761 Holden Rd Frederick, MD 21701

Eastchurch NeighborhoodEstimated Value: $503,310 - $615,000

Studio

2

Baths

1,690

Sq Ft

$324/Sq Ft

Est. Value

About This Home

This home is located at 761 Holden Rd, Frederick, MD 21701 and is currently estimated at $547,078, approximately $323 per square foot. 761 Holden Rd is a home located in Frederick County with nearby schools including Spring Ridge Elementary School, Gov. Thomas Johnson Middle School, and Gov. Thomas Johnson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 2018

Sold by

Wormald Homes At Eastchurch Llc

Bought by

Vanbush Gary Van

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$331,200

Outstanding Balance

$288,826

Interest Rate

4.5%

Mortgage Type

VA

Estimated Equity

$258,252

Purchase Details

Closed on

Mar 6, 2017

Sold by

Nicodemus Farm Llc

Bought by

Workald Homes At Eastchruch Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,950,000

Interest Rate

4.19%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vanbush Gary Van | $403,158 | None Available | |

| Workald Homes At Eastchruch Llc | $624,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vanbush Gary Van | $331,200 | |

| Previous Owner | Workald Homes At Eastchruch Llc | $2,950,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,331 | $503,100 | $165,000 | $338,100 |

| 2024 | $8,331 | $470,967 | $0 | $0 |

| 2023 | $7,706 | $438,833 | $0 | $0 |

| 2022 | $7,305 | $406,700 | $90,000 | $316,700 |

| 2021 | $7,297 | $406,700 | $90,000 | $316,700 |

| 2020 | $7,282 | $406,700 | $90,000 | $316,700 |

| 2019 | $7,597 | $424,700 | $72,000 | $352,700 |

| 2018 | $7,476 | $419,100 | $0 | $0 |

| 2017 | $635 | $36,000 | $0 | $0 |

| 2016 | -- | $36,000 | $0 | $0 |

Source: Public Records

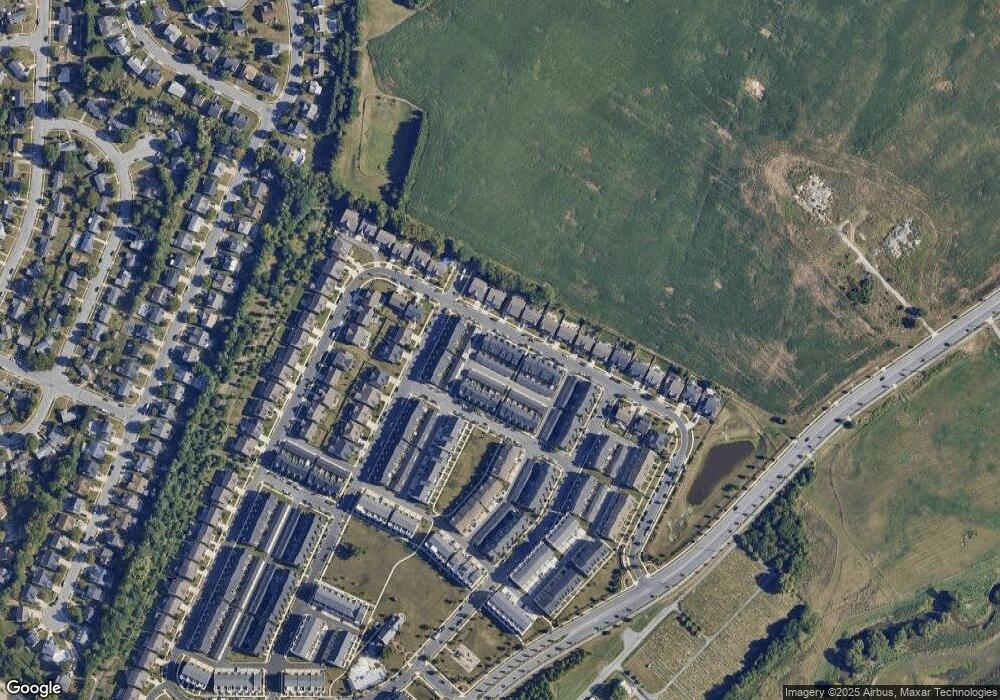

Map

Nearby Homes

- 747 Holden Rd

- 924 Lindley Rd

- 1135 Holden Rd

- 1133 Holden Rd

- 728 Holden Rd

- 828 Geronimo Dr

- 667 E Church St Unit B

- 809 Shawnee Dr

- 800 Stratford Way Unit E

- 434 Herringbone Way

- 485 Hanson St

- 477 Tiller St

- 484 Tiller St

- Carlton Plan at Renn Quarter - Townhomes

- Hadley Plan at Renn Quarter - Single Family

- Summit Plan at Renn Quarter - Single Family

- Jade Plan at Renn Quarter - Single Family

- Alec Plan at Renn Quarter - Single Family

- Hampshire Plan at Renn Quarter - Single Family

- Auburn Plan at Renn Quarter - Townhomes

- 763 Holden Rd

- 759 Holden Rd

- 765 Holden Rd

- 757 Holden Rd

- 755 Holden Rd

- 753 Holden Rd

- 1014 Lindley Rd

- 751 Holden Rd

- 1018 Lindley Rd

- 1016 Lindley Rd

- 1010 Lindley Rd

- 1012 Lindley Rd

- 1008 Lindley Rd

- 749 Holden Rd

- 752 Holden Rd

- 0 Holden Rd- Prescott Unit 1004373439

- 750 Holden Rd

- 611 Blandwood Rd

- 609 Blandwood Rd

- 607 Blandwood Rd

Your Personal Tour Guide

Ask me questions while you tour the home.