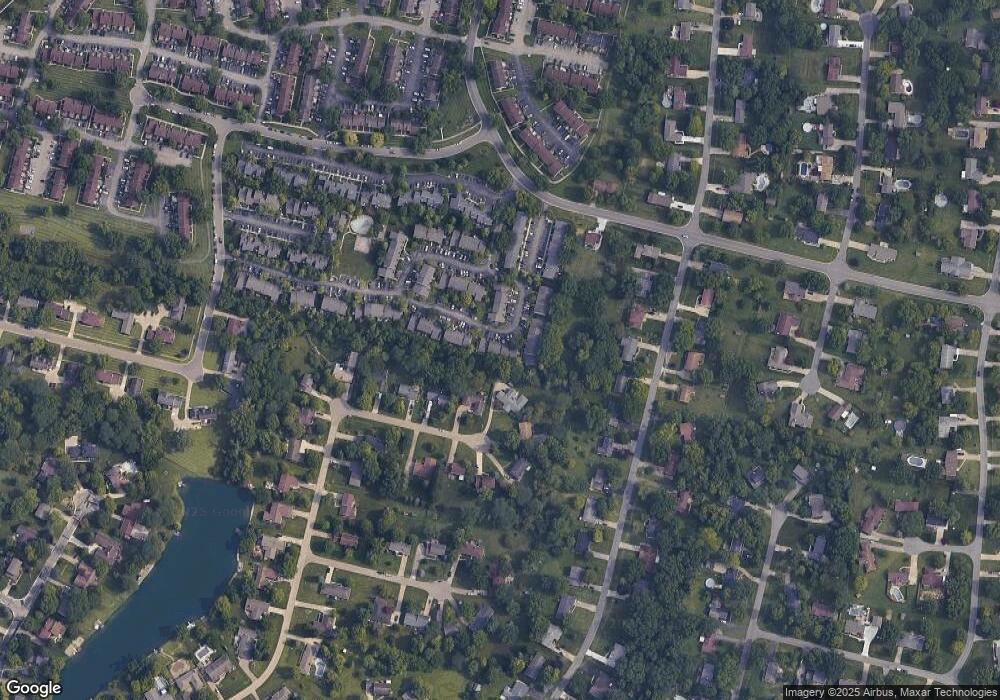

7599 Granby Way Unit 106 West Chester, OH 45069

West Chester Township NeighborhoodEstimated Value: $182,000 - $204,000

2

Beds

3

Baths

1,250

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 7599 Granby Way Unit 106, West Chester, OH 45069 and is currently estimated at $193,769, approximately $155 per square foot. 7599 Granby Way Unit 106 is a home located in Butler County with nearby schools including Hopewell Early Childhood School, Woodland Elementary School, and Hopewell Junior School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2021

Sold by

Swigart Amy M and Stenger Amy

Bought by

Swigart Larry L and Swigart Amy M

Current Estimated Value

Purchase Details

Closed on

Jul 27, 2010

Sold by

Stenger Matthew

Bought by

Stenger Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,945

Outstanding Balance

$73,194

Interest Rate

5.25%

Mortgage Type

FHA

Estimated Equity

$120,575

Purchase Details

Closed on

Nov 3, 2003

Sold by

Fannin Cara

Bought by

Stenger Matthew and Stenger Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,000

Interest Rate

7.49%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 11, 1998

Sold by

Roark Heidi D Tr

Bought by

Miller Faith A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,200

Interest Rate

7.27%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 1, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Swigart Larry L | -- | None Available | |

| Stenger Amy | -- | Freibert Title Group Llc | |

| Stenger Matthew | $103,000 | First Service Title Agency I | |

| Miller Faith A | $72,000 | -- | |

| -- | $214,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stenger Amy | $106,945 | |

| Closed | Stenger Matthew | $103,000 | |

| Previous Owner | Miller Faith A | $70,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,436 | $51,330 | $5,600 | $45,730 |

| 2023 | $2,111 | $51,330 | $5,600 | $45,730 |

| 2022 | $1,990 | $38,410 | $5,600 | $32,810 |

| 2021 | $1,951 | $36,850 | $5,600 | $31,250 |

| 2020 | $1,997 | $36,850 | $5,600 | $31,250 |

| 2019 | $2,745 | $28,640 | $5,600 | $23,040 |

| 2018 | $1,630 | $28,640 | $5,600 | $23,040 |

| 2017 | $1,659 | $28,640 | $5,600 | $23,040 |

| 2016 | $1,761 | $28,640 | $5,600 | $23,040 |

| 2015 | $1,751 | $28,640 | $5,600 | $23,040 |

| 2014 | $1,793 | $28,640 | $5,600 | $23,040 |

| 2013 | $1,793 | $28,380 | $6,300 | $22,080 |

Source: Public Records

Map

Nearby Homes

- 7541 Granby Way Unit 89

- 8166 Shadybrook Dr

- 7531 Exchequer Ct

- 7506 Parliament Ct Unit 149

- 6729 Maverick Dr

- 8253 Lake Ridge Dr

- 7594 Barret Rd

- 7574 Barret Rd

- 7331 Jean Dr

- 7661 Brookdale Dr

- 8199 Vadith Ct

- 8558 Cox Rd

- 7985 Kenneth St

- 7203 Cherrywood Ln

- 8430 Meadowlark Ct

- 7986 Tylers Way

- 8698 Cox Rd

- 8608 Goldfinch Way

- 8500 Crestmont Dr

- 8749 Monticello Dr

- 7601 Granby Way

- 7595 Granby Way

- 7603 Granby Way

- 7615 Granby Way Unit 110

- 7624 Granby Way

- 7587 Granby Way Unit 103

- 7613 Granby Way

- 7619 Granby Way

- 7617 Granby Way Unit 111

- 7621 Granby Way

- 7626 Granby Way

- 7585 Granby Way Unit 102

- 7628 Granby Way

- 7583 Granby Way

- 7583 Granby Way Unit 101

- 7623 Granby Way

- 7632 Granby Way Unit 120

- 7581 Granby Way Unit 100

- 7590 Lakewood Cir

- 7584 Lakewood Cir