7630 Catawba Place Unit D10 Dublin, OH 43017

Estimated Value: $401,000 - $433,615

3

Beds

3

Baths

1,831

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 7630 Catawba Place Unit D10, Dublin, OH 43017 and is currently estimated at $419,154, approximately $228 per square foot. 7630 Catawba Place Unit D10 is a home located in Franklin County with nearby schools including Wyandot Elementary School, Henry Karrer Middle School, and Dublin Coffman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2025

Sold by

Mounts Family Preservation Trust and Hall Camille R

Bought by

Schwieterman Rick J and Farlow Beverly J

Current Estimated Value

Purchase Details

Closed on

Jan 6, 2012

Sold by

Mounts Betty J

Bought by

Hall Camille R and The Mounts Family Preservation Trust

Purchase Details

Closed on

Dec 1, 2008

Sold by

Mounts Frank S and Mounts Betty J

Bought by

Mounts Betty J and The Betty J Mounts Revocable Estate Plan

Purchase Details

Closed on

Jul 30, 2004

Sold by

Rickey Nancy F

Bought by

Mounts Frank S and Mounts Betty J

Purchase Details

Closed on

Sep 25, 2002

Sold by

Mark Stover and Mark Renee

Bought by

Rickey Nancy F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,300

Interest Rate

6.34%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 27, 1998

Sold by

The Villas Earlington Partners

Bought by

Stover Mark

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schwieterman Rick J | $400,000 | None Listed On Document | |

| Hall Camille R | -- | None Available | |

| Mounts Betty J | -- | None Available | |

| Mounts Betty J | -- | Attorney | |

| Mounts Frank S | $196,000 | -- | |

| Rickey Nancy F | $187,000 | Lawyers Title | |

| Stover Mark | $199,900 | Title First Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rickey Nancy F | $168,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,027 | $133,350 | $21,000 | $112,350 |

| 2023 | $7,956 | $133,350 | $21,000 | $112,350 |

| 2022 | $5,915 | $93,140 | $14,490 | $78,650 |

| 2021 | $5,929 | $93,140 | $14,490 | $78,650 |

| 2020 | $5,978 | $93,140 | $14,490 | $78,650 |

| 2019 | $5,786 | $80,990 | $12,600 | $68,390 |

| 2018 | $2,906 | $80,990 | $12,600 | $68,390 |

| 2017 | $5,385 | $80,990 | $12,600 | $68,390 |

| 2016 | $4,599 | $66,680 | $12,950 | $53,730 |

| 2015 | $2,314 | $66,680 | $12,950 | $53,730 |

| 2014 | $4,635 | $66,680 | $12,950 | $53,730 |

| 2013 | $2,358 | $66,675 | $12,950 | $53,725 |

Source: Public Records

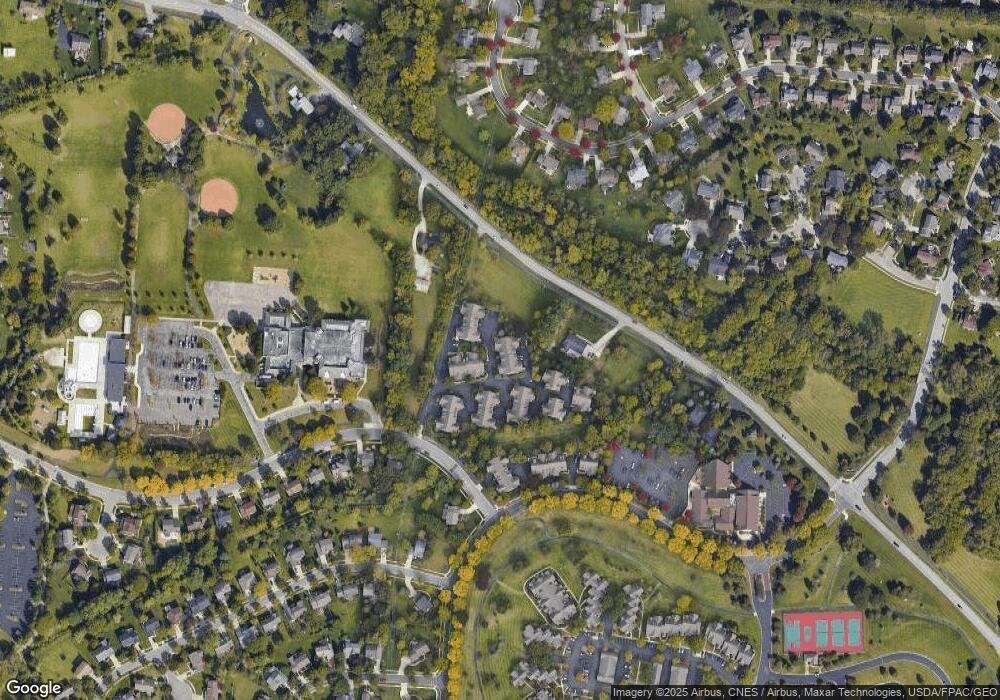

Map

Nearby Homes

- 5753 Finnegan Ct

- 5545 Caplestone Ln

- 5735 McNeven Ct

- 7744 Heatherwood Ln

- 7633 Johntimm Ct

- 7195 Dominick Ct

- 7689 Johntimm Ct

- 7480 Maynooth Dr

- 7668 Brandbury Place

- 9064 Moors Place N

- 5578 Corey Swirl Dr

- 9102 Moors Place N

- 7168 Innisfree Ct

- 5309 Adventure Dr

- 7199 Achill Dr

- 7326 Pueblo Ct

- 7145 Forest Run Ct

- 7035 Coffman Rd

- 7246 Sundown Ct

- 5327 Brennan Ct

- 5516 Villas Dr

- 5516 Villas Dr Unit C

- 5516 Villas Dr Unit 10-C

- 7626 Catawba Place

- 7626 Catawba Place Unit 10-A

- 5512 Villas Dr Unit 10B

- 7609 Catauba Place

- 7615 Catawba Place Unit 11C

- 7619 Catawba Place Unit 12B

- 7609 Catawba Place Unit 11

- 0 Villas Dr

- 4 Villas Dr

- 7623 Catawba Place Unit C12

- 7623 Catawba Place Unit 12-C

- 7618 Caspersan Ct Unit A12

- 7618 Caspersan Ct Unit 12-A

- 7614 Caspersan Ct Unit 11D

- 7614 Caspersan Ct Unit D

- 5517 Villas Dr Unit 6D

- 7610 Caspersan Ct Unit 11A