7633 Montgomery Rd Unit 4 Cincinnati, OH 45236

Estimated Value: $149,000 - $171,000

2

Beds

2

Baths

984

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 7633 Montgomery Rd Unit 4, Cincinnati, OH 45236 and is currently estimated at $163,011, approximately $165 per square foot. 7633 Montgomery Rd Unit 4 is a home located in Hamilton County with nearby schools including Silverton Paideia Elementary School, Shroder High School, and Clark Montessori High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2016

Sold by

Elliott Nason Trust

Bought by

Canady Donald and Canady Martina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$49,700

Outstanding Balance

$39,243

Interest Rate

3.66%

Mortgage Type

New Conventional

Estimated Equity

$123,768

Purchase Details

Closed on

Jan 27, 1999

Sold by

Elliott Nason Maxine

Bought by

Elliott Nason Maxine and The Maxine Elliott Nason Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$37,000

Interest Rate

6.79%

Purchase Details

Closed on

Jan 6, 1999

Sold by

Elliott Nason Maxine Tr

Bought by

Nason Maxine Elliott

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$37,000

Interest Rate

6.79%

Purchase Details

Closed on

Jul 10, 1995

Sold by

Elliott Nason Maxine

Bought by

Elliott Nason Maxine

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Canady Donald | $71,000 | -- | |

| Elliott Nason Maxine | -- | -- | |

| Nason Maxine Elliott | -- | Precision Land Title Agency | |

| Elliott Nason Maxine | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Canady Donald | $49,700 | |

| Previous Owner | Nason Maxine Elliott | $37,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,855 | $44,408 | $6,545 | $37,863 |

| 2023 | $1,888 | $44,408 | $6,545 | $37,863 |

| 2022 | $2,023 | $32,179 | $5,040 | $27,139 |

| 2021 | $1,970 | $32,179 | $5,040 | $27,139 |

| 2020 | $1,998 | $32,179 | $5,040 | $27,139 |

| 2019 | $1,717 | $24,850 | $5,040 | $19,810 |

| 2018 | $1,721 | $24,850 | $5,040 | $19,810 |

| 2017 | $1,051 | $24,850 | $5,040 | $19,810 |

| 2016 | $1,571 | $32,375 | $5,600 | $26,775 |

| 2015 | $1,411 | $32,375 | $5,600 | $26,775 |

| 2014 | $1,423 | $32,375 | $5,600 | $26,775 |

| 2013 | $1,451 | $32,375 | $5,600 | $26,775 |

Source: Public Records

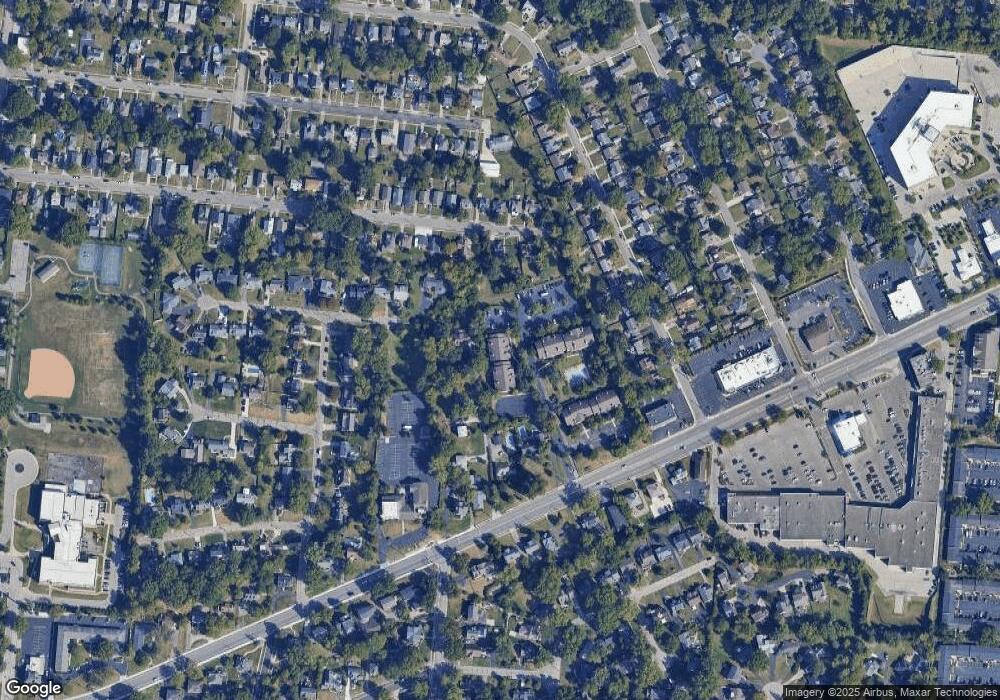

Map

Nearby Homes

- 6008 Winnetka Dr

- 4248 South Ave

- 5635 Euclid Rd

- 7722 Dalton Ave

- 4025 Deer Park Ave

- 4050 O'Leary Ave

- 8021 Beech Ave

- 6705 Elwynne Dr

- 4123 Hoffman Ave

- 6829 Alpine Ave

- 3990 Superior Ave

- 13 Wentworth Ln

- 34 Wentworth Ln

- 42 Wentworth Ln

- 4305 Myrtle Ave

- 7719 Dearborn Ave

- 7818 Eustis Ct

- 6577 Plainfield Rd

- 3805 O'Leary Ave

- 6752 Rose Crest Ave

- 7633 Montgomery Rd

- 7633 Montgomery Rd

- 7633 Montgomery Rd

- 7633 Montgomery Rd

- 7633 Montgomery Rd

- 7633 Montgomery Rd

- 7633 Montgomery Rd

- 7633 Montgomery Rd

- 7633 Montgomery Rd Unit 8

- 7633 Montgomery Rd Unit 11

- 7633 Montgomery Rd Unit 1

- 7633 Montgomery Rd Unit 2

- 7633 Montgomery Rd Unit 3

- 7633 Montgomery Rd Unit 5

- 7631 Montgomery Rd Unit 76312

- 7631 Montgomery Rd Unit 76318

- 7631 Montgomery Rd Unit 76317

- 7631 Montgomery Rd

- 7631 Montgomery Rd Unit 76316

- 7631 Montgomery Rd

Your Personal Tour Guide

Ask me questions while you tour the home.