7617 Sniktau Point Peyton, CO 80831

Falcon NeighborhoodEstimated Value: $382,030 - $392,000

3

Beds

2

Baths

1,457

Sq Ft

$266/Sq Ft

Est. Value

About This Home

This home is located at 7617 Sniktau Point, Peyton, CO 80831 and is currently estimated at $388,008, approximately $266 per square foot. 7617 Sniktau Point is a home located in El Paso County with nearby schools including Woodmen Hills Elementary School, Falcon Middle School, and Falcon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2018

Sold by

Madler Joshua L

Bought by

Whiseant Christopher P and Whiseant Melissa M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$267,547

Outstanding Balance

$232,836

Interest Rate

4.5%

Mortgage Type

VA

Estimated Equity

$155,172

Purchase Details

Closed on

Mar 28, 2008

Sold by

Pulte Home Corp

Bought by

Madler Joshua L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,655

Interest Rate

6.11%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Whiseant Christopher P | $259,000 | Empire Title Colorado Spring | |

| Madler Joshua L | $170,000 | Land Title Guarantee Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Whiseant Christopher P | $267,547 | |

| Previous Owner | Madler Joshua L | $173,655 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,629 | $26,360 | -- | -- |

| 2024 | $1,523 | $26,810 | $3,020 | $23,790 |

| 2022 | $1,344 | $19,360 | $2,850 | $16,510 |

| 2021 | $1,397 | $19,910 | $2,930 | $16,980 |

| 2020 | $1,101 | $15,620 | $2,650 | $12,970 |

| 2019 | $1,091 | $15,620 | $2,650 | $12,970 |

| 2018 | $859 | $12,090 | $2,660 | $9,430 |

| 2017 | $787 | $12,090 | $2,660 | $9,430 |

| 2016 | $805 | $12,200 | $2,950 | $9,250 |

| 2015 | $806 | $12,200 | $2,950 | $9,250 |

| 2014 | $747 | $11,100 | $2,950 | $8,150 |

Source: Public Records

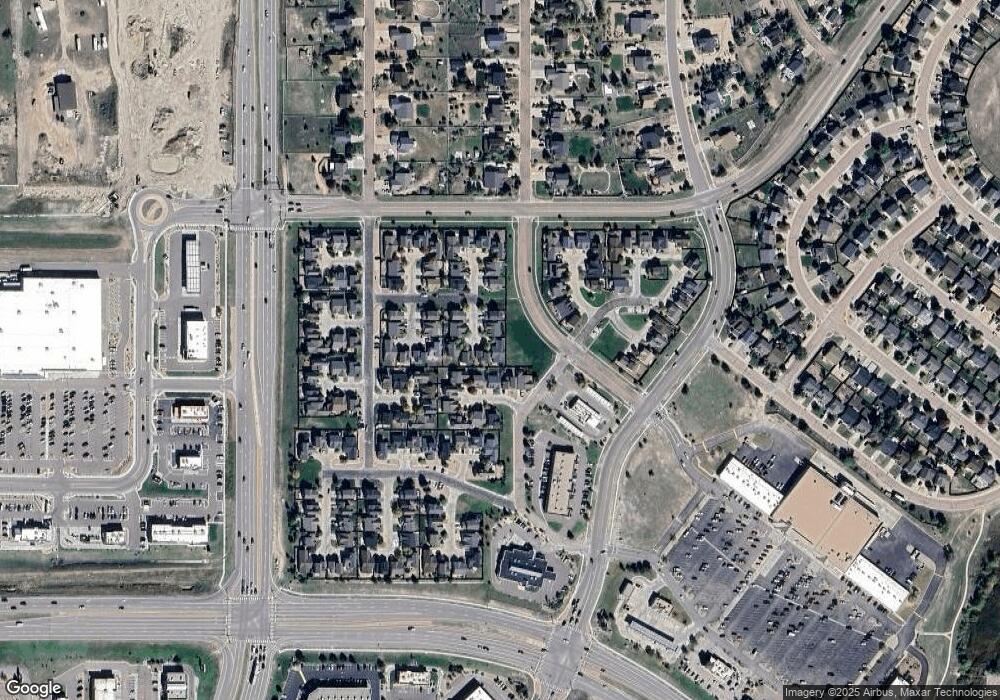

Map

Nearby Homes

- 7627 Loopout Grove

- 11893 Trissino Heights

- 7651 Loopout Grove

- 7682 Capel Point

- 11856 Gorman Grove

- 7544 Jaoul Point

- 7507 Soane Grove

- 7660 Bullet Rd

- 7394 Owings Point

- 7524 Stephenville Rd

- 11455 Owl Place

- 11649 Shaolin Grove

- 11579 Ducal Point

- 11485 Owl Place

- 11584 Louvre Point

- 11572 Farnese Heights

- 11751 Sedge Ct

- 7514 Teocalli Point

- 11763 Sedge Ct

- 7523 Saynassalo Point

- 7605 Sniktau Point

- 7629 Sniktau Point

- 11938 Rodez Grove

- 7604 Sniktau Point

- 11950 Rodez Grove

- 11926 Rodez Grove

- 7641 Sniktau Point

- 7616 Sniktau Point

- 7628 Sniktau Point

- 11914 Rodez Grove

- 7640 Sniktau Point

- 11902 Rodez Grove

- 7615 Loopout Grove

- 11939 Rodez Grove

- 7653 Sniktau Point

- 11903 Rodez Grove

- 11882 Trissino Heights

- 7639 Loopout Grove

- 7618 Capel Point

- 7652 Sniktau Point